If you grew up dreaming of owning your own restaurant, a catering company is the next best thing. There are multiple areas and events you can serve when you're a caterer, making it exciting. Your Kentucky business insurance needs to match the risk exposures of your catering operation to avoid financial ruin or worse.

Fortunately, a Kentucky independent insurance agent can help find coverage that won't break the bank. Since they do the shopping for free, you'll save time and get the best policy for your catering business. Connect with a local expert to get started today.

What Is Catering Company Insurance?

In Kentucky, owning a catering company can be fun and ever-changing. The right coverage is necessary to protect your livelihood and clients. Check out some common policy options for catering companies below:

- General liability: Pays for a claims of bodily injury or property damage.

- Business property: Pays for the replacement or repair of your business property.

- Business inventory: Pays for the replacement or repair of your business inventory.

- Business equipment breakdown: Pays for replacing or repairing your business equipment when a covered breakdown occurs.

- Commercial umbrella liability: Pays for additional liability coverage when underlying limits have been exhausted due to a larger claim.

- Business auto: Pays for an accident when a business auto is involved.

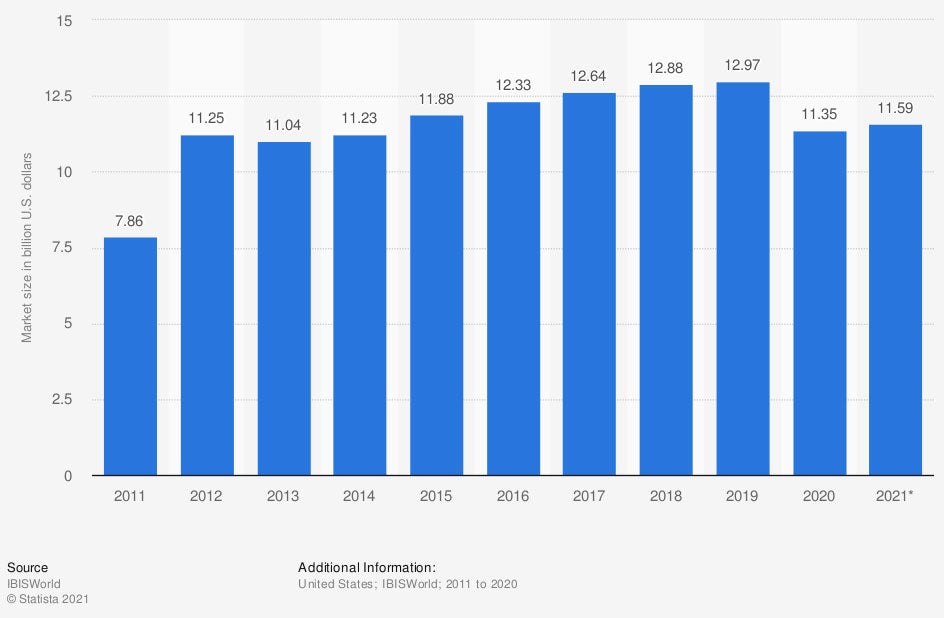

Market Size of the catering sector in the US from 2011 to 2020, with a forecast for 2021 (in billion US dollars)

While you want to stand out in a sea of vendors, knowing the size of your competition can only help. If you hire employees to assist with events, you'll also want to look at workers' compensation insurance and employment practices liability coverage.

What Does Catering Company Insurance Cover in Kentucky?

Kentucky currently has 351,260 small businesses in existence. Industry-specific insurance for your catering company is necessary to have adequate protection for your business. Let's look at standard catering company insurance options:

- Coverage for claims of bodily injury or property damage

- Coverage for your business inventory such as products

- Coverage for business equipment that breaks down due to a covered loss

- Coverage for employees who are injured or become ill on the job

- Coverage for commercial vehicles used to operate the business

- Coverage for disgruntled employees that sue due to discrimination or harassment

Protection against fire, natural disasters, theft, vandalism, and water damage comes in most catering company policies. Check with a trained professional to make sure you're fully insured.

How Much Is Catering Company Insurance in Kentucky?

