Insurance Content Navigation

- Average Cost of Agribusiness Insurance in Kentucky

- What Does Agribusiness Insurance Cover in Kentucky?

- What Doesn't Agribusiness Insurance Cover in Kentucky?

- Is Agribusiness Insurance Required in Kentucky?

- Does Agribusiness Insurance Cover Transportation of Products in Kentucky?

- Additional Agribusiness Insurance Coverages in Kentucky

- How a Kentucky Independent Insurance Agent Can Help You

Average Cost of Agribusiness Insurance in Kentucky

The cost to insure your agribusiness will vary depending on your farm's specifics. The volume of insured farmland by acres is 140,210 in the US.

What impacts your agribusiness insurance premiums:

- Value of land

- How many acres you own

- Prior losses

- How the farmland is used

- If you have livestock

- If you have equipment or machinery

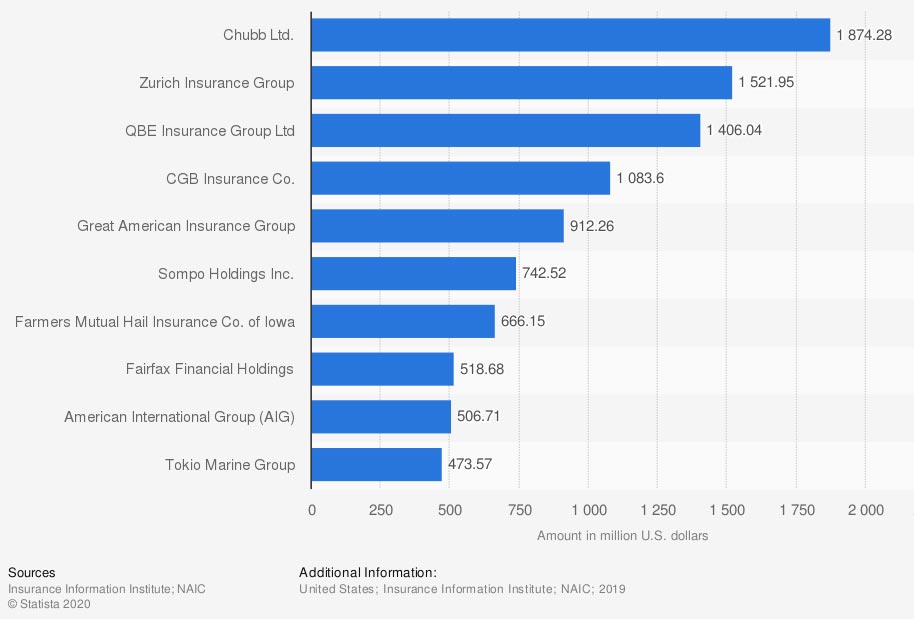

Largest multiple peril crop insurance companies in the US, by direct premiums written

If you're in the agriculture business, you're likely to be selling whatever you're growing or producing. It all needs the right protection. Multiple peril crop insurance is backed by the federal government.

What Does Agribusiness Insurance Cover in Kentucky?

All agribusinesses in Kentucky will have unique exposures that need tending. Whether you're growing crops on thousands of acres or just a few, you'll want to be prepared.

Coverage options your agribusiness should consider:

- General liability: This pays for a lawsuit against your farm due to bodily injury or property damage.

- Commercial property: This policy covers your farm structures and pole barns, and can even insure your equipment.

- Accidents: This can be anything from coverage for electrocution, fire and smoke, to loading and unloading of livestock.

- Natural disasters: Volcanic eruptions and sinkholes are covered. Typically floods and earthquakes are covered under separate policies.

- Weather events: Lightning, wind, hail, tornadoes, and more.

- Crimes and civil unrest: This is for theft and vandalism of livestock.

