Bakeries can be a sweet treat if you're looking for a snack or want an enjoyable experience. When you're the owner of one of these establishments, it will come with a set of unique risks. That's why it's imperative to have adequate Kentucky business insurance for all your bakery needs.

If you're shopping for a policy with all the bells and whistles, consider using a licensed professional. A Kentucky independent insurance agent can help you save money and time. Get connected with a local expert for tailored bakery insurance quotes today.

What Is Bakery Insurance?

There are several risks you'll have as a bakery owner in Kentucky. Some might be common knowledge, while others may surprise you. Check out standard coverage choices for bakeries below:

- General liability: Pays for bodily injury and property damage losses.

- Business property: Pays for damage to your building or business belongings.

- Business inventory: Pays for any damage or loss to your bakery's inventory.

- Business equipment breakdown: Pays for the covered breakdown of any included piece of equipment.

- Commercial umbrella liability: Pays for additional liability coverage once your underlying policy limits have been exhausted.

- Workers' compensation: Pays for any employee's medical expenses and lost wages if they get injured or become ill due to working for your bakery.

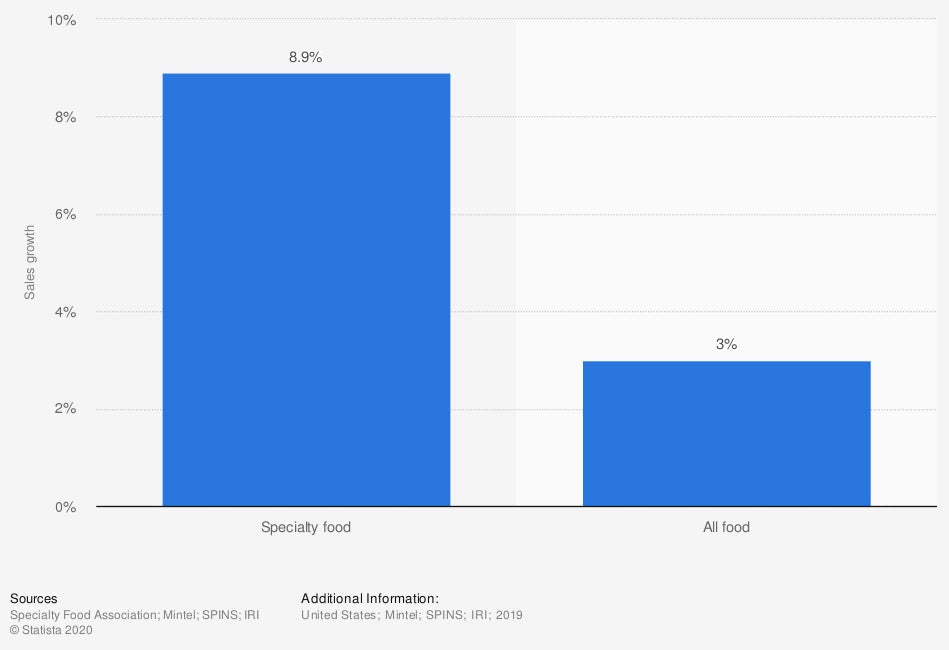

Retail sales growth of food in the US in 2019, by type

When you're in the business of selling baked goods, there can be a lot of overhead. What other retail and restaurants in your area gross can give you insight into the industry.

What Does Bakery Insurance Cover in Kentucky?

In Kentucky, there are 351,260 small businesses in existence. It's important to understand what your bakery insurance covers and how it works. Let's look at standard bakery policies:

- Coverage for claims of bodily injury or property damage

- Coverage for your business inventory such as products

- Coverage for business equipment that breaks down due to a covered loss

- Coverage for employees who are injured or become ill on the job

- Coverage for commercial vehicles used to operate the business

- Coverage for disgruntled employees that sue due to discrimination or harassment

Your bakery insurance will include protection against fire, theft, vandalism, and severe weather as well. If your property or inventory is directly affected, your property and liability policies can assist in the loss.

