If you own a company and work out of your home, there are some things you need to know. Protection for your operation will look different when you mix personal with business. Fortunately, Kentucky commercial coverage will have support for your home-based business.

A Kentucky independent insurance agent has access to multiple markets so that you have options. They'll even do the shopping for free, making it easy. Connect with a local expert to get started today.

What Is Home-Based Business Insurance?

Sometimes your Kentucky homeowners policy will have coverage for your home-based business. Other times, you'll need to obtain separate insurance. Check out the policies that may be necessary for your home-run operation:

- Liability insurance: Pays for a lawsuit for bodily injury, property damage, or slander.

- Equipment breakdown insurance: Pays for the replacement or repair of business equipment damaged by a power surge, outage, and more.

- Business property insurance: Pays to replace or repair any business property damaged by a covered peril.

- Professional liability: Pays for legal fees when you're sued due to possible faulty professional services offered.

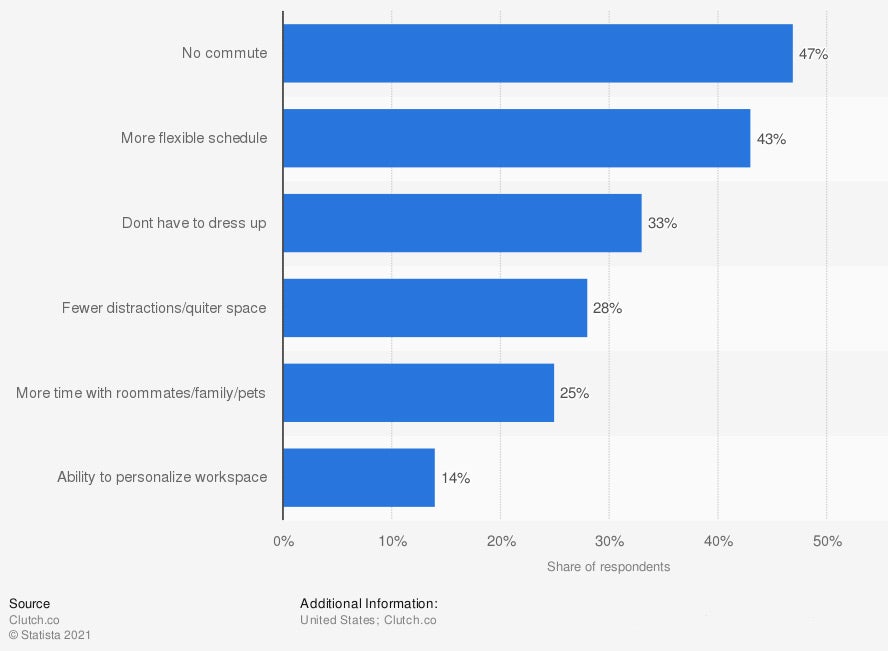

Top benefits of working from home in the US in 2020

When you work from home, there can be a lot of perks. If you're running a business, you'll need to understand how coverage works.

What Does Home Business Insurance Cover in Kentucky?

When you run a business out of your home, there are a couple of ways you can obtain insurance coverage. Check out some options below for your Kentucky business:

- Homeowners policy coverage: If you simply do desk work from your home office and don't have any business property or any other risk exposures, then you may be able to extend coverage from your homeowners policy. This coverage will only give you your current liability limit, and that's pretty much it.

- Separate business policy coverage: If you have a more robust business with equipment, inventory, business property, and more, you'll need separate business insurance. These policies may need to come from your same home insurance carrier, depending on their guidelines. The policies can include general liability, commercial auto, business property, equipment breakdown, professional liability, and more.