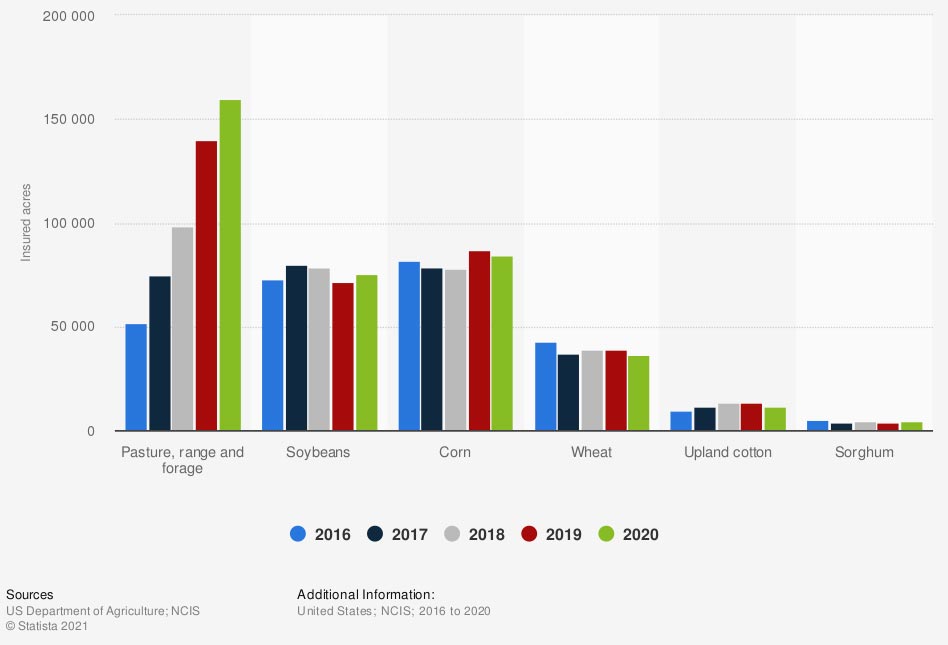

Volume of insured acres of farmland in the US, by crop

The coverages your agribusiness will need will depend on what you're doing with your acres. From livestock roaming your acreage to flipping crops for a profit, every farm is different.

What Doesn't Agribusiness Insurance Cover in Kentucky?

Every insurance policy will come with some exclusions on coverage. You may be able to add some limits back into the policy for a premium, while others are off the table entirely.

Coverage that could be added but does not come standard on your policy:

- Attacks by wild animals

- The collapse of a building on livestock

- Flooding

- Hail damage to crops

- Crop coverage

Not all protection for your Kentucky agribusiness can be sold, making some losses out-of-pocket expenses. This includes death to your livestock by natural causes or old age and any intentional and malicious acts of destruction or loss.

Is Agribusiness Insurance Required in Kentucky?

Insurance for your agribusiness isn't usually required by law. However, if you're keen on keeping as much profit as possible, it should be considered. Check out when farm insurance may be required for your agribusiness in Kentucky:

- When you have a mortgage on your farmhouse, outbuilding, barns, and more

- When you have loans out on your farm equipment

- When you have a distributor who requires proof of insurance

- When you are required to have workers' compensation insurance to cover employees

Does Agribusiness Insurance Cover Transportation of Products in Kentucky?

You've spent back-aching months growing or producing the perfect product from your agribusiness. Now, you have to transport it to be sold throughout the state or country. However, the transportation of your goods isn't automatically covered under your agribusiness policies.

Instead of being surprised and out of funds after a hard year's work, obtain the right insurance. Your policies can have an option to include cargo coverage and property in-transit coverage so that you're fully protected from a loss. Adding these limits will ensure that your product is protected up to the replacement amounts list on the policy and while they're on the road.

Additional Agribusiness Insurance Coverages in Kentucky

Whatever the size of your Kentucky agribusiness, you'll want to be fitted for the right protection. The proper coverage comes from knowing your crop specifics and how you're using your agribusiness.

Your independent insurance agent will need to know the following to get started:

- Your crop specifications: What are your crops, where will you be storing them, how much is there, and how many acres will your crops occupy?

- What your crops are worth: How much will it cost to replace your crops before, during, and after the final completion of your product?

- If you have any livestock: If you're letting farm animals graze your pastures, they'll need to know values, specifications on each herd, and gross annual sales.

- What preemptive protection you have in place: Are there special measures you take to ensure that your crops are safe from pests, wild animals, and predators? Are you using pesticides? What equipment are you using to care for your crops? Where are you storing your crops after growing and before distributing them?

How a Kentucky Independent Insurance Agent Can Help You

Your agriculture business will need proper protection if you plan on keeping it growing year after year. When you are looking for the best insurance policies to suit your needs, it can be challenging all by yourself. Fortunately, you won't have to go it alone.

A Kentucky independent insurance agent reviews your coverage and premiums for free, saving you time and money. They shop your policies through a network of highly rated carriers so that you're getting the best deal. Connect with a local expert on trustedchoice.com for custom quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/689397/largest-mpci-companies-usa-by-direct-premiums/

https://www.statista.com/statistics/723015/volume-of-insured-acres-of-farmland-usa-by-crop/

http://www.city-data.com/city/Kentucky.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.