Average Cost of Life Insurance in Kentucky

Many factors go into calculating insurance costs. Prices can be influenced by the type of policy you are buying and the amount of coverage you want. Other factors that can affect rates are your age, weight, occupation, health history, and family health history. Also, if you smoke cigarettes or use tobacco products, your premium rates can be as much as 300% higher than if you don’t. An independent insurance agent can help you decide what type of life insurance policy is right for you and can assist you with finding a competitively priced policy that meets your coverage needs.

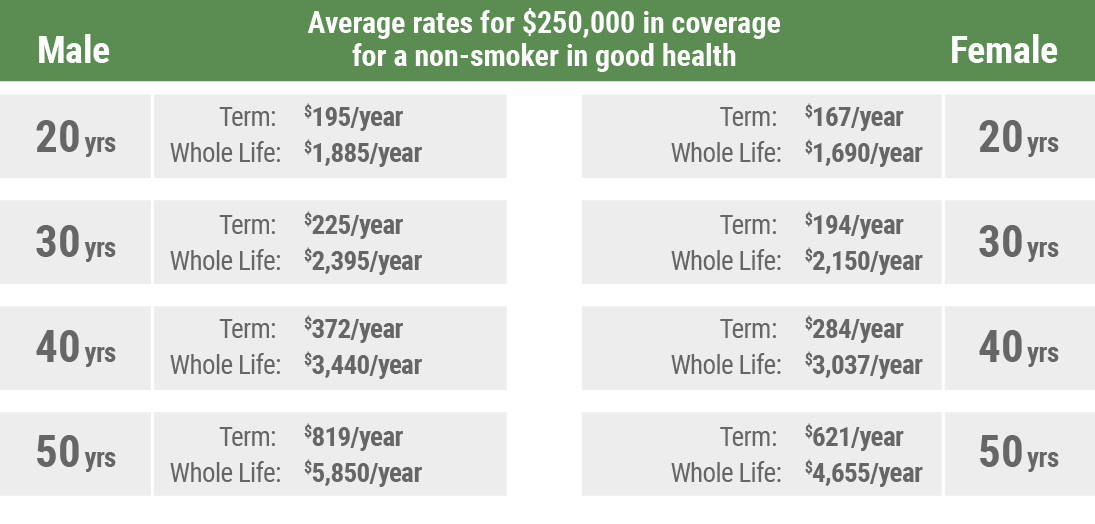

Cost of Life Insurance in Kentucky: Term vs. Whole Life Insurance