In Kentucky, $4,661,744,000 in commercial insurance claims were paid in 2019 alone. When you own commercial property, protection for your largest assets is a must. Kentucky business insurance can help cover your structures, belongings, and more so you can avoid bankruptcy or worse.

Fortunately, a Kentucky independent insurance agent has access to a network of carriers for all your coverage needs. They'll even do the shopping for free, giving you options. Connect with a local expert for instant savings on your policies.

What Does Commercial Property Insurance Cover in Kentucky?

Your Kentucky commercial property could fall into a few different categories. There are several types of property policies, making it challenging to know what's best. Take a look at what is covered under a commercial property policy in Kentucky:

- Commercial equipment: This can be anything from machinery to forklifts. Coverage will go off of an actual cash value or replacement cost. A deductible usually applies.

- Commercial structure: This covers the actual building you own up to the dwelling amount listed. A replacement cost estimator is used to determine how much it would cost to repair or replace your building. Coverage can be for actual cash value, replacement cost, or depreciated value.

- Commercial belongings: This will cover any business belongings, such as furniture, office supplies, and more. It will be for replacement cost, actual cash value, or depreciated value.

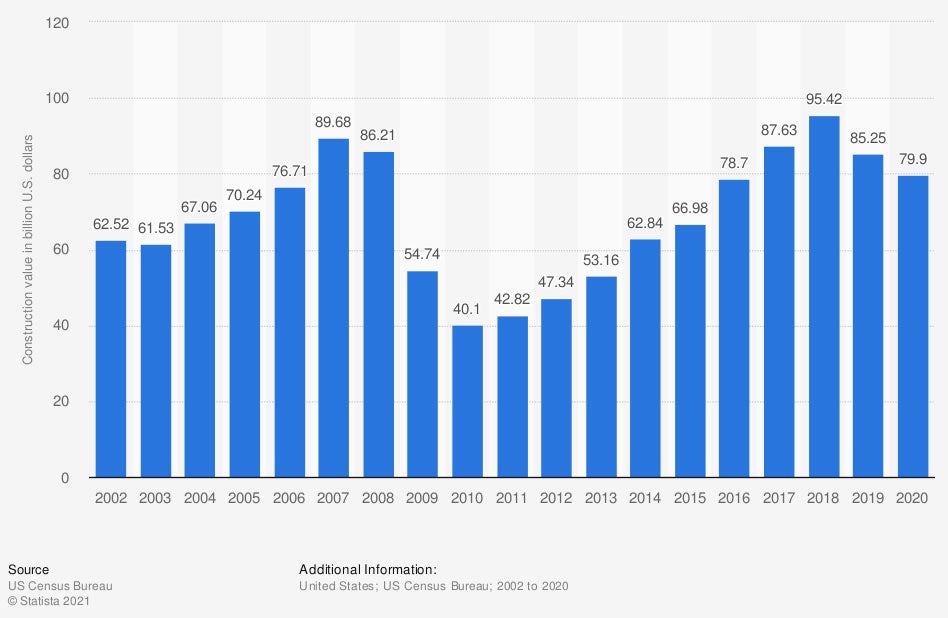

Value of US commercial construction put in place from 2002 to 2020 (in billion US dollars)

If you own commercial property, you could have a considerable expense to replace it without proper insurance. It's essential to review your policies for sufficiency with a trusted expert.

What Does Commercial Property Insurance Cost in Kentucky?

The price of your commercial property coverage will differ from everyone else. This is because carriers look at your individual history, data, and past losses in the area. Check out the risk factors insurance companies use in Kentucky:

