Your commercial insurance will have coverage for many different things tailored to your industry and history. If you have employees, particular policies can protect your company if things get ugly. Fortunately, Kentucky business insurance will have an option to include employment practices liability coverage against a lawsuit.

A Kentucky independent insurance agent can help you find a policy that's affordable and sufficient. They'll do the shopping for you and at no cost to your business. Connect with a local expert for tailored quotes in minutes.

What Is Employment Practices Liability Insurance?

When you hire staff members, it can mean more room for delegation and productivity. However, without adequate protection, you'll be financially responsible for anything that goes wrong. Check out the coverage that can help:

- Employment practices liability insurance(EPLI): Pays for your legal defense when an employee files a lawsuit against you. This can be a claim due to discrimination or sexual harassment, and many others.

What Does Employment Practices Liability Insurance Cover in Kentucky?

In Kentucky, $4,661,744,000 in commercial insurance claims were paid in 2019 alone. Your insurance can help protect your operation against numerous lawsuits. Employment practices liability insurance provides coverage for legal expenses arising from the following claims:

- Sexual harassment

- Wrongful termination

- Breach of an employment contract

- Discrimination

- Violation of local and federal employment laws

- Infliction of emotional distress or mental anguish

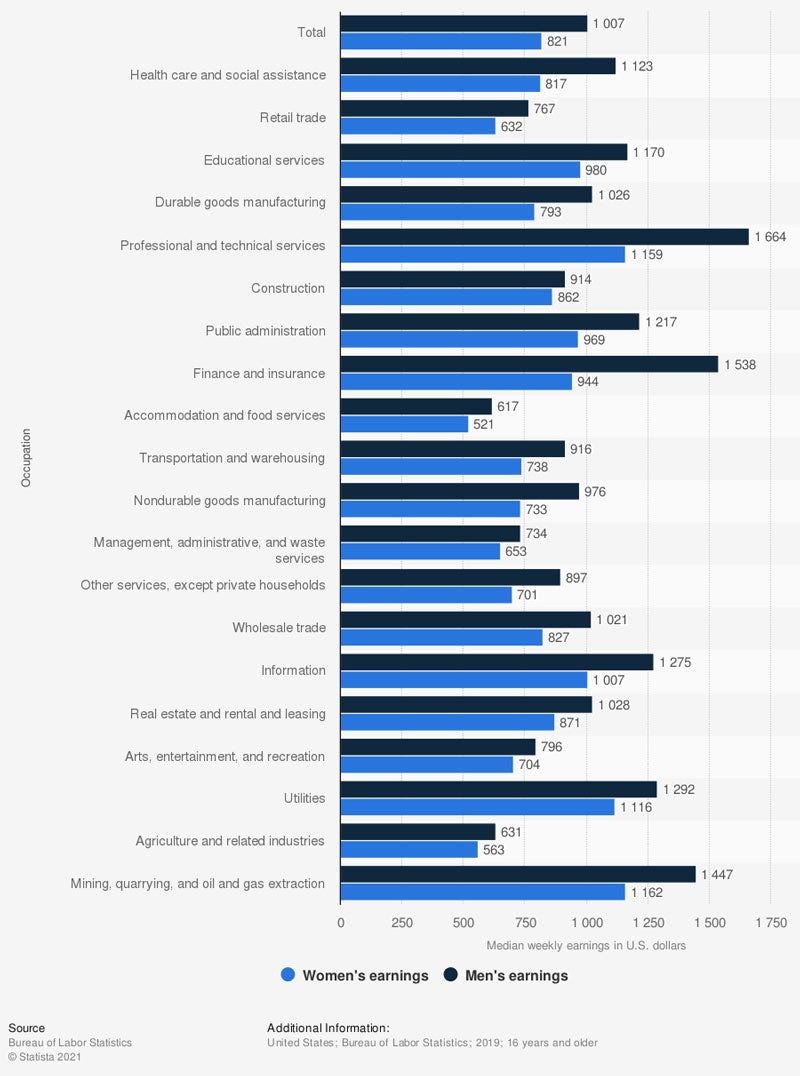

Gender wage gap by industry in the US in 2019, by median weekly earnings (in US dollars)

If your business fails to employ or promote, mismanages employee benefits, commits defamation of character, or violates privacy, you could be on the hook. Review your policy for accuracy with a licensed professional.

