If you own a business, there are many risk exposures that you'll need to take into account. While living the American dream can be exciting and profitable, it also comes with a lot of responsibility. Business umbrella insurance can be included with your Kentucky commercial insurance policies whatever your industry.

Fortunately, a Kentucky independent insurance agent can help with policy and premium options that are affordable. They'll even do the shopping for you at no additional cost to your company. Get connected with a local expert for tailored quotes in minutes.

What Is Commercial Umbrella Insurance?

Additional coverage is necessary for most businesses to have adequate protection limits for all the what-ifs. If you have a loss that exceeds your underlying policies, umbrella coverage can help. Check out how it works:

- Commercial umbrella insurance: Provides an extra layer of liability coverage over your underlying business policies for a substantial bodily injury or property damage claim.

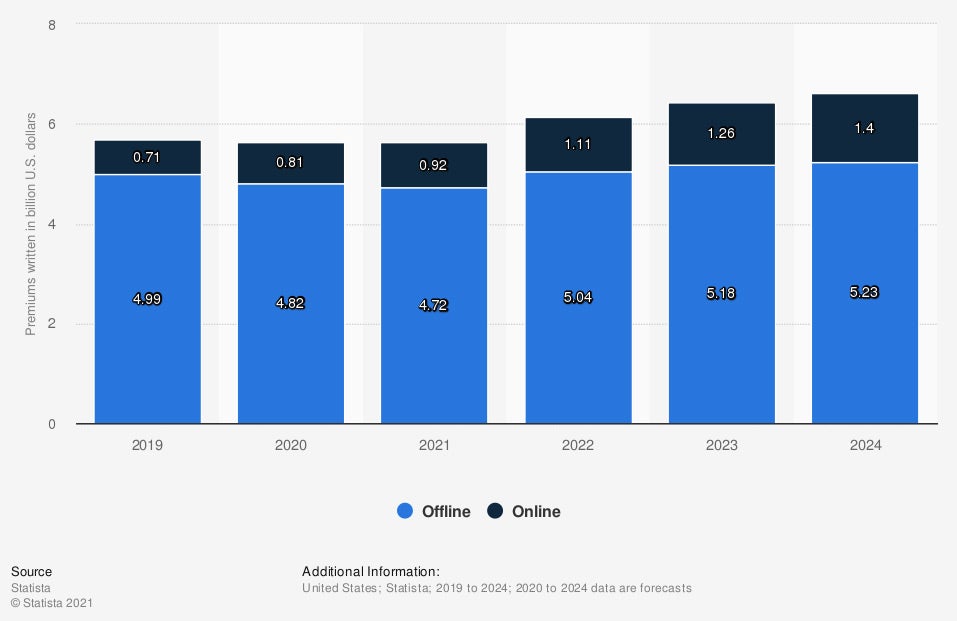

Value of business-to-consumer general liability insurance premiums written in the US (in billion US dollars)

Your commercial umbrella is a form of general liability coverage. Limits of protection will start at $1,000,000 and kick in after your underlying policies are exhausted.

What Does Commercial Umbrella Insurance Cover in Kentucky?

If your Kentucky business has a major liability loss, then you may not have the extra reserves to cover the bill. Most small companies simply do not have enough cash flow to pay out a claim in the millions. Take a look at some things a commercial umbrella policy can provide protection for:

- A lawsuit arising out of slander

- A lawsuit arising out of liability

- A lawsuit arising out of defamation of character

- A lawsuit arising out of bodily injury

Commercial Umbrella Insurance Costs in Kentucky

The average cost of business insurance will vary and depends on the industry, among other factors. In Kentucky, your insurance carrier will look at your unique data and history to calculate a premium. Check out the following items companies use to rate your commercial umbrella coverage:

