Your business probably wouldn’t be as successful or productive without its crew, which is why it’s important to keep them protected. Employees are vulnerable to injuries and illness on the job in even the safest environments. That’s what makes having adequate workers’ comp coverage critical.

Luckily a Kentucky independent insurance agent can help you get set up with all the workers’ comp your business needs to maintain smooth operations. Better yet, they’ll get you covered before you need to file a claim. First, here’s a closer look at this important coverage.

What Is Workers’ Compensation?

Workers’ compensation insurance, or workers' comp, is an important part of a complete Kentucky business insurance policy. Coverage is designed to protect your staff in the event of injuries, illness, and even death on the job or due to work-related activities.

If you’ve got employees, it’s highly likely that you’re required to carry this coverage. Workers’ comp protects employers from employee lawsuits for claims of incidents resulting in illness or injury.

What Does Workers’ Compensation Cover in Kentucky?

Workers’ comp provides several key protections to businesses in Kentucky. Coverage is meant to protect your company from costly employee lawsuits, and reimburse you for several costs related to these cases.

Workers’ comp covers the following:

- Legal protection: If your business gets sued, workers’ comp will reimburse for attorney, court, and settlement fees.

- Death and disability benefits: If an employee gets killed or becomes disabled due to their work, workers’ comp may pay out a lump sum death or disability benefit.

- Employee wages: Workers’ comp may reimburse for lost employee wages while they are out of work recovering from an injury or illness.

- Injury or illness: Employees are protected from injury and illness related to workplace equipment or materials, as well as other disasters like workplace violence, terrorist attacks, and storms, under workers’ comp.

- Medical care: Workers’ comp reimburses for employee medical treatment for workplace injuries or illnesses.

- Funeral costs: If an employee gets killed on the job or as a result of job duties, workers’ comp may reimburse for funeral costs, as well.

A Kentucky independent insurance agent can help further break down the core coverages provided by workers’ comp.

What’s Not Covered by Workers’ Compensation in Kentucky?

Workers’ comp offers a ton of critical protection for many kinds of businesses in Kentucky. However, your policy doesn’t cover everything. According to insurance expert Paul Martin, workers’ comp policies often exclude these incidents:

- Those that occur while employees travel to or from the jobsite

- Those that occur due to employee negligence

- Those that occur due to intentional or dishonest acts by employees

Workers’ comp covers many incidents that occur on the job, as long as the employee was adhering to company guidelines for safety.

What Kinds of Incidents Does Workers’ Comp Cover Most Often?

Before you shop for workers’ comp, it’s important to understand when and why your business may use it. Check out some of the most common workplace incidents below.

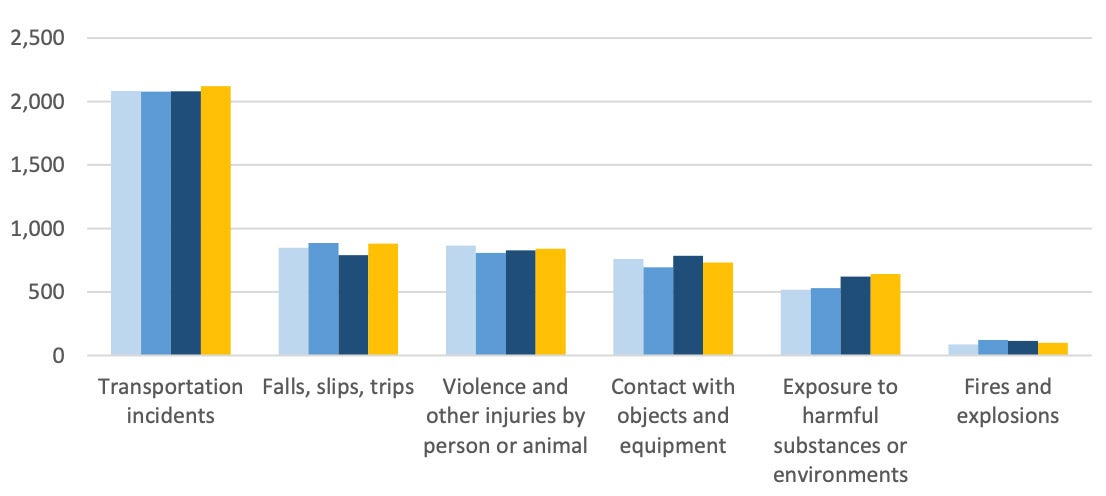

Fatal Work Injuries by Major Event or Exposure

By far the most common fatal workplace events in recent years have stemmed from transportation incidents. Next most common are those stemming from trips, falls, and slips, followed by violence and other injuries by a person or animal. Other top causes include contact with objects and equipment, and exposure to harmful substances or environments.

Your Kentucky independent insurance agent can further explain which incidents may impact your business that would require workers’ comp coverage.

Is Workers’ Comp Required for all Businesses in Kentucky?

Pretty much, yes. Under Kentucky state law, all employers with at least one employee, even if the worker is part-time, are legally obligated to provide occupational injury coverage. So, if you’ve got any hired workers, whatever their total hours on the job, your Kentucky business needs to be equipped with adequate workers’ comp coverage.

Does My Location Influence My Workers’ Compensation Rates?

Yes, your location will influence your workers’ comp premium rates, much like it would for any other type of insurance. There are several factors all together that determine your policy’s rates, but businesses in larger cities often pay a bit more for their coverage than those in rural or small towns.

Other factors that influence workers’ comp rates are:

- The size of your business

- How many employees you have

- The type of business you run

- Your business’s specific operations

- Kentucky’s state regulations

A Kentucky independent insurance agent can help you find the right workers’ comp insurance at the most affordable rate in your area.

Here’s How a Kentucky Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect businesses against commonly faced liabilities. Kentucky independent insurance agents shop multiple carriers to find providers who specialize in workers’ compensation insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

graph - https://www.bls.gov/news.release/pdf/cfoi.pdf

https://www.iii.org/fact-statistic/facts-statistics-workplace-safety-workers-comp

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/specific-coverages/workers-compensation-insurance

© 2024, Consumer Agent Portal, LLC. All rights reserved.