- Local weather

- Claims history

- Type of property insured

- Square footage

- Value or replacement cost of property

- If you rent out the commercial property to others

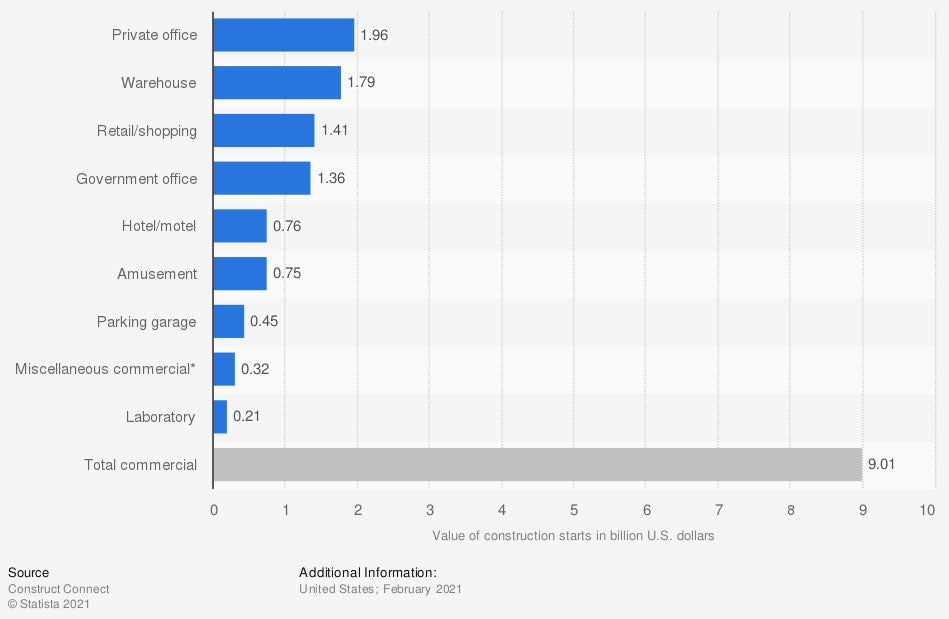

Value of US commercial construction starts in February 2021, by property type (in billion US dollars)

The value of each type of commercial property varies. It's vital to understand how much coverage your specific property will need.

How Much Commercial Property Insurance Do I Need in Kentucky?

In Kentucky, there are 351,260 small businesses in existence. The amount of protection your commercial property will need depends on your specifications. Take a look at the different ways you can insure your commercial property:

- Replacement cost: This will pay for your commercial property's current value at the time of loss in total. When you have a claim, it will restore or replace your property to like kind and quality.

- Actual cash value: This coverage is equal to replacement cost minus depreciation. If your commercial property is damaged, aged, or has natural wear and tear, this will be subtracted from the replacement cost amount.

- Functional replacement cost: This meets between actual cash value and replacement cost. It will replace or repair your commercial property with material that is less costly but just as functional.

Who Needs Commercial Property Insurance in Kentucky?

If your business owns commercial property in any form, you'll want protection from all the what-ifs. Your coverage may include inventory, structures, or office supplies. Check out who commercial property insurance would apply to:

- Business owners

- Commercial property owners

- If you have commercial equipment

- If you have a property titled in a business name

Does Commercial General Liability Insurance Cover Property Damage in Kentucky?

Commercial property insurance is different from general liability insurance in Kentucky. Both are usually necessary and cover separate parts of a loss. Take a look at the facts:

- General liability insurance: Pays for a lawsuit arising from bodily injury, property damage, or slander. This is usually the most accessed policy you'll own.

- Commercial property insurance: Pays for replacement or repair of a commercial structure, belongings, or equipment. This does not have its own liability limit, but is in addition to your general liability coverage.

- Commercial package policy: This is just how it sounds, a package. This package will include general liability, commercial property, and more ancillary coverages together in one policy. Typically, lower premiums and more robust coverage options will be included in a commercial package.

How a Kentucky Independent Insurance Agent Can Help

When you own a business in Kentucky, there are several coverages you could need for adequate protection. If you have commercial property, you'll need a property policy to cover your assets. Fortunately, a licensed adviser can review your insurance for free, making it a no-brainer.

A Kentucky independent insurance agent does the shopping for you, saving you time and money. They have a network of carriers they do business with so that you have options. Get connected with a local expert on trustedchoice.com for maximum savings.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/245029/value-of-us-commercial-construction/

Graphic #2: https://www.statista.com/statistics/197623/total-value-of-commercial-construction-starts-by-type-in-the-us/

http://www.city-data.com/city/Kentucky.html