When you operate a farm, your animals can be your livelihood. If you own a slice of land that helps you make an income, then you're living the American dream. Kentucky business insurance can help with your horse farm coverage, so you're fully protected.

A Kentucky independent insurance agent will do the shopping for free, making it a no-brainer. They work with a variety of commercial carriers so that you're presented with options. Get connected with a local expert for custom quotes in minutes.

What Does Horse Farm Insurance Cover in Kentucky?

In Kentucky, your horse farm will typically need several insurance policies. Therefore, it's essential to understand what is and isn't covered under your insurance.

What your horse farm insurance generally covers:

- Accidents: This can be anything from coverage for electrocution, fire, and smoke, to loading and unloading of livestock.

- Natural disasters: Volcanic eruptions and sinkholes are covered. Typically floods and earthquakes are covered under separate policies.

- Weather events: Lightning, wind, hail, tornadoes, and more.

- Crimes and civil unrest: This is for theft and vandalism of livestock.

Number and average size of farms in the US from 2012 to 2020

There are many farms in the US, and everyone will have different coverage needs. It's important to remember not all policies are created equal.

What Doesn't Horse Farm Insurance Cover in Kentucky?

Kentucky horse farm insurance will come with a list of exclusions, just like any policy. You should know what is not insured before a loss arises.

What your horse farm insurance will exclude:

- Old age

- Death by natural causes

- Disease

Some things can be added to your coverages for an additional premium. The most common are accidental shooting, drowning, attack by wild animals, and the collapse of a building onto your horses.

How Many Horses Are Covered under Horse Farm Insurance in Kentucky?

Your livestock policy will work in one of three ways as far as coverage is concerned. Check out how your horses would be protected under your insurance:

- Individual coverage: This insurance usually covers higher-value animals on an individual basis. The animals are covered for a specific dollar amount.

- Blanket coverage: This type of policy allows you to insure all your farm property for a predetermined value. It includes structures, equipment, tools, and livestock.

- Herd coverage: This is the simplest type of insurance for livestock. This coverage allows you to insure a specific number of animals.

Common Risks on a Kentucky Horse Farm

Every business has industry-specific risk exposures. Your Kentucky horse farm is no different, and there are some qualifying questions your adviser will typically ask to have you covered accurately. Check out some items they may ask below:

- Your herd's specifics: You'll need to cover the risks that are specific to your herd. Horses will have different needs from cattle and so on.

- What your livestock is worth: This is the value you can get in the marketplace for your livestock. You are covering the risk of the replacement cost if something happened to them.

- What preemptive protection you have in place: Carriers will want to know how you are proactive. They'll want to know If you are accounting for the risk of predators by having fencing and more.

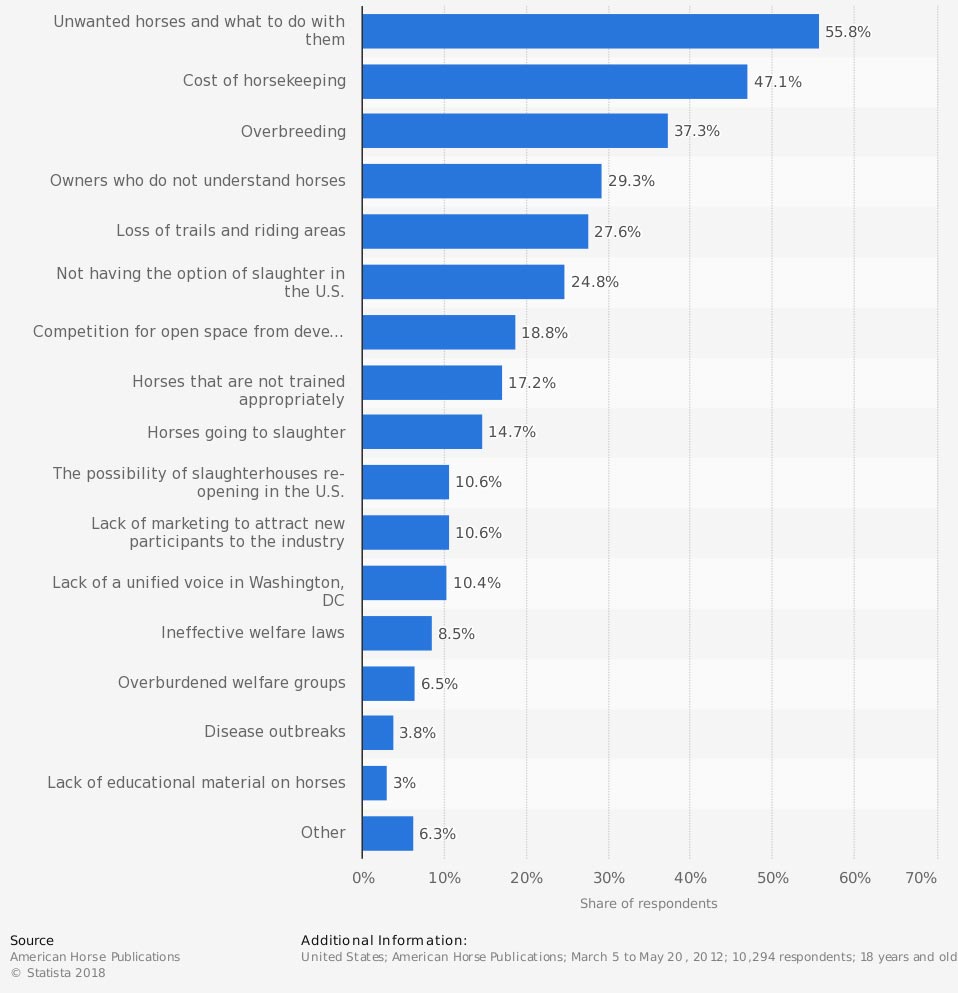

Leading challenges facing the equine industry in the US as of March 2012

As a horse farm owner, you'll never know what could befall your animals. It's best to be prepared for the worst and have proper limits of protection.

Additional Coverage for Your Horse Farm in Kentucky

In Kentucky, $4,661,744,000 in commercial insurance claims were paid out in 2019 alone. Sometimes, you'll want extra protection for all the what-ifs. Take a look at some additional coverage options for your horse farm in Kentucky:

- Commercial umbrella insurance: This policy can be obtained for additional liability coverage above and beyond your underlying limits.

- Inland marine insurance for farm equipment: This can be added to any farm policy that uses equipment, tractors, and more for tending to their farm.

- Extended liability limits: You can increase your underlying liability limits for added coverage.

How a Kentucky Independent Insurance Agent Can Help

Your Kentucky horse farm deserves the best protection money can buy. Luckily, a trusted adviser doesn't have to be hard to find. In fact, you can get help from a licensed professional in minutes and all for free.

A Kentucky independent insurance agent works with multiple markets at once, doing the shopping for you at no additional cost. They'll present you with the best coverage and rate options so that you can relax. Get connected with a local expert on TrustedChoice.com and start saving today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/207273/number-and-size-of-us-farms/

Graphic #2: https://www.statista.com/statistics/396480/leading-challenges-facing-the-equine-industry-us/

http://www.city-data.com/city/Kentucky.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.