Kentucky crops bring in more than $2 billion dollars a year to the state. With nearly 76,000 farms across Kentucky, if you're one of the many farmers growing crops you'll want the proper insurance to protect your products. Crop insurance protects more than 3.5 million acres of farmland in Kentucky and in 2019 alone crop insurers paid $112.5 million to cover crop losses.

The good news about crop-hail insurance is it can be purchased at any time during the year, but that doesn't mean you should wait for a disaster to strike to seek out this insurance. A Kentucky independent insurance agent can help you prepare for the worst today so that you're not faced with financial turmoil later.

What Is Kentucky Crop-Hail Insurance?

Crop-hail insurance is a type of farm and ranch insurance that is designed to pay for any damage that happens to your crops that have yet to be harvested as a result of hail. Typically, crop-hail insurance is written as supplementary coverage on a farm insurance policy.

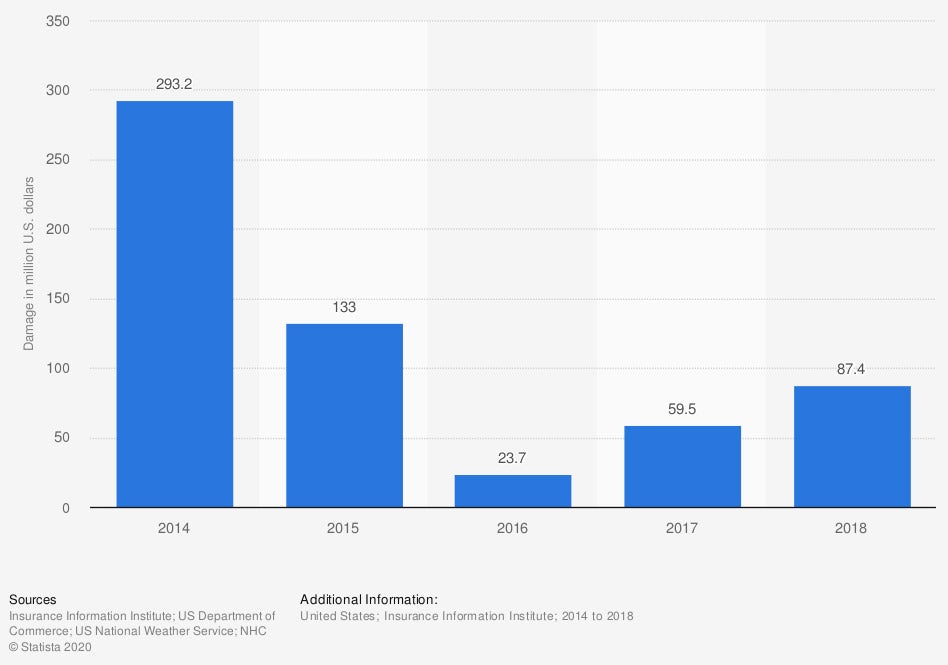

Crop damage from hail in the United States from 2014 to 2018

(in million US dollars)

The United States experienced $87.4 million in crop hail damage in 2018. This was almost $28 million more than was experienced the previous year.

What Does Crop-Hail Insurance Cover in Kentucky?

Even though this policy has "hail" in the name, it covers much more than that. In fact, it's designed to cover most natural disasters that your farm might encounter in Kentucky. According to insurance expert Jeffrey Green, crop-hail insurance can be extended to include the following coverage:

- Hail

- Fire

- Lightning

- Theft

- Wind

- Vandalism

- Malicious mischief

Should your farm and crops be destroyed in one of these events, crop-hail insurance will help cover the costs of product loss, labor and lost profits.

Unlike general crop insurance, crop-hail insurance is purchased by acre and can be bought from private companies. Crop insurance can only be purchased through the Federal Crop Insurance Program.

What Doesn't Kentucky Crop-Hail Insurance Cover?

While crop-hail insurance will cover many events, it does have some exclusions. First, not every crop is covered under crop-hail insurance. The most common crops grown in Kentucky are covered, but it's still best to check which crops are included in your policy. It also will not cover disease outbreaks or changes in crop values. There are several major weather-related events that are excluded in crop-hail insurance, including:

- Frost

- Drought

- Excess moisture

- Flood

All of these weather patterns are covered under general crop insurance, which is part of the Federal Crop Insurance Program (FCIP). Kentucky does experience frost and drought, so it's important to understand the difference between crop and crop-hail insurance and make sure you have the right protection against weather that may threaten your farm.

What Are the Best Crop-Hail Insurance Companies in Kentucky?

The best way to find a great crop-hail insurance company is to work with your Kentucky independent insurance agent. They are familiar with the variety of insurers who offer crop-hail insurance and can pull multiple quotes to determine which insurance company aligns best with your needs. You can also seek out the Crop Insurance of America website for a list of Kentucky insurance companies that are currently writing crop-hail policies.

Does Crop-Hail Insurance Cover Wind Damage in Kentucky?

A typical crop-hail policy will most likely not cover wind damage and windstorms, but that is coverage you can add to your policy. Wind has caused millions of dollars in damage to property in Kentucky over the years, so farmers should consider building a policy that fully protects against all risks.

How Do You Add Crop-Hail Insurance to Your Kentucky Insurance Policy?

Crop-hail insurance is typically purchased as supplementary coverage to a farm and ranch policy. The nice thing about crop-hail insurance is it can be purchased at any time of the year, unlike crop insurance, which must be purchased before your crops are planted.

However, you cannot file a crop-hail insurance claim within 30 days of purchasing the coverage. This means you don't want to wait until you hear a storm is coming in to purchase it. Farmers who are interested in adding crop-hail insurance to their policy should work with their Kentucky independent insurance agent to contact their insurance company and discuss the options for adding this coverage to their policy.

How Can a Kentucky Independent Insurance Agent Help?

Understanding the differences between farm insurance, crop insurance, and crop-hail insurance can be confusing. Every farmer has different needs, and working with a Kentucky independent insurance agent can ensure that you're getting the coverage that best fits your farm. They not only understand the differences in farm insurance coverages, but also know the insurance market in Kentucky. They can pull quotes from multiple carriers to find you the best deal and help get your farm protected as soon as possible.

Article Reviewed by | Jeffery Green

https://www.kyfoodandfarm.com/quick-ag-facts

https://cropinsuranceinamerica.org/kentucky/

https://www.statista.com/statistics/1015612/crop-hail-damage-usa/

© 2024, Consumer Agent Portal, LLC. All rights reserved.