A rock from your neighbor's lawnmower isn't how you'd expect your car's windshield to shatter, but who pays for the damage if this unusual situation occurs?

Understanding your Kentucky insurance options can help you prepare for situations like these. To find the best insurance in your area, you can start with an independent insurance agent. But first, here's how different insurance coverages can help you in this scenario and others.

Who’s Responsible if My Neighbor Accidentally Shatters My Windshield?

If you do the crime, you pay the time, except there's a gray area regarding how insurance would handle if your neighbor accidentally shattered your windshield. Despite the incident being your neighbor's fault, your insurance would likely be the one that responded to the damage. Here's how this works.

If your vehicle is damaged, you typically file the claim through car insurance, not home insurance. In this scenario, since your vehicle is the one that is damaged, you'd start with filing the claim through your insurance.

An agent can help you understand why incidents like this fall under car insurance and not home insurance, even though the vehicle is parked at your house. They can also make sure you have the right coverage in place.

Am I Responsible for Covering Any Damage Caused by My Neighbor?

If your neighbor's lawnmower is kicking up a rock into your car's windshield, your insurance would be responsible for the damage. However, it would only pay if you had the right coverage, which is comprehensive insurance.

If you did not have comprehensive insurance, you could try and get reimbursed in one other way.

- Choosing to file a lawsuit against your neighbor: This would include filing a claim through your neighbor's home insurance against their liability coverage. Once again, we don't recommend relying on this solution.

The best chance of getting insurance to pay for damage that occurs to your vehicle when parked at your home is by making sure you have the proper car insurance in Kentucky. Without the right coverage, you're left having to pay out of pocket for incidents like these that may not even be your fault.

What Does Car Insurance Cover in Kentucky?

Car insurance in Kentucky can protect you against scenarios where your neighbor breaks your windshield and more. It can also cover injuries you cause to others, damage to your vehicle during a collision, property damage that you cause, incidents with uninsured drivers, and other things. There are required coverages for all drivers in Kentucky and optional policies you can discuss with your independent insurance agent.

Mandatory Kentucky auto insurance coverage:

- Bodily injury liability: $25,000 for injury or death of one person in an accident, $50,000 for injury or death of more than one person in an accident. This coverage pays for third-party medical expenses and legal fees if you're sued.

- Property damage liability: $25,000 for damage to the property of another person. This coverage pays for damage you cause to someone else's vehicle or property.

- Personal injury protection (PIP): Up to $10,000 per person per accident for medical expenses, regardless of fault. This coverage reimburses injuries to the driver and their passengers after a car accident.

Optional Kentucky auto insurance coverage:

- Collision coverage: This covers the cost to repair or replace your vehicle if it is damaged or totaled in a collision, regardless of fault.

- Comprehensive coverage: This covers the cost to repair or replace your vehicle if it is damaged or totaled by a non-collision event such as a hailstorm or theft.

- Uninsured motorist coverage: This coverage pays for damage to your vehicle and personal injuries if you're in an accident with an uninsured or underinsured motorist.

What if I Don’t Have Comprehensive Coverage on My Vehicle?

Unfortunately, in this situation, if you did not have comprehensive car insurance, you would be left paying for damage to your vehicle out of pocket. Even though it's not required, comprehensive coverage is the only insurance policy that pays for damage to your car outside of a collision.

An agent can walk you through the benefits of comprehensive auto insurance to help you determine if it's the right option for you.

What if I Am at a Stop Light and I Was Rear-Ended, Causing Me to Sustain Serious Injuries?

There are "no-fault" and "at-fault" states when it comes to auto insurance. Whether your state is an at-fault or no-fault state impacts the type of insurance you must have and how claims are handled.

Kentucky is a no-fault state which means that each driver is responsible for filing a claim with their insurance after an accident, regardless of who is at fault. Suppose you happened to be at a stop light and another driver rear-ends your vehicle, causing you to sustain serious injuries. In that case, your medical costs and other economic losses are the responsibility of your insurance company, not the other driver's.

That is why Kentucky requires all drivers to carry PIP coverage. This policy pays for medical expenses, lost wages, and other associated costs after an accident. It would pay up to $10,000 or your policy limits for your injuries.

Comprehensive Car Insurance Stats

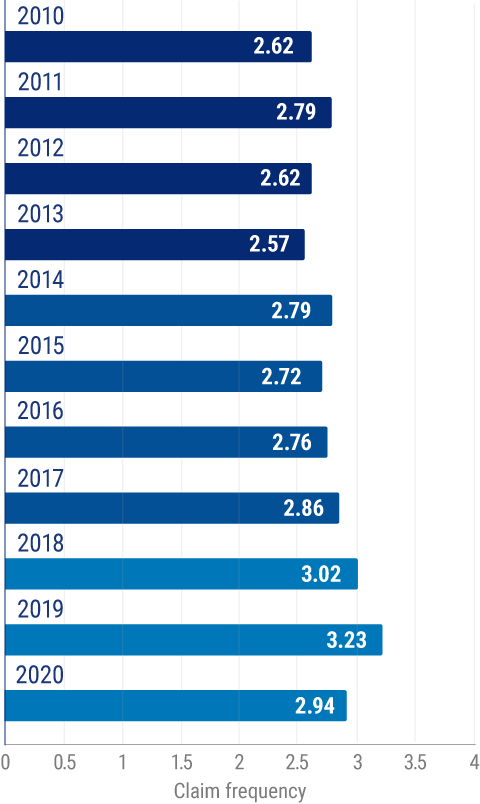

Since it's an optional coverage, you'll have to work with your independent insurance agent to determine if comprehensive car insurance is right for you. These statistics of how frequently comprehensive insurance claims happen can help your decision.

Frequency of Auto Claims

- Even though the frequency of comprehensive insurance claims fell in the last year, it continually increased in frequency year after year in previous years.

- In one recent year, there were 3.23 comprehensive insurance claims filed per 100 cars.

- In the following year, this number dropped to 2.94 per 100 cars.

- In that same year, the average value of private passenger auto comprehensive insurance claims for physical damage was $1,995.

How Can a Kentucky Independent Insurance Agent Help?

Your vehicle is susceptible to damage on and off the road. Whether you're in a collision or you encounter bad luck from your neighbor's weekend landscaping duties, Kentucky car insurance is designed to help you pay for unexpected disasters.

To find the best car insurance, a Kentucky independent insurance agent can help. Agents are located across the state. They understand the auto laws and are shopping for insurance quotes with your best interest in mind. Agents will help you find the coverage you need and keep you away from what won't benefit you. They do it all for free, too. Work with a local agent today.

Article reviewed by | Jeffrey Green

https://drive.ky.gov/motor-vehicle-licensing/Pages/Mandatory-Insurance.aspx

https://insurance.ky.gov/ppc/newstatic_info.aspx?static_id=24

https://www.iii.org/fact-statistic/facts-statistics-auto-insurance