Kentucky averages 10 tornadoes a year. Even the sturdiest home can experience costly damage if a tornado sweeps through your property.

Fortunately, Kentucky homeowners insurance covers tornado damage. However, you still need to be properly protected. Working with a Kentucky independent insurance agent, you can shop affordable policies and make sure you have coverage long before you need it.

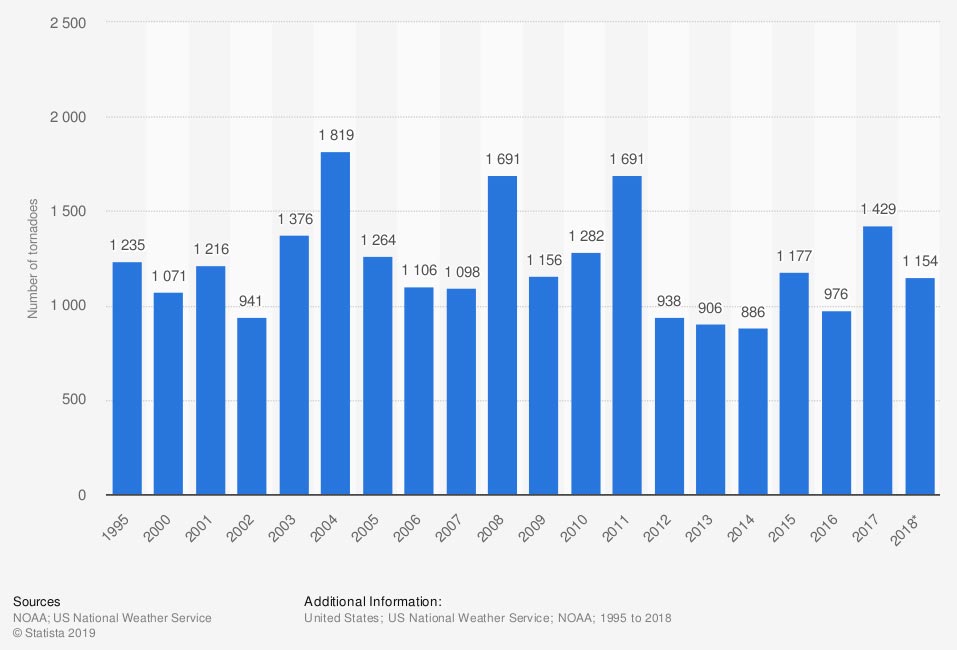

Number of tornadoes in the United States

The US experiences hundreds, and often more than 1,000, tornadoes every year.

What Does Homeowners Insurance Cover In Kentucky?

Homeowners insurance is a combination of liability and property coverage that will pay to repair or replace your home and belongings should they be damaged by a covered loss.

A standard Kentucky homeowners insurance policy will provide the following:

- Dwelling coverage: Pays for any damage to the structure of your home including detached structures.

- Personal property coverage: Pays for any damaged belongings inside your home and on your property.

- Liability coverage: Pays for legal fees and medical bills for injuries or property damage you cause to someone else visiting your home.

- Temporary living expenses: Pays for a hotel if you're temporarily displaced from your home by a covered peril.

These situations would be covered if they're a result of the following causes of loss:

- Severe storms and tornadoes

- Fire and smoke

- Lightning

- Wind and hail

- Theft

- Vandalism

Every homeowners policy is different and you may have limitations of coverage for specific events. A Kentucky independent insurance agent can walk you through the details of your policy so you understand your coverages.

What Isn't Covered under Kentucky Homeowners Insurance?

A standard homeowners policy will not pay for any damage that results from a flood, earthquake, or nuclear war.

Since flood and water damage are the second-highest risk to Kentucky homeowners, it's worth talking with your independent insurance agent about flood insurance. It can be purchased by your agent through the National Flood Insurance Program (NFIP).

"Flood insurance covers buildings up to $250,000 and contents up to $100,000," said insurance expert Jeffrey Green. "Every home and business owner should consider flood insurance, even if you are in a low-risk area."

