In Kentucky, there are 351,260 small businesses currently in existence. If you're one of them, you could be missing the mark when you shop for insurance on your own. Fortunately, a trusted adviser can help you get the best Kentucky commercial coverage that includes business income protection.

A Kentucky independent insurance agent will work on your behalf for free so that you save time and premium dollars. They'll compare your coverage with multiple markets, giving you options. Get connected with a local expert for tailored quotes to start.

What Is Business Income Insurance?

Business income insurance is the same as business interruption insurance. It is a critical coverage to obtain for any business owner, small or large.

- Business income insurance: Pays for regular business expenses in the event of a covered loss. This coverage will help your company avoid closure.

Leading risks of US businesses from 2018 to 2021

Business interruption is the Number One risk to US businesses. This means that having proper protection for a loss is necessary to avoid financial ruin or worse.

What Does Business Income Insurance Cover in Kentucky?

In Kentucky, your commercial insurance can help you protect your livelihood. While it won't insure everything, your business income coverage can help protect your daily operations. Check out what's typically included under your business income insurance:

- Income: This will be based on what your business historically made during the same period in prior years.

- Payroll: Any payroll you usually pay will be taken care of under this coverage.

- Taxes: If your loss occurs during tax season, you'll have coverage for business taxes due.

- Rent or mortgage: If the building you occupy is unusable, the rent or mortgage will be paid by this coverage.

- Relocation: If you have to move to a temporary location, business income will help pay the bill.

- Loans: Any loan payments you have incurred are part of this regular expense.

What Won't Business Income Insurance Cover in Kentucky?

All commercial insurance policies have a list of excluded instances they won't insure. Take a look at standard business income insurance exclusions:

- A pandemic: When a pandemic occurs, neither your business income nor any other commercial policies will provide coverage for closure.

- Flood insurance: If you don't currently have a flood insurance policy, you won't have coverage for flooding under your business income coverage.

- Earthquake insurance: If you don't have earthquake insurance before your business is compromised, income coverage won't cover damage for this.

- Undocumented income: If your business is used to dealing only in cash with no paper trail, business income coverage will only apply to expenses that can be proven.

How Much Does Business Income Insurance Cost in Kentucky?

Business income insurance premiums will vary across the board for every company. Carriers use prior claims reported and personal history to determine your costs. Check out the most common natural disasters in Kentucky that impact your insurance rates:

Kentucky natural disasters that will impact your premiums:

- Severe storms and lightning damage

- Flooding and water damage

- Wildfires and residential fires

- Tornadoes

- Burglary and other property crimes

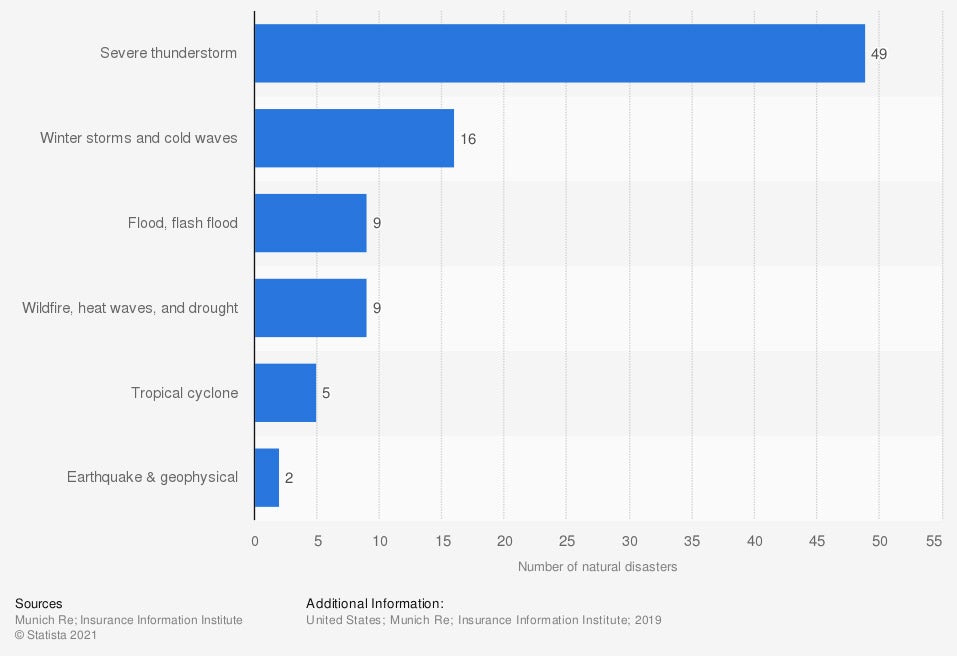

The number of natural disasters in the US by type (in 2019)

It's crucial to know what catastrophes are lurking around the corner when you're a business owner. If you have to shut down due to a covered loss, it's essential to be prepared.

Business Income Insurance and Extra Expense in Kentucky

In Kentucky, $4,661,744,000 in commercial insurance claims were paid in 2019 alone. However, sometimes there are additional costs involved when you have to shut down your operation for some time. Fortunately, there is a way to cover anything extra through your business income insurance.

- Extra expense coverage option: This will pay for extra expenses outside of your regular business expenses that are caused by a covered claim.

How to Connect with an Independent Agent in Kentucky

Your commercial insurance needs to be accurate and sufficient no matter the industry. Unfortunately, with all the policies on the market today, it can be challenging to know what applies to your operation. Instead of going it alone, consider using a trusted adviser to review your business income coverage for free.

A Kentucky independent insurance agent can help with policy and premium options that won't break the bank. Since they do the shopping for you, savings are right around the corner. Get connected with a local expert on trustedchoice.com for custom quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/422203/leading-business-risks-usa/

Graphic #2: https://www.statista.com/statistics/216819/natural-disasters-in-the-united-states/

http://www.city-data.com/city/Kentucky.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.