Insurance Content Navigation

- What Does Personal Property Insurance Cover in Kentucky?

- What Doesn't Personal Property Insurance Cover in Kentucky?

- When Does Kentucky Personal Property Insurance Cover You?

- How Much Personal Property Insurance Coverage Do You Need?

- Does Renters Insurance Include Personal Property Coverage?

- How Much Does Personal Property Insurance Cost In Kentucky?

- How a Kentucky Independent Insurance Agent Can Help You

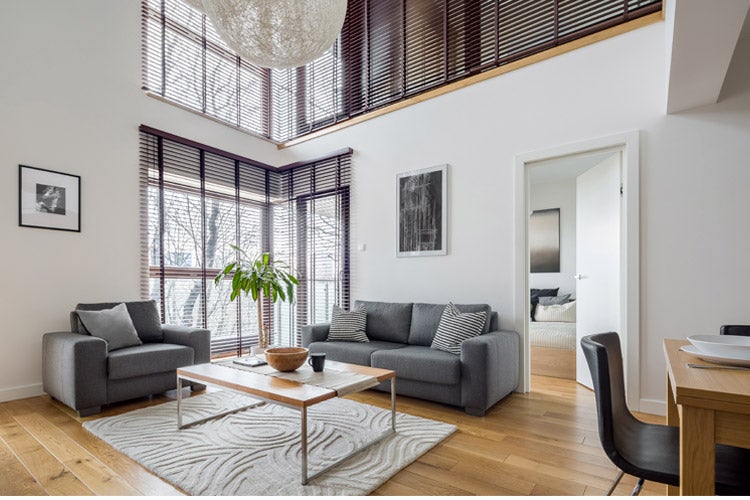

If your home and belongings are damaged in a fire or stolen from your property, you'll want coverage that will pay to repair or replace the items. For some, this coverage is in a homeowners policy, but a home policy doesn't always cover personal belongings. You may need to look into personal property insurance or contents coverage.

In Kentucky, an independent agent can help you understand whether your homeowners insurance includes personal property protection and how to increase your coverage if necessary.

What Does Personal Property Insurance Cover in Kentucky?

Personal property insurance, also known as contents coverage, pays to repair or replace your personal belongings if they're damaged in a covered loss. Your personal belongings include furniture, electronics, appliances, entertainment systems, and clothing. They can even include jewelry and artwork.

"Some high-value items like jewelry may have individual item limits and a sub-limit for all of the jewelry in the household," says Jeffrey Green, insurance expert. "For example, there may be a limit of $1,500 per piece and $3,000 for all of the jewelry. Sub-limits are lower than the overall limits of the coverage."

Top 5 risks for Kentucky homeowners

- Severe storms and lightning damage

- Flooding and water damage

- Tornados

- Wildfires and residential fires

- Burglary and other property crimes

What Doesn't Personal Property Insurance Cover in Kentucky?

Since personal property insurance is part of your homeowners policy, it will only cover damage from perils that are listed in your existing policy. This means electrical failures or fuse shorts that ruin your entertainment systems or appliances would not be covered. For these items, you'll need equipment breakdown insurance or a home warranty. It also will not cover any damage that is caused by flooding. Flood insurance is not included in traditional homeowners insurance, so you need to add it as additional coverage. If you don't have flood insurance added to your policy and your home is flooded, your personal belongings and other damage to your home won't be covered.

When Does Kentucky Personal Property Insurance Cover You?

If any of your personal items are damaged in your home, garage, vehicle, or even a hotel room while you're traveling by covered perils such as fire, lightning, wind damage, or even theft, they'll be covered under the personal property portion of your homeowners insurance.

After you pay your deductible, your personal property insurance will pay to replace these and other personal items up to your policy limit.