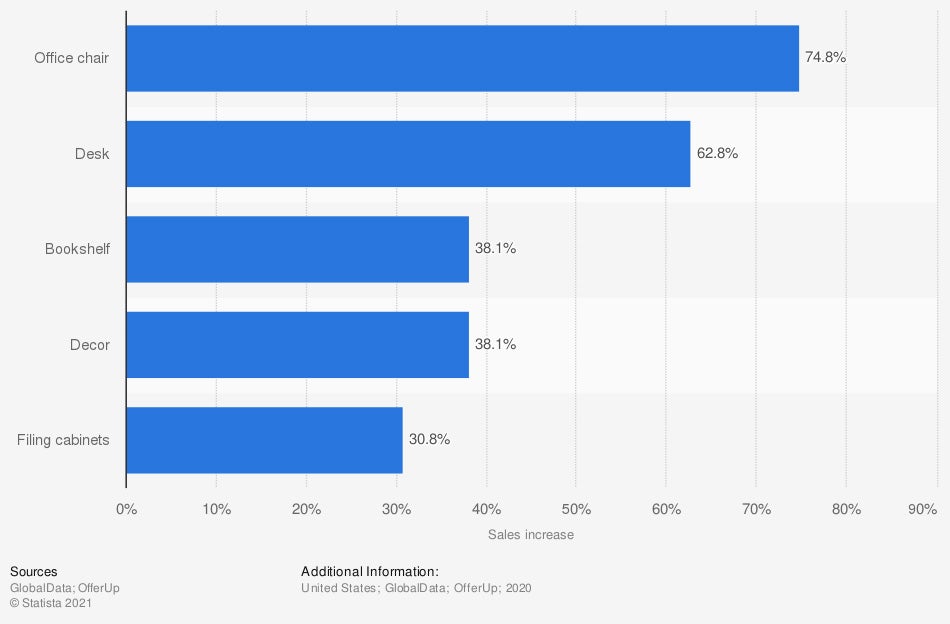

Office furniture sales increase in the US during the coronavirus pandemic in 2020, by category

The number of people working out of their homes nowadays has increased significantly. Along with it has come an increase in office furniture sales.

What Doesn't Home Business Insurance Cover in Kentucky?

It's equally important to understand what your Kentucky home-based business insurance excludes. Typical policies will not include the following coverages without adding them individually:

- Inventory: If you have business inventory, your policy will not provide coverage for its replacement or repair. You will need a business property policy that endorses this protection.

- Business equipment breakdown: Equipment breakdown due to a power outage or more will not be covered under your home or standard business policies without manually adding it beforehand.

- Customers on-premises: If you have customers showing up at your house to pick up an item or come inside for business purposes, your policy could exclude this. Most homeowners policies will prohibit this risk. Some business policies may pick up this exposure depending on what's involved.

- Commercial auto: If you use your vehicle to run your business, you may need a commercial auto policy. This is separate insurance that is not automatically included.

- Professional liability: If you offer professional services like accounting, you'll need to have your own professional liability coverage for any poor advice or negligence that could occur. Your standard business insurance policies will not provide coverage for this type of lawsuit.

Do Home-Based Businesses Need Insurance in Kentucky?

In Kentucky, $4,661,744,000 in commercial insurance claims were paid in 2019 alone. All business exposures should be covered by proper coverage. When you work out of your home, there are even more risks because your personal assets are on the line as well.

How Much Does Home-Based Business Insurance Cost in Kentucky?

Kentucky homeowners insurance costs $1,109 per year on average. If your home policy allows business operation coverage under their policy, then you'll have to add it. The extra coverage could cost you anywhere from $200 to $1,000 annually.

How to Connect with a Kentucky Independent Agent

Home-based business insurance can be tricky if you're not a licensed professional. Fortunately, the right limits of protection can be easily obtained through the help of a trusted adviser. They'll review your operation for free to make sure you're fully insured.

A Kentucky independent insurance agent will have a network of carriers so that you have the best options. This means your coverage and premiums can be tailored to your needs. Connect with a local expert on TrustedChoice.com for custom quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/1123005/top-benefits-of-working-remotely-in-the-us/

Graphic #2: https://www.statista.com/statistics/1229454/united-states-office-furniture-sales-increase/

http://www.city-data.com/city/Kentucky.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.