Cost of Car Insurance in Kentucky

Vehicle owners in Kentucky pay an average of $1,341 per year for their coverage. This is just slightly higher than the national average rate of $1,311. Your price for coverage will be based on a number of factors, including specifics about your car (such as its make, model, and year), details about you (like your age, occupation, driving record, and credit score), and information about the other licensed drivers in your household. Every insurance company has its own way of calculating rates, so comparing quotes helps you be sure that you are getting your policy at a competitive price.

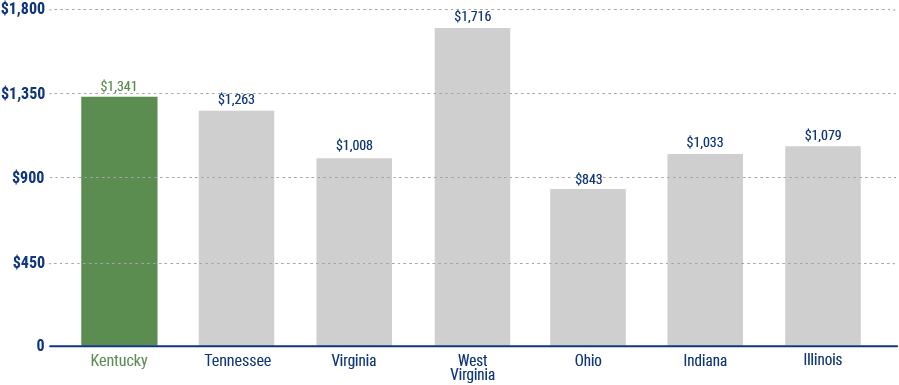

Cost of Car Insurance in Kentucky Compared to Surrounding States