What Won't Employment Practices Liability Insurance Cover in Kentucky?

All commercial insurance comes with items it won't cover. Check out what claims your Kentucky employment practices liability insurance could exclude;

- If your company violates an industry-standard guideline from OSHA, a claim will be voided.

- When there is a data breach, EPLI will not cover any damages that arise from stolen employee information.

- There will be exclusions for punitive damages or criminal act losses as well.

What Does Employment Practices Liability Insurance Cost in Kentucky?

Insurance companies look at several risk factors when calculating your premiums. In Kentucky, your employment practices liability costs are determined based on the following:

- Your experience level

- The safety practices you have in place

- If you have a human resources department

- How you deal with hiring

- How you deal with termination

- Prior claims reported

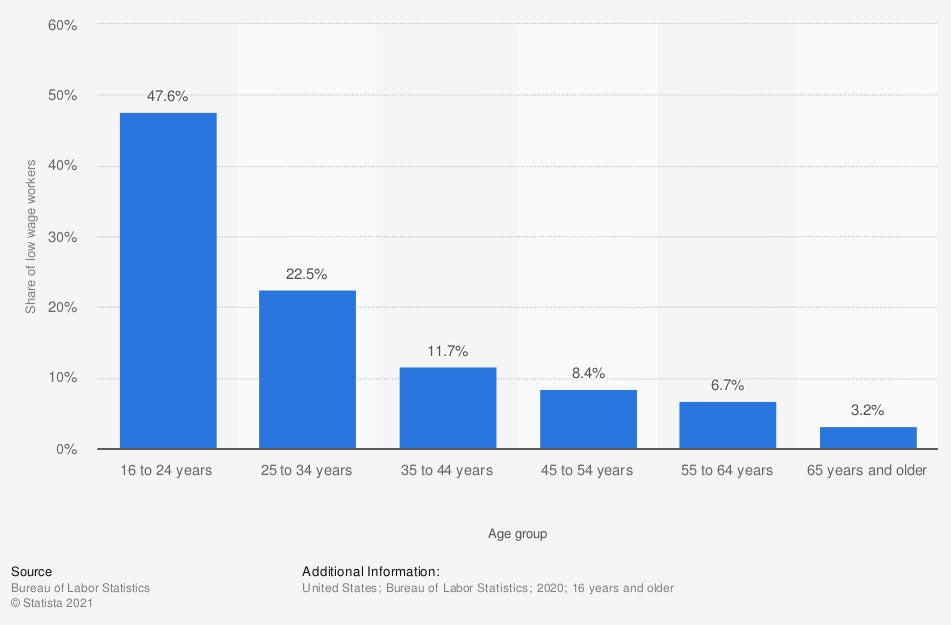

Percentage distribution of workers paid hourly rates with earnings at or below minimum wage in the US 2020 (by age)

Even if your company is not at fault when an employee files an EPLI lawsuit, you'll still need to defend yourself against the claim. Again, this can put a financial burden on your business without proper coverage.

Employment Practices Liability Insurance Third-Party Coverage in Kentucky

Third-party employment practices liability insurance is needed for those cases that involve a non-employee. Were you aware that third parties can still file a claim against your business for discrimination? Check out what third-party EPLI covers in Kentucky:

- Third-party employment practices liability coverage: This is a separate insuring agreement within employment practices liability insurance (EPLI). It covers liability claims brought by non-employees against employees of your business.

How to Work with a Kentucky Independent Insurance Agent

Your business insurance is vital to running a smooth operation in Kentucky. When you need protection for all that life throws at your company, consider working with a licensed adviser. They'll review your policies for free so that you can relax.

A Kentucky independent insurance agent works on your behalf, finding your business the best coverage. Since they have access to multiple carriers, you'll save premium dollars with options. Get connected with a local expert on TrustedChoice.com for the ultimate savings.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/244202/us-gender-wage-gap-by-industry/

Graphic #2: https://www.statista.com/statistics/298866/percentage-of-low-wage-workers-in-the-us-by-age/

http://www.city-data.com/city/Kentucky.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.