Kentucky has 351,260 small businesses in existence right now. When you operate a company, you're living out the American dream, and the right insurance could help you protect it. Fortunately, Kentucky business coverage will have premises liability insurance for all your risks.

A Kentucky independent insurance agent can shop your policies with their network of carriers for free. Which means you'll have options that are affordable in no time. Connect with a local expert to get started today.

What Is Premises Liability Insurance?

If you have a commercial property, you'll need coverage that protects all the risks. There are numerous instances where your premises liability coverage could apply.

- Premises liability insurance: Pays for losses arising out of bodily injury and property damage that occur on your premises. This can be due to hazards or negligence on your end.

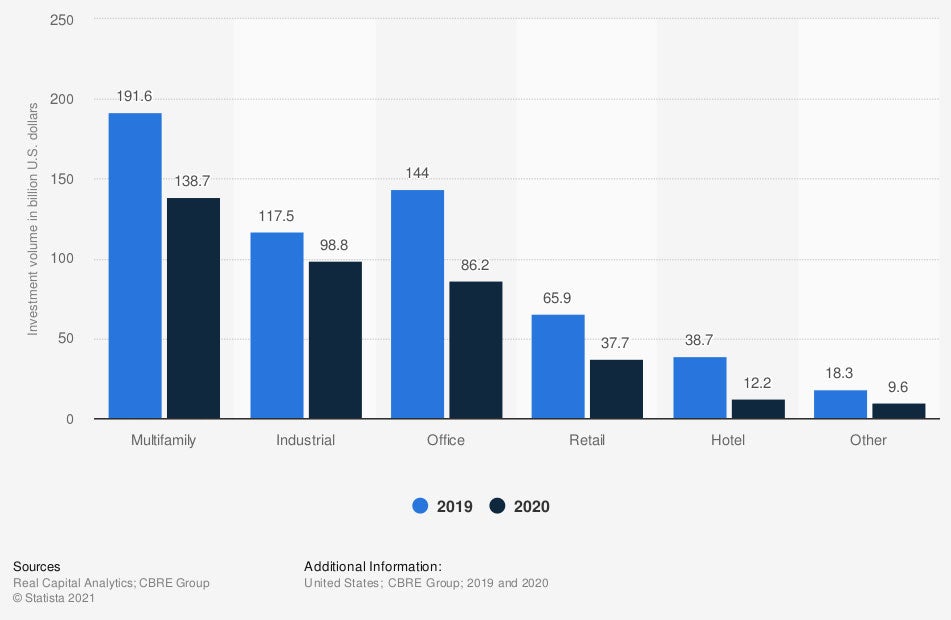

Value of commercial real estate investments in the United States from 2019 to 2020, by property type

The kind of coverage you're real estate needs depends on the type of property you are insuring. There are several exposures associated with each that you'll want to understand.

What Does Premises Liability Insurance Cover in Kentucky?

Similar to your other commercial policies, specific coverage options apply to each structure type. Check out what your premises liability policy will protect against:

- Bodily injury coverage due to an accident

- Bodily injury coverage due to the owner's negligence

- Bodily injury coverage for a trespasser

- Bodily injury coverage for a customer

- Bodily injury coverage for a guest or friend

What Doesn't Premises Liability Insurance Cover in Kentucky?

Your Kentucky premises liability insurance will have exclusions that apply. Some standard items not included under your premises liability insurance are:

- Employee injuries: This would fall under workers' compensation insurance.

- Intentional damage: If you intentionally damage your own business property, there is no coverage under this policy or any other policy for that matter.

- Medical malpractice injuries: If you are a physician and injure a party medically, this would not fall under premises liability. Instead, you would need a medical malpractice policy.