How Much Is Bakery Insurance in Kentucky?

In Kentucky, $4,661,744,000 in commercial insurance claims were paid in 2019 alone. To avoid paying any part of that number out of your own pocket, you'll need to protect your business. The number of paid claims in an area will drive up insurance premiums for everyone, but specific risk factors impact your rates. Take a look at the factors companies consider when quoting your bakery insurance:

- Loss history

- Replacement cost values

- Insurance score

- Experience level

- Location

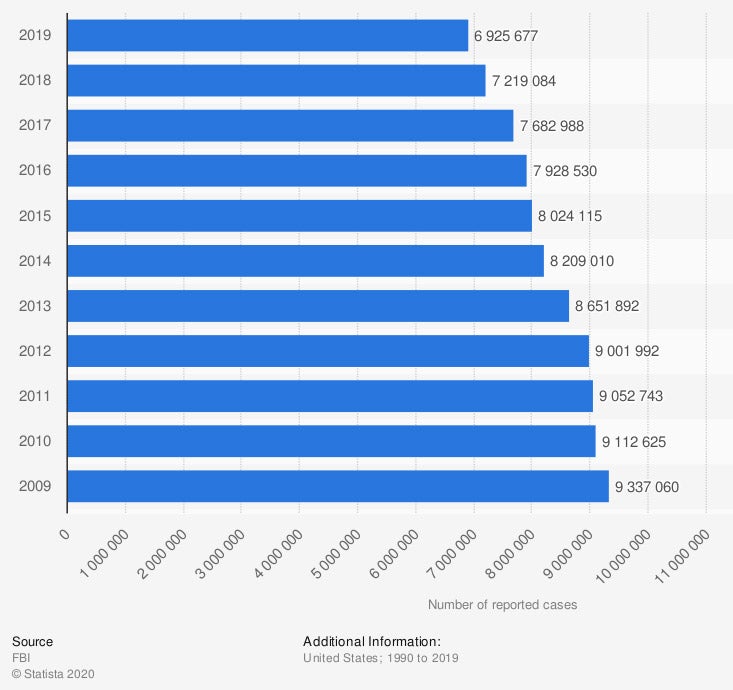

Number of reported cases of property crime in the US from 2009 to 2019

Carriers look at the safety of the place where your bakery is located in Kentucky. If your location has a high crime rate, you can expect to pay more for commercial insurance across the board.

Is Theft Coverage Included under Kentucky Bakery Insurance?

Your Kentucky bakery will need a commercial property policy in order to have coverage for structures, inventory, business equipment, and more. One of the primary coverages included under most commercial property policies is theft and vandalism. This will help pay for a break-in to your bakery or if someone damages your equipment.

Will My Kentucky Location Impact My Rates?

There are 4,414,349 residents in the state of Kentucky and growing. Where your bakery resides will have more of an impact on your business than you think. Your commercial insurance policies are rated on a variety of factors, and location is one of them. Insurance companies will look at local crime, the number of claims filed, and potential flood risk in your area. If you have chosen an unsafe place to run your operation, you could have a larger insurance bill to pay.

How an Independent Insurance Agent Can Help in Kentucky

In Kentucky, your bakery should run on more than just hopes and dreams. The right protection is necessary to avoid significant financial loss and closure. Fortunately, a trusted professional can help review your policies so that you're covered.

A Kentucky independent insurance agent has access to several markets, giving you options and saving time. The best part is they'll do the shopping for you at no additional cost to your bakery. Connect with a local expert on TrustedChoice.com for custom quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/1017330/us-specialty-food-sales-growth-by-retail-channel/

Graphic #2: https://www.statista.com/statistics/191208/reported-cases-of-property-crime-in-the-us-since-1990/

http://www.city-data.com/city/Kentucky.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.