Your Kentucky catering company will have unique commercial insurance costs. In Kentucky, $4,661,744,000 in commercial insurance claims were paid in 2019 alone. The amount of coverage needed and your business specifications will determine how much you're charged for protection. Take a look at the factors carriers consider when quoting:

- Loss history

- Replacement cost values

- Insurance score

- Experience level

- Local crime rate

- Local weather patterns

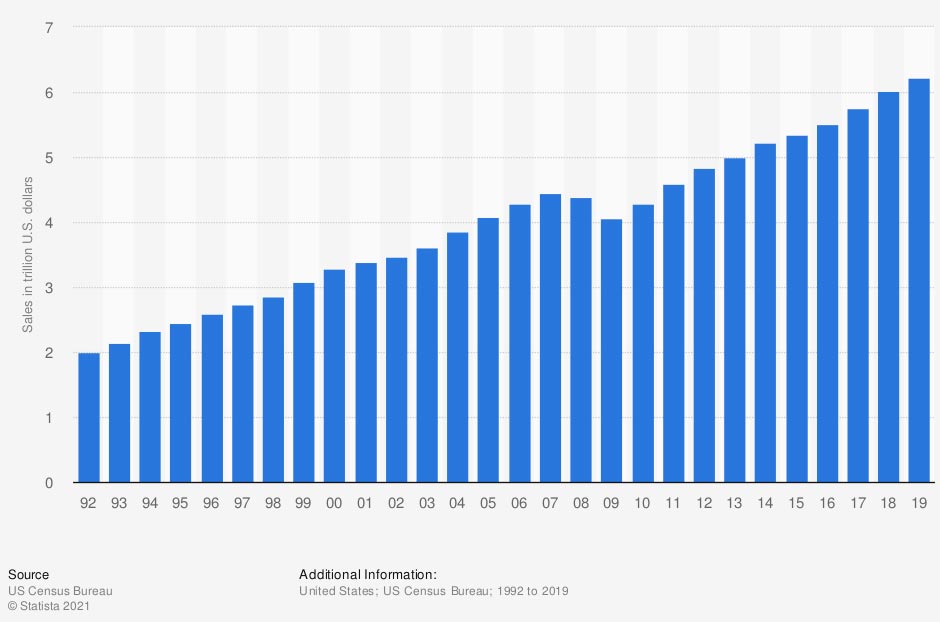

Total retail and food services sales in the US from 1992 to 2019 (in trillion US dollars)

The amount of food-related sales in the US is hard for anybody to ignore. Everyone has to eat, and your catering company could benefit financially from it.

How Much Product Is Covered under Catering Company Insurance in Kentucky?

Kentucky catering company insurance will need coverage for your food, spoilage, inventory, equipment, products, and more. Protection for a liability, property, or food spoilage claim is necessary to avoid a significant financial loss. Every business will require different limits according to its risk.

Your commercial property insurance will have coverages that you can preselect so that you're completely covered. If the food you're serving could cause illness, then you'll need to add food spoilage to your policies for proper insurance. Get with a licensed adviser to review your exact amounts.

Will My Kentucky Location Impact My Rates?

In Kentucky, there are 4,414,349 residents that call this place home. You'll want to position your catering company in an area that gets you the most business. Where your catering company is located does impact your insurance. Carriers look at local crime rates, weather, past losses, and more when determining your premiums. What flood zone you're in affects your insurance costs as well and should be discussed for accuracy.

How an Independent Insurance Agent Can Help in Kentucky

Commercial insurance for any business can be challenging when you're not a trained professional. You'll have many options when you own a catering company, and how much coverage is one of them. Fortunately, you can get advice from a trusted adviser in minutes and all for free.

A Kentucky independent insurance agent does the shopping for you and reviews the most competitive findings at no additional cost. They work with a network of carriers so that you'll have options from Day One. Get connected with a local expert on TrustedChoice for affordable quotes today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/1174156/caterer-industry-market-size-us/

Graphic #2: https://www.statista.com/statistics/197569/annual-retail-and-food-services-sales/

http://www.city-data.com/city/Kentucky.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.