Does Home Insurance Cover Tornado Damage In Kentucky?

Yes, most Kentucky homeowners insurance policies will pay for any damage that is the result of wind or hail, which includes tornado damage.

Within your policy, the structure of your home would be covered under the dwelling coverage and any damaged personal belongings would be protected by the personal property coverage.

4 surprising Kentucky tornado stats

- Kentucky ranks 15 in the US for number of tornado-related deaths.

- The cost of tornado-related repairs in Kentucky is estimated to be upwards of $300 million.

- The majority of Kentucky’s tornados are F0-F1 on the Fujita scale.

- April is Kentucky’s peak month for tornados.

Do I Need Additional Coverage to Be Insured against a Tornado?

While most homeowners insurance will include coverage against tornados, some carriers will have hail or wind exclusions. In this case, you would need to request tornado coverage as a rider to your policy.

It's also possible that you will need to increase your policy limits to have sufficient tornado damage coverage. As you can see below, tornados are costly natural disasters.

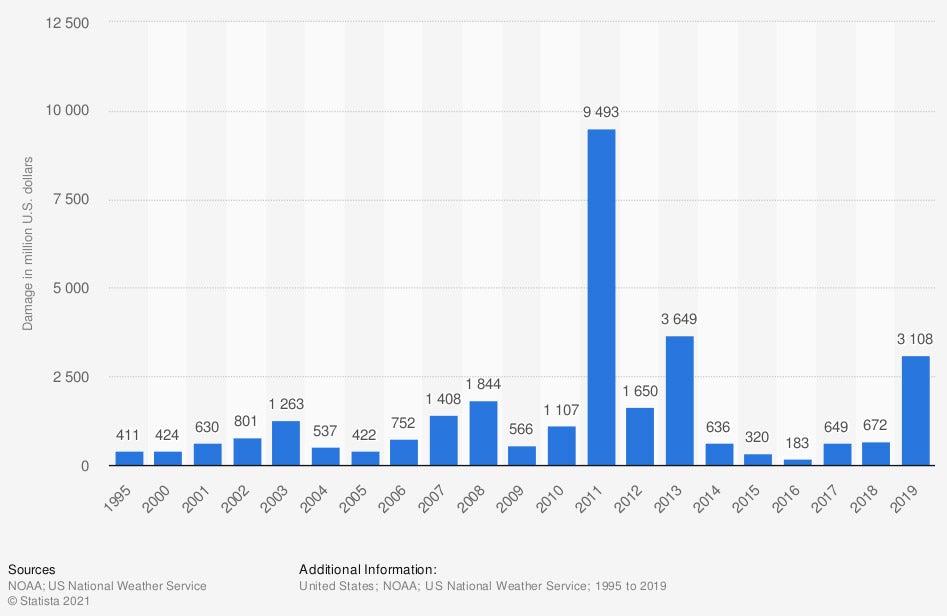

Economic damage caused by tornadoes in the US

Tornadoes have resulted in approximately $3.1 billion in damage across the United States.

Lastly, you will want to review your auto insurance policy if you want your vehicle protected from tornado damage. Kentucky drivers must have comprehensive insurance for damage to their vehicle to be covered.

How Can a Kentucky Independent Insurance Agent Help?

Kentucky is no stranger to tornados, so homeowners need to be prepared with the proper homeowners insurance. A Kentucky independent insurance agent will speak with you, free of charge, to discuss your needs.

They'll shop multiple carriers and can help you pick an affordable policy from a reputable carrier. They're experts, not only in home insurance, but also in the needs of residents in Kentucky. Work with a TrustedChoice agent today.

Author | Sara East

Article Reviewed by | Jeffery Green

https://www.groundzeroshelters.com/kentucky-tornado-facts

https://www.ncdc.noaa.gov/climate-information/extreme-events/us-tornado-climatology

https://www.weather-us.com/en/kentucky-usa-climate#climate_text_4

© 2024, Consumer Agent Portal, LLC. All rights reserved.