If you own a company, there is always risk involved, no matter what industry. While you can't be aware of every threat, you can be prepared. Kentucky business insurance will help you stay on the straight and narrow with protection that's necessary and required.

A Kentucky independent insurance agent has access to a network of carriers so that you're fully covered for an affordable price. They'll even do the shopping for free, making it a no-brainer. Connect with a local expert at no obligation in minutes.

What Is Business Insurance?

If you're the proud owner of a Kentucky business, then you'll want the right coverage to be protected. Whether it's required or not is a different story. Check out some policies your business may want to consider:

- General liability: Pays for a bodily injury or property damage losses.

- Business interruption: This coverage usually falls under your general liability policy and pays for regular business expenses to keep you operational during a covered loss.

- Business property: Pays for the replacement or repair of property owned by the business.

- Business inventory: Pays for the replacement or repair of inventory owned by the business. This can include spoilage coverage as well.

- Workers' compensation: Pays for an injured or ill employee's medical expenses and lost wages when hurt on the job.

- Business auto: Pays for commercial vehicles involved in an accident or loss due to business operations.

- Employment practices liability: Pays for a discrimination or harassment lawsuit filed by a disgruntled employee.

Is Business Insurance Required in Kentucky?

Kentucky has 351,260 small businesses in operation today. Despite just being a good idea, coverage will be required in various instances. Let's look at when you'd be obligated to carry insurance for your Kentucky business:

- When you're leasing a building for your business

- When you have a mortgage on a structure for your business

- When you have one or more employees

- When you have a contract or client that requires proof of coverage

- When you own company vehicles titled in the business name

Do You Need Workers' Compensation for Your Employees in Kentucky?

In Kentucky, $4,661,744,000 in commercial insurance claims were paid in one year alone. Some of those were workers' compensation-related. If you're employing staff, you'll be required to carry workers' compensation insurance with just one employee, according to Kentucky regulations.

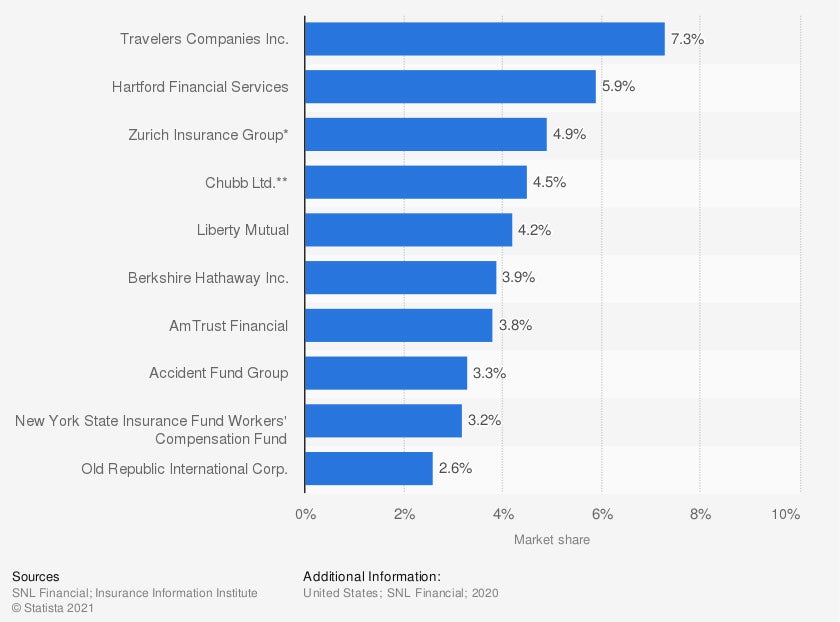

Market share of leading workers' compensation insurance companies in the US, by direct premiums written

When obtaining workers' compensation insurance, there are private carriers you can get coverage through. If you've been in business for less than three years, then you'll usually have to go through the state workers' compensation program until you gain experience.

Can Your Employees Sue Your Business for Not Having Workers' Compensation Insurance?

In Kentucky, if you're not correctly insuring your employees for injury or illness they may get as a result of their duties, then you're already behind. It's critical that you have workers' compensation benefits no matter how many staff members you have. An employee can and will sue your company for medical expenses and lost wages without the right policy in place.

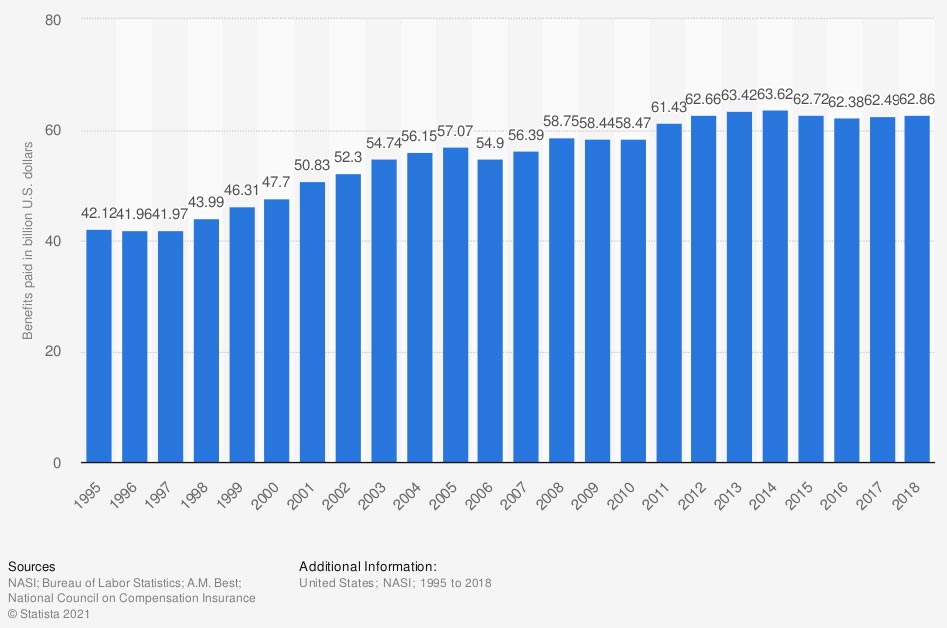

Value of workers' compensation benefits in the US

The amount of workers' compensation benefits paid out is staggering. It makes being proactive an intelligent move to avoid a lawsuit from an injured employee that could impact your bottom line.

How an Independent Insurance Agent Can Help in Kentucky

If you're searching for the best commercial coverage that complies with Kentucky requirements, you're not alone. Several policies that are necessary are just a part of doing business. Fortunately, a licensed professional can help review your risk exposures for free.

A Kentucky independent insurance agent will do the shopping at zero cost to your operation. This means you'll be presented with a plan that fits your budget without doing the work. Connect with a local expert on trustedchoice.com to start saving today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/186474/leading-writers-of-us-workers-compensation-insurance-by-market-share/

https://www.statista.com/statistics/194854/us-workers-compensation-benefits-paid-per-year/

http://www.city-data.com/city/Kentucky.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.