Every business, large or small, will need protection from all that could go wrong. Your daily tasks and regular operations make you a profit, but they can also leave you exposed. Fortunately, Kentucky business insurance will have general liability coverage in case you get sued.

A Kentucky independent insurance agent will have access to multiple markets, saving you time and money. They'll even do the shopping for you at zero cost to your business. Connect with a local expert for tailored quotes to get started.

What Is General Liability Insurance Coverage?

The types of assets and operations your business does daily set the standard for the limits of coverage necessary. Your Kentucky general liability insurance is typically the first policy you'll purchase.

- General liability insurance: Will pay for a lawsuit arising out of bodily injury, property damage, or slander.

What Is Commercial General Liability Insurance in Kentucky?

Every business will need a commercial general liability policy in some form. Almost all companies in Kentucky will start with a general liability policy as their foundation and add other coverages from there. Some losses where it could apply are:

- A customer slips and falls on-premises.

- A building catches on fire.

- A product is improperly installed, causing a water loss.

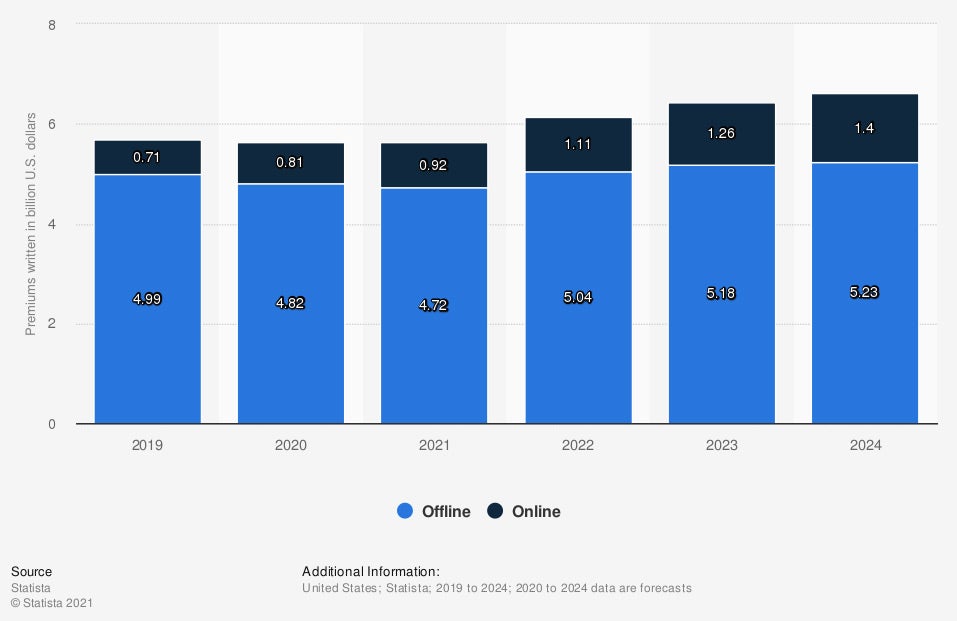

Value of business to consumer general liability insurance premiums written in the US from 2019 to 2024 (in billion US dollars)

Your general liability costs will vary and depend on your exact risks. For your pricing, connect with an adviser.

What Is Kentucky Professional Liability Insurance?

If you're in the business of consulting or advising, then a professional liability policy may be for you. It will help protect against lawsuits arising out of negligent advice. Some industries where professional liability applies in Kentucky are as follows:

- Accountant

- Lawyer

- Real Estate Agent

- Insurance Agent

- Financial Adviser

- Business broker

What Is Employment Practices Liability Insurance Coverage in Kentucky?

When your Kentucky business has employees, you'll need to account for the risk associated. Similar to a workers' compensation policy, employment practices liability insurance will protect you from an employee lawsuit. Check out what it covers:

- Employment practices liability insurance or EPLI: Pays for a lawsuit filed by a disgruntled employee due to discrimination or sexual harassment in some form.

Does Homeowners Insurance Have Liability Coverage in Kentucky?

Your personal assets and the liability risk of all household members are covered under your standard Kentucky homeowners policy. Liability limits on your home insurance start at $100,000 and go up in increments. Take a look at some instances where this coverage could apply:

- A guest or trespasser injures themselves on your property.

- Your tree falls and damages your neighbor's roof.

- You have a pool party, and a guest drowns.

What's the Difference between Full Coverage and Liability Insurance in Kentucky?

Full coverage and liability-only speaks to your commercial auto policy. Auto insurance in Kentucky is usually required, but only liability coverage is mandated. If you have full coverage, then it adds a comprehensive approach to your protection.

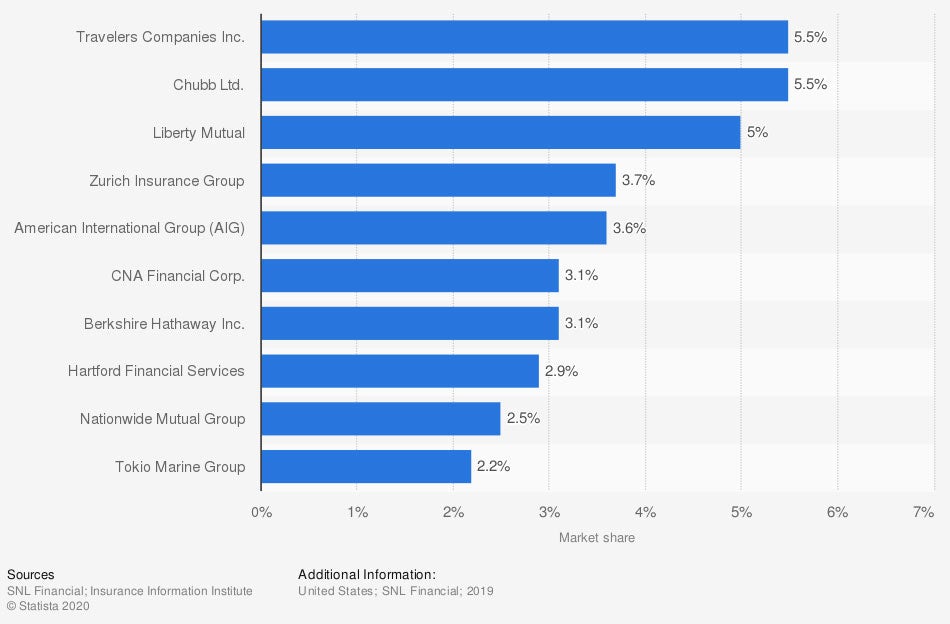

Market share of leading commercial auto insurance companies in the US in 2019, by direct premiums written

The difference between liability-only and full coverage auto insurance:

- Liability-only insurance: This is just liability coverage at the amount preselected for your auto policy. It will pay for bodily injury per person, per accident, and property damage of another party.

- Full coverage insurance: This will include additional coverages that protect you on the road. Things like comprehensive, collision, towing, and more are among the optional coverages you can select.

How a Kentucky Independent Insurance Agent Can Help

If you own a business, there is a lot that you'll be responsible for knowing and obtaining to stay well protected. Instead of going it alone, consider working with a licensed professional. They can review your general liability insurance for free so that you're completely covered.

A Kentucky independent insurance agent has a network of carriers that they use for maximum savings. Since they compare policies, you'll have more time to run your operation. Get connected with a local expert on TrustedChoice.com for custom quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/1119019/value-b2c-liability-insurance-premiums-written-usa/

Graphic #2: https://www.statista.com/statistics/186443/top-us-commercial-auto-insurance-writers-by-market-share/

http://www.city-data.com/city/Kentucky.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.