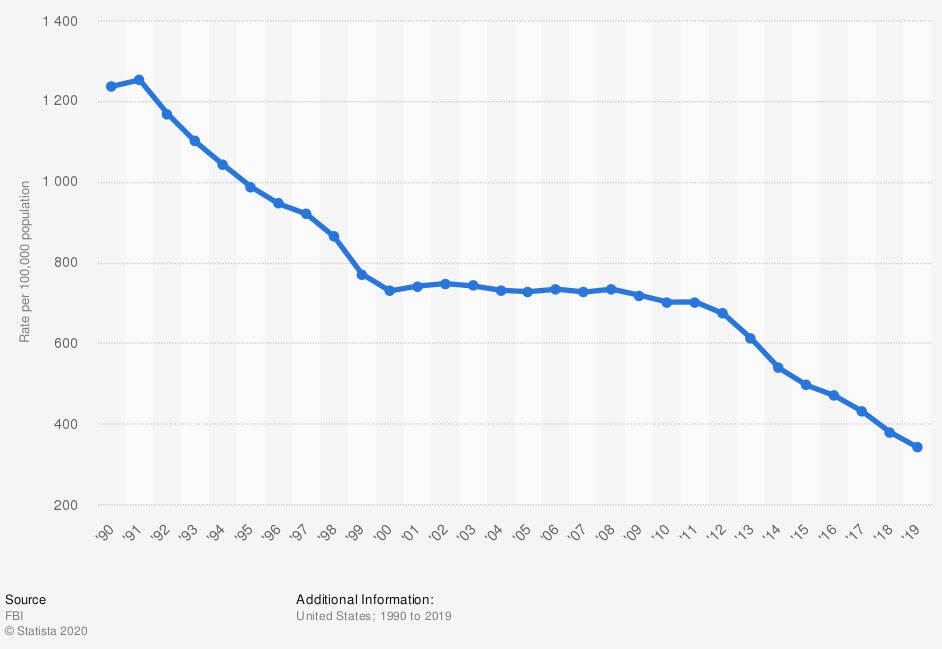

Reported burglary rate in the United States from 1990 to 2019

In 2019, the nationwide rate was 340.5 burglary cases per 100,000 of the population.

How Much Personal Property Insurance Coverage Do You Need?

When creating your home insurance policy, you'll get to decide how much personal property insurance you want. The easiest way to determine how much coverage you need is to calculate the value of your assets. A Kentucky independent insurance agent can help you calculate that value, and may even have access to software that calculates personal property replacement costs based on national averages.

One thing to keep in mind is that even a software calculator will not be able to put a value on specialized jewelry, artwork, and high-value items, so it will be up to you to determine the value. You can use appraisals to get estimates on any highly valuable items.

Once you've supplied your agent with the value of your items, they can help you determine how much coverage you need. You'll also decide whether you want your coverage based on actual cost value or replacement value. If you are hoping to replace your contents on a new-for-old basis, then replacement cost is the best choice. If you aren't concerned about replacing the items but just want to receive the cash value at the time they were lost or damaged, then actual cash value is the best choice.

Does Renters Insurance Include Personal Property Coverage?

If you have a personal renters insurance policy it will include personal property coverage. The coverage works the same as it would for a homeowner with home insurance. It's a common misconception that a landlord's insurance policy will protect a renter's personal belongings should they be damaged while renting the property. The only time landlord insurance would cover damage to your personal property is if the damage was caused by the landlord themself. If the landlord was in the rental fixing the stove and started a fire, then the damage would land on their landlord insurance. Any other perils would only be covered if you've purchased a renters insurance policy.

How Much Does Personal Property Insurance Cost In Kentucky?

Home insurance in Kentucky averages $1,109 annually. This price is slightly below the national average of $1,211. Since personal property insurance is part of a homeowners policy, Kentucky residents can use the state's average as a base for premium cost. However, homeowners have the choice to increase the amount of coverage they have, and can also choose to add specialty coverage for high-value items that can increase premiums. Of course, home insurance premiums vary greatly based on house size, age, location, and potential risks.

How a Kentucky Independent Insurance Agent Can Help You

Even though personal property insurance is included in a homeowners policy, that doesn't mean it isn't worth looking into. A Kentucky independent agent can help you understand how much personal property coverage you have and whether you need more.

If you purchase or acquire new, valuable items, your agent can help reevaluate your existing policy to see if changes need to be made. Agents have access to multiple insurance companies and policy types and can compare quotes to find a policy that will fit your needs and budget. They are prepared to take the time to help you assess how much coverage you need for your personal property. Contact your local agent today.

Article Author | Sara East

Article Reviewed by | Jeffery Green

iii.org

statista.org

© 2024, Consumer Agent Portal, LLC. All rights reserved.