When you're searching for a company you can trust to protect your livelihood, it can be challenging. There are many carriers on the market, each with its own spin on how coverage looks for your operation. Fortunately, a trusted adviser can help with your Kentucky business insurance for your farm.

A Kentucky independent insurance agent works only with highly rated carriers so that you're presented with the best options at a fair price. They'll compare your policies with dozens of companies, giving you the most affordable choice. Connect with a local expert to get started in minutes.

Best Farm Insurance Companies in Kentucky

The best farm insurance company to purchase from in Kentucky is relative. What covers your exposures and fits your budget will be different from any other farmer out there. However, the carriers that are most used are usually the one's people trust.

Check out the top property and casualty insurance carriers in the US:

- Nationwide

- Farmers Insurance Exchange

- Auto-Owners Insurance

- Erie Insurance

- Sentry Insurance Group

What Makes a Farm Insurance Company the Best in Kentucky?

What makes an insurance company better than another varies, but there are key items you'll want to look for when shopping carriers. How much protection they offer, if they are highly rated, and what premiums look like will tell a lot about their stability as a company.

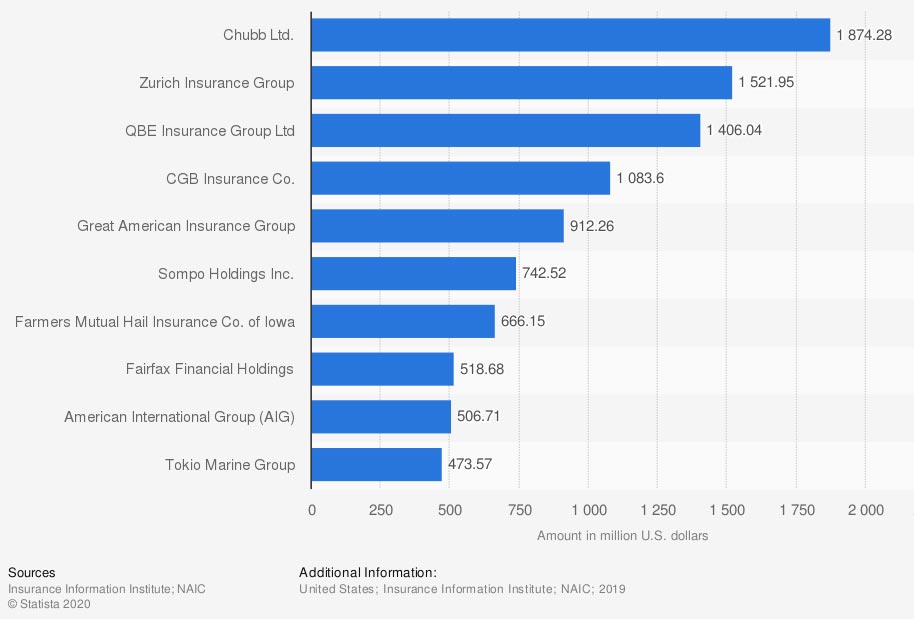

Largest multiple peril crop insurance companies in the US, by direct premiums written (in million US dollars)

Just because an insurance carrier is popular, it doesn't automatically mean it's the best for your operation. To discover which market is suitable for your farm, consider speaking with a licensed adviser.

What Do the Best Farm Insurance Companies Provide in Kentucky?

In Kentucky, farm insurance policies will depend on the individual needs of each business. With your coverage, you'll have options, but every farmer starts with a foundation. Take a look at standard policies available to most farms:

- Liability: A general liability policy will provide bodily injury and property damage coverage.

- Commercial property: This policy covers your farm structures and pole barns, and can even insure your equipment.

- Accidents: This can be anything from coverage for electrocution, fire, and smoke, to loading and unloading of livestock.

- Natural disasters: Volcanic eruptions and sinkholes are covered. Typically floods and earthquakes are covered under separate policies.

- Weather events: Lightning, wind, hail, tornadoes, and more.

- Crimes and civil unrest: This is for theft and vandalism of livestock.

- Crops: There are a couple of different crop policies you can obtain. All will cover various types of damage to your crops and cover replacement cost if necessary.

How Much Does Farm Insurance Cost in Kentucky?

