Owners of farms need to be aware of all the risks to their property, including potential liabilities and lawsuits. Without the right protection, you could get stuck paying out of your own pocket to cover hefty lawsuit charges, even if you’ve done nothing wrong.

Fortunately a Kentucky independent insurance agent can help you find the right type of farm land liability insurance to protect you against unexpected lawsuits. But before we jump too far ahead, here’s a breakdown of this important coverage.

What Is Farm Land Liability Insurance?

Farm land liability insurance is essentially one aspect of a complete Kentucky farm insurance package designed to protect third parties who visit farms. More specifically, coverage protects the owner of the farm from lawsuits filed against them by guests, etc. who claim to have been harmed in some way on your premises.

What Does Farm Land Liability Insurance Cover in Kentucky?

Farm land liability insurance protects farm owners from hefty legal fees in the event of a lawsuit. According to insurance expert Jeffery Green, farm land liability insurance provides the following protections:

- Bodily injury to others: Farm land liability insurance protects you against lawsuits filed by third parties for claims of bodily injury on your property.

- Medical payments: Coverage also reimburses for medical payments like doctor visits for injured guests.

- Property damage to others: Coverage pays for lawsuits stemming from claims of personal property damage on your premises by third parties.

Farm land liability insurance covers the actions of family members, employees, livestock, and pets on your property to third parties as well. A Kentucky independent insurance agent can explain these coverages even further.

What Isn’t Covered by Farm Land Liability Insurance in Kentucky?

Farm land liability insurance provides a ton of critical protection. However, it can’t cover everything. Green listed the following as commonly excluded perils under farm land liability insurance:

- Business pursuits outside of farming

- Pollution

- Intentional/malicious acts

- Motorized vehicles

- Renting property to others

- Farming someone else’s land for a fee

Activities taking place outside of the listed property are also not covered. A Kentucky independent insurance agent can listen to your concerns about any perils not covered by farm land liability insurance and get you set up with additional coverage, if necessary.

How Important Is Farm Land Liability Insurance in Kentucky?

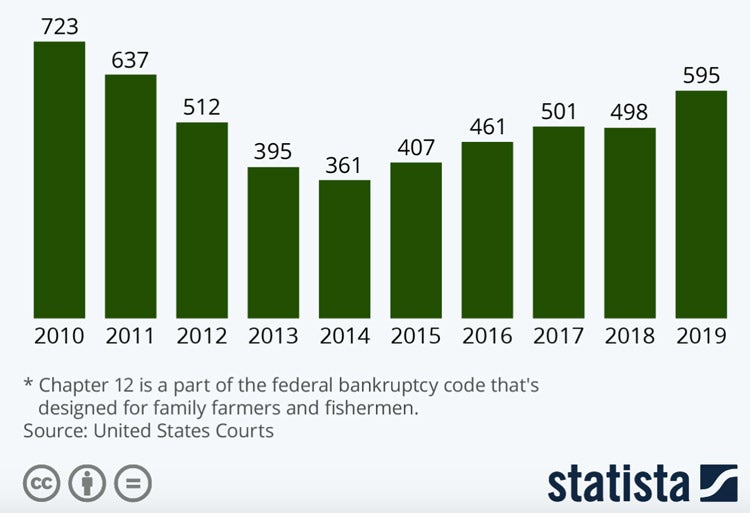

Having the right liability coverage for your farm can help protect you from critical, but preventable, disasters like bankruptcy. Check out the disturbing rise in farm bankruptcies in recent years.

US farm bankruptcies reach eight-year high

In the observed period, there were 723 farm bankruptcies reported at the start. Farm bankruptcies declined considerably over the next few years. However, eight years later, farm bankruptcies began a sharp increase once again, with 595 occurring in one year.

The best way to protect your farm from bankruptcy is to get it set up with all the crucial coverage it deserves, including liability. A Kentucky independent insurance agent can help.

Average Cost of Farm Land Liability Insurance in Kentucky

The liability section of your farm insurance policy will account for just a fraction of your total premium. Average farm insurance policies cost anywhere between $47 and $89 annually. There are several factors that go into determining the cost of your coverage, which we’ll explore further in the next section.

What Are Some Factors That Can Influence My Rates?

As with many other types of insurance, there are many pieces of information that all together determine the cost of your coverage. These factors are commonly considered when calculating farm land liability insurance premiums:

- The farm’s location

- The farm’s specific operations

- The farm’s risk level

- The type and amount of livestock on the farm

- The type and amount of equipment on the farm

The more potentially dangerous pieces of equipment, livestock, or operations are on or occur on your farm, the higher the cost of your farm land liability insurance is likely to be. A Kentucky independent insurance agent can help you scout out any discounts you may qualify for.

Here’s How a Kentucky Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect farm owners against commonly faced liabilities. Kentucky independent insurance agents shop multiple carriers to find providers who specialize in farm land liability insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

https://www.statista.com/chart/20779/chapter-12-bankruptcies-filed-in-the-us/

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/insurance-for-specific-businesses/farms-and-ranches

© 2024, Consumer Agent Portal, LLC. All rights reserved.