Commercial Premises Liability Insurance in Kentucky

Kentucky premises liability coverage can be included on your commercial property, package, or business owners policies. The limits would be preselected beforehand and should be reviewed for accuracy. Some examples of potential lawsuits are as follows:

- Not covering up a hole on your premises

- Leaving dangerous equipment out in the open

- Having unrestricted access by the public

- Not displaying cautionary signs and warnings

- Leaving hazardous materials unattended

- No sprinkler system for a fire

Premises Liability Insurance vs. General Liability Coverage in Kentucky

In Kentucky, your premises liability and general liability coverages are two entirely different policies. They each cover separate parts of a loss, and both are usually necessary. Check out the contrasts below:

- General liability: Pays for claims of bodily injury, property damage, or slander arising out of the business's operation. These occurrences may not have been preventable. General liability policies include coverage for premises liability, such as slips and falls.

- Premises Liability: Pays for negligence on the property owner's part. These claims are usually preventable and often just overlooked.

Premises Liability Insurance Costs in Kentucky

There were $4,661,744,000 in commercial insurance claims paid in 2019 in Kentucky. To avoid having to pay for a loss out of pocket, you'll want to understand how your premiums are calculated. Take a look at what carriers use to determine your premises liability costs:

- Location

- Square footage

- Property updates

- Age of building

- Prior claims

- Replacement cost of said property

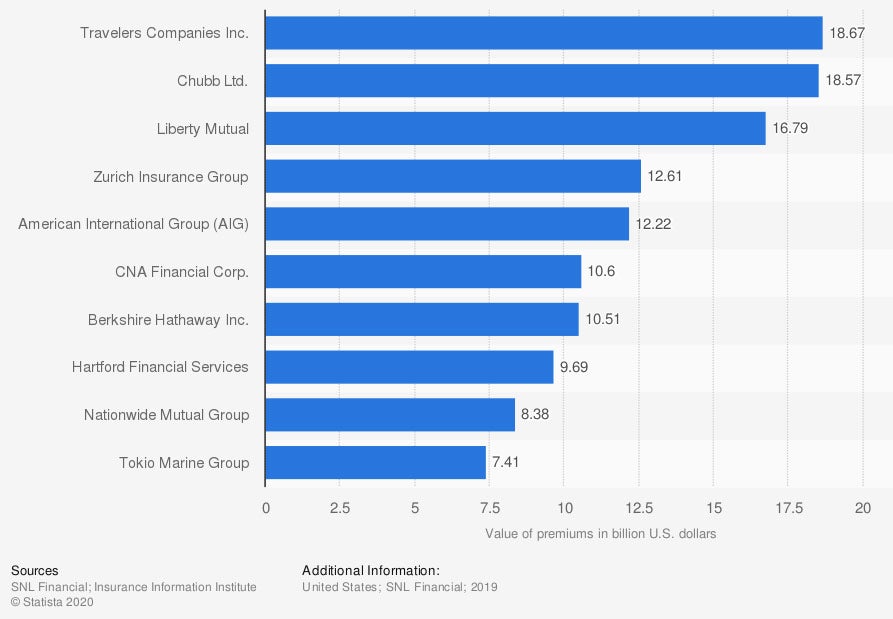

Leading writers of commercial lines insurance in the United States in 2019, by direct premiums (in billion US dollars)

Where you get your business insurance through is essential. Some carriers are more well-known than others and have competitive pricing.

How to Connect with a Kentucky Independent Agent

Your premises liability insurance should be handled by the best of the best. Accurate coverage can be easily obtained when you have the help of a trusted adviser. Fortunately, a licensed professional can review your policies and shop rates for free.

A Kentucky independent insurance agent has a network of carrier options and will present you with the one that fits your needs. This means you can find coverage for an affordable price without doing all the work. Connect with a local expert on TrustedChoice.com for custom quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/1215470/property-investment-volumes-usa-by-property-type/

Graphic #2: https://www.statista.com/statistics/186457/us-commercial-lines-insurance-leading-writers-by-direct-premiums-written/

http://www.city-data.com/city/Kentucky.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.