The only way to obtain exact pricing for your Kentucky farm insurance is by having an agent quote your policies. Carriers look at your specific risk factors when calculating premiums, which means each farm will have a different cost for coverage. Check out what goes into your rates:

- Prior losses

- Value of farm equipment and property

- Value of crops

- Your age and experience

- Length of time with the previous carrier

- Local crime rate

Farm Insurance Requirements in Kentucky

Technically, there are no farm insurance requirements in Kentucky, with the exception of lenders needing proof of coverage for a loan. However, the right insurance for your operation is necessary to avoid a major financial loss to your home, barns, livestock, equipment, crops, and more. To get started, your adviser will need to know some of the following information:

- Your herd's specifics: You'll need to cover the risks that are specific to your herd. Horses will have different needs from cattle and so on.

- What your livestock is worth: This is the value you can get in the marketplace for your livestock. You are covering the risk of the replacement cost if something happened to them.

- If you have crops: If your farm deals with planting and producing crops, you'll need separate crop insurance.

- Other structures and buildings: If you have a home, pole barns, and more on your property, you'll need coverage for the buildings themselves.

- If you have farm equipment: If you use tractors or farm equipment of any kind, you'll need a specific property policy for these items.

- What preemptive protection you have in place: Carriers will want to know how you are proactive, such as if you are accounting for the risk of predators by having fencing and more.

Is Farm Insurance Necessary in Kentucky?

In the South, farms are common and are in most areas of the state. While you may not think there's much risk to owning a slice of land, all property needs the right protection from the elements. Check out some Kentucky farm facts:

- Value of private crop-hail insurance in Kentucky: $122,900,000

- Crop-hail loss ratio in Kentucky: 164.00%

- Number of organic farms in the US: 14,367

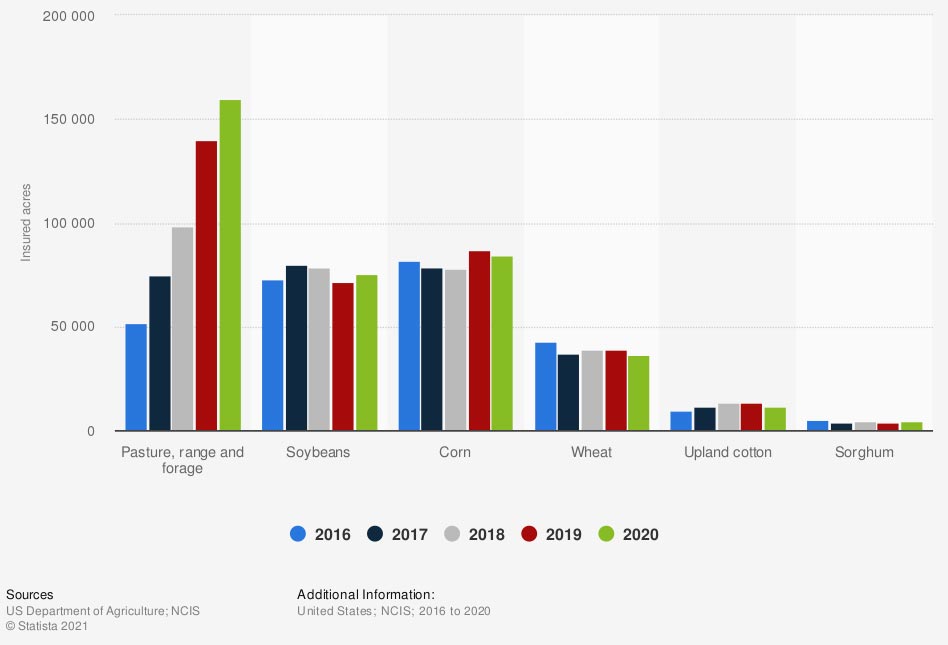

- Volume of insured farmland in the US by acres: 140,210 pasture, range, and forage

Volume of insured acres of farmland in the US, by crop

There are thousands of acres of farmland across the country. If you have a piece of this American dream, then it makes sense to have proper coverage for all the what-ifs.

How a Kentucky Independent Insurance Agent Can Help You

In Kentucky, the proper protection for your farm is a must if you want to avoid bankruptcy or worse. There are several options when it comes to choosing your policies. Fortunately, you're not alone, and a trusted adviser can help at no cost to your business.

A Kentucky independent insurance agent works with a slew of carrier options so that your coverage is affordable. A bonus is that they only work with highly rated companies, giving you the cream of the crop when it comes to your insurance. Connect with a local expert on trustedchoice.com for custom quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/689397/largest-mpci-companies-usa-by-direct-premiums/

https://www.statista.com/statistics/723015/volume-of-insured-acres-of-farmland-usa-by-crop/

https://www.statista.com/statistics/185365/revenue-of-leading-mutual-property-casualty-insurance-companies/

http://www.city-data.com/city/Kentucky.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.