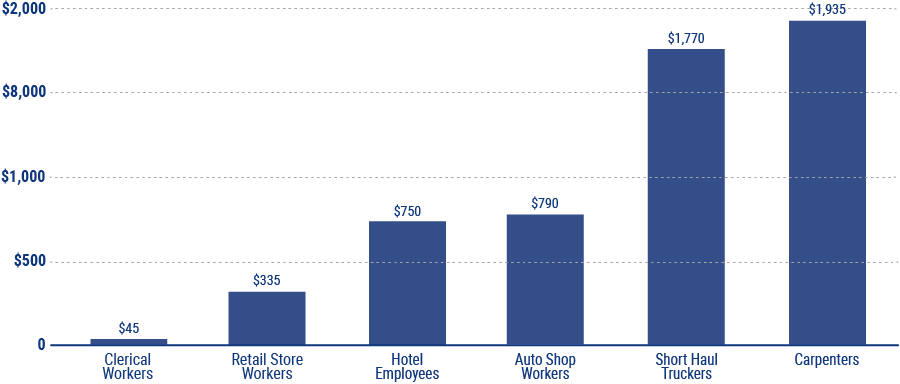

Average Cost of Workers’ Compensation Insurance in Kentucky

The good news is that in Kentucky, rates for workers’ compensation insurance are about 18% lower than the national average. Your price for coverage will be based mainly on the types of jobs your employees do and your company’s overall payroll. Every job is assigned a base rate by the Kentucky Department of Workers’ Claims according to how likely it is that workers in that job will suffer a serious injury. With a solid history of worker safety, your business can be rewarded with policy discounts of up to 25%. Some insurance companies are better equipped to meet the needs of businesses in certain industries than others, so it is advantageous to compare a few policies and quotes before making a purchase.

Kentucky Workers' Comp Cost Per $50,000 in Payroll