- Your claims history

- Your assets

- Your gross business income

- Local weather patterns

- The industry you are in

- Your experience level

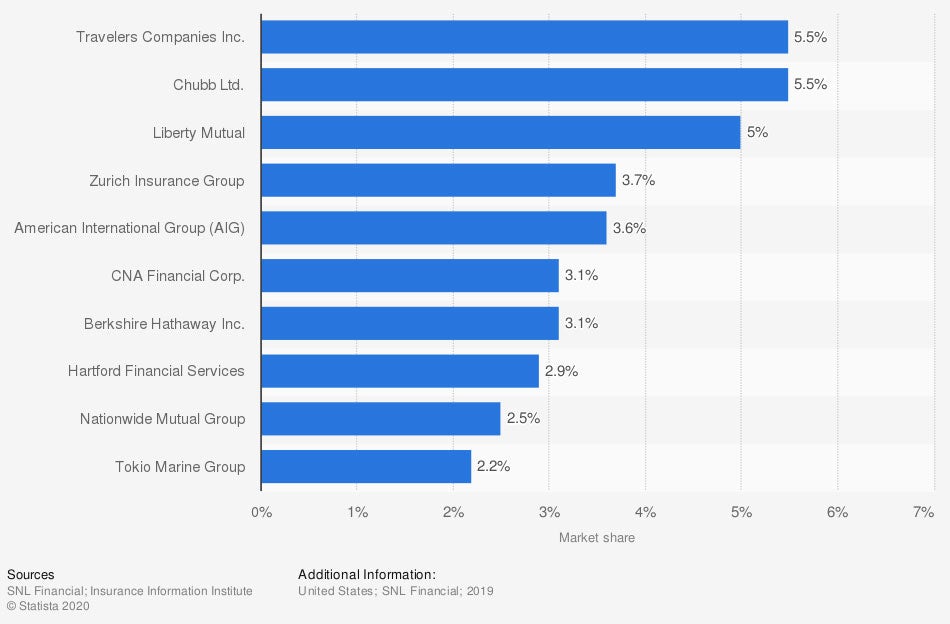

Market share of commercial lines insurance companies in the US in 2019, by direct premiums written

Commercial insurance premiums will be different for every operation. How your business is run, and the exposures you have, will determine the cost charged. To get exact pricing, consult with a licensed agent.

Commercial General Liability Insurance vs. Umbrella Insurance in Kentucky

Every business will usually start with a general liability policy as its foundational coverage. From there, several options and other policies can be added depending on your needs as a company. Commercial umbrella insurance is an additional policy that you can obtain for more liability coverage. Your general liability and commercial umbrella insurance are separate policies but work in conjunction with one another.

How they work together:

- General liability insurance: Pays for a lawsuit arising out of bodily injury, property damage, or slander.

- Commercial umbrella insurance: Pays for a lawsuit arising out of bodily injury, property damage, or slander. This is a continuation of liability coverage when a larger claim occurs.

Stand-Alone Commercial Umbrella Insurance in Kentucky

In Kentucky, $4,661,744,000 in commercial insurance claims were paid in 2019 alone. A commercial umbrella policy can help cover some of your business's most costly exposures. The majority of insurance companies offer a business umbrella policy through the same carrier as your underlying coverage. A stand-alone commercial umbrella policy can be obtained, but very few carriers allow an umbrella policy on its own. Discuss options with a trusted adviser for the best results.

How to Connect with an Independent Agent in Kentucky

When you operate a business in Kentucky, you'll want coverage that's accurate and sufficient. A commercial umbrella policy can protect your company from a catastrophic loss. When a claim runs your underlying policies dry, umbrella insurance can save the day.

Fortunately, a Kentucky independent insurance agent can help with affordable coverage that protects your assets and livelihood. Since they work with multiple carriers at once, you'll have options. Connect with a local expert on TrustedChoice.com to get started today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/1119019/value-b2c-liability-insurance-premiums-written-usa/

Graphic #2: https://www.statista.com/statistics/186464/leading-us-commercial-lines-insurance-by-market-share/

http://www.city-data.com/city/Kentucky.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.