In Kentucky, $4,661,744,000 in commercial insurance claims were paid in 2019 alone. When you own a company, you're living the American dream, and protecting it should be on the top of your to-do list. Kentucky commercial insurance can come in many forms, and one of them is through a business owners policy.

Fortunately, a Kentucky independent insurance agent can help find coverage for a fair price. They'll even do the shopping for you at no extra cost. Connect with a local expert for trusted quotes in minutes.

What Is a Business Owners Policy?

Commercial insurance coverage is necessary whatever the industry. In Kentucky, You'll want protection for all the what-ifs. Check out the policy that can get you there:

- Business owners policy (BOP): This will include liability coverage for bodily injury and property damage. Any business property will be insured for replacement and repair in this policy. There are several other coverages as well.

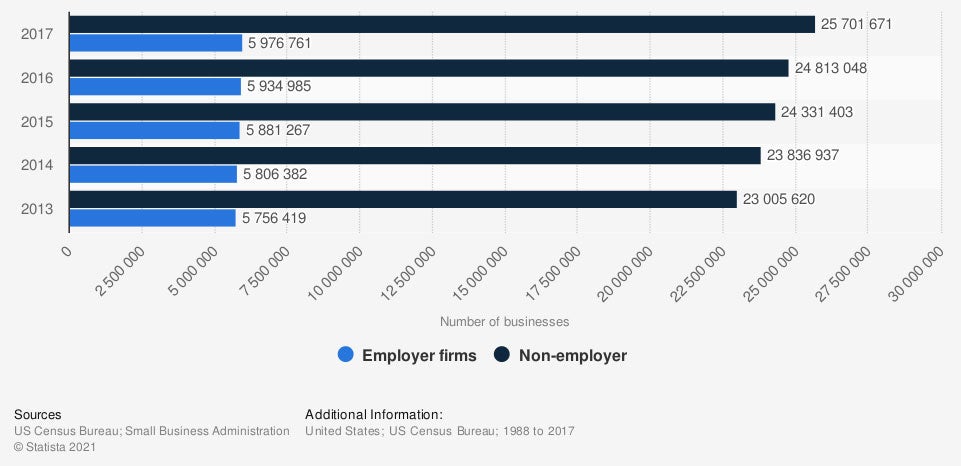

Number of small businesses (employer and non-employer) in the US from 2013 to 2017

When you obtain a business owners policy, your gross sales are typically on the smaller end. That's because a BOP is truly for the small business owner in every way.

What Does a Business Owners Policy Cover in Kentucky?

Your Kentucky business owners policy will typically have an industry-specific list of coverage offerings. However, there are numerous standard limits included in every BOP. Take a look at the most common policy options:

- General liability insurance: Pays for claims of bodily injury or property damage when you and your employees are responsible.

- Business interruption: This will pay for regular business expenses when you are temporarily shut down due to a covered loss.

- Commercial property insurance: Pays for damage to your building, equipment, and inventory from a covered loss.

- Crime insurance: Pays for a claim involving forgery, fraud, or theft to your company.

Leading risks to businesses in the US from 2018 to 2021

Some business owners policies will include coverage for identity theft, cybercrime, and equipment as well. To fully understand what your operation needs, consult with a trained adviser.

What Does a Business Owners Policy Cost in Kentucky?

A Kentucky business owners policy will have multiple coverage offerings at conservative pricing. Since you can only get exact costs by obtaining a quote, it's crucial to understand how they're calculated. Below are the risk factors carriers use to rate your BOP:

- How long you've been in business

- Your gross annual sales

- The type of industry you're in

- If you have any employees

- Business property details

- Prior claims

Coverage Differences and Options for Kentucky Business Owners Insurance

Which policy option is right for your business, and what are the differences? If you're not a licensed professional, these things can be challenging to know. Check out some policy options below:

- Business owners policy: A BOP has standard coverage options and is more of a one-size-fits-all approach. It has a pretty rigid template when it comes to coverage offerings. There is not much flexibility in the limits, and the endorsements are as-is. A BOP truly is for small business owners that don't exceed a specific gross annual income.

- Commercial package policy: A commercial package policy, or CPP, is more robust. It is designed to tailor coverages exactly how your business needs them. A CPP is usually used for mid-size to large companies. You can add and remove coverages as they pertain to your operation. It is a more flexible option for some business owners.

- General liability: This policy is on its own. It will give you liability coverage for bodily injury, property damage, or slander. Anything else will have to be added to a separate policy.

Additional Coverage for Your Business Owners Policy in Kentucky

In Kentucky, there are currently 351,260 small businesses in existence. While a business owners policy can be comprehensive, you may need additional protection. Take a look at some policy options below:

- Commercial umbrella insurance: Pays for a more substantial liability loss when your underlying limits have been exhausted

- Commercial auto insurance: This policy pays for an auto accident or loss for any scheduled vehicles titled in the business name.

- Professional liability insurance: If you're in the business of consulting, this policy pays for your negligence or bad advice given to a client.

How a Kentucky Independent Insurance Agent Can Help

If you run an operation in Kentucky, the right coverage can mean the difference between whether the carrier pays for a loss, or you have to. Instead of trying to figure it out on your own, consider using a trusted professional. They will review your policies for free, making it a no-brainer.

A Kentucky independent insurance agent has access to multiple carriers at once so that you have options. Since they do the shopping for you, you'll save time and money. Connect with a local expert on TrustedChoice.com to get started today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/257521/number-of-small-businesses-in-the-us/

Graphic #2: https://www.statista.com/statistics/422203/leading-business-risks-usa/

http://www.city-data.com/city/Kentucky.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.