When you are starting a new building project, there is a lot that you'll be responsible for handling. Whether you're building from the ground up or renovating your current home, the right coverage matters. One loss could halt your project for good, making it crucial to have adequate builders risk insurance.

This policy can be added to your Kentucky business insurance or homeowners insurance. Fortunately, a Kentucky independent insurance agent can help. Get connected with a local expert for custom quotes and details.

What Is Builders Risk Insurance?

A Kentucky builders risk policy will supply protection for the build-out process. It covers the in-between when your project is underway. Check out what builders risk insurance will insure when construction is happening:

- Fire

- Lightning

- Hail

- Theft

- Vandalism

- Acts of God, like tornadoes

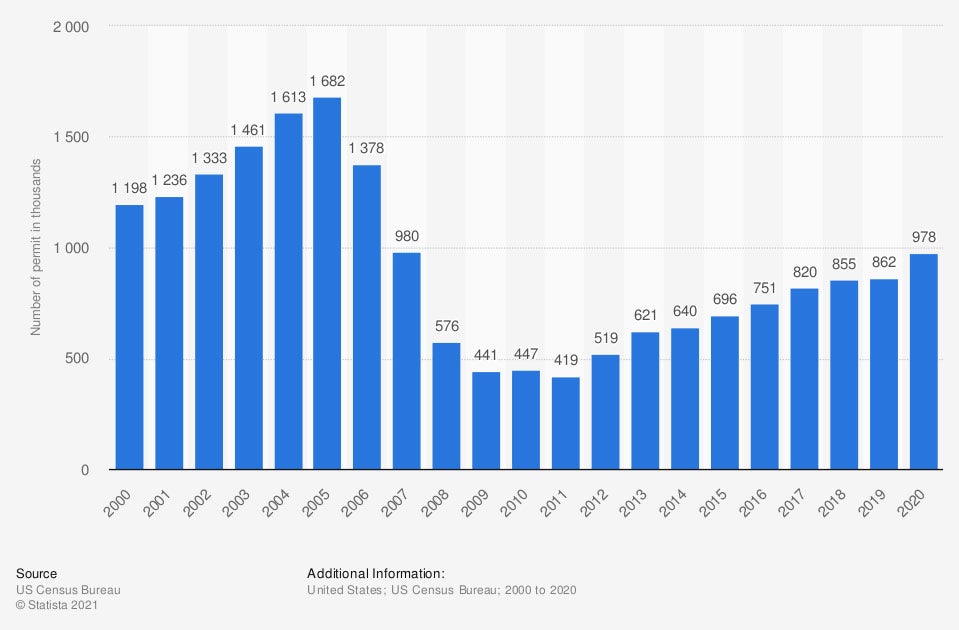

The number of single family building permits in the US from 2000 to 2020 (in thousands)

If you're building something in the US, you're not the only one. With the proper insurance policy, you won't have to worry about a loss stopping you before you've even started.

What Does Builders Risk Insurance Cover in Kentucky?

It's important to know what is covered under your Kentucky builders risk policy, so you're aware of the exposures. While you can't account for everything that could go wrong during the build-out process, you can at least insure the basics. Kentucky builders risk pays for things like:

- Materials

- Equipment on site

- Equipment in transit

- Delays in project scope

- Loss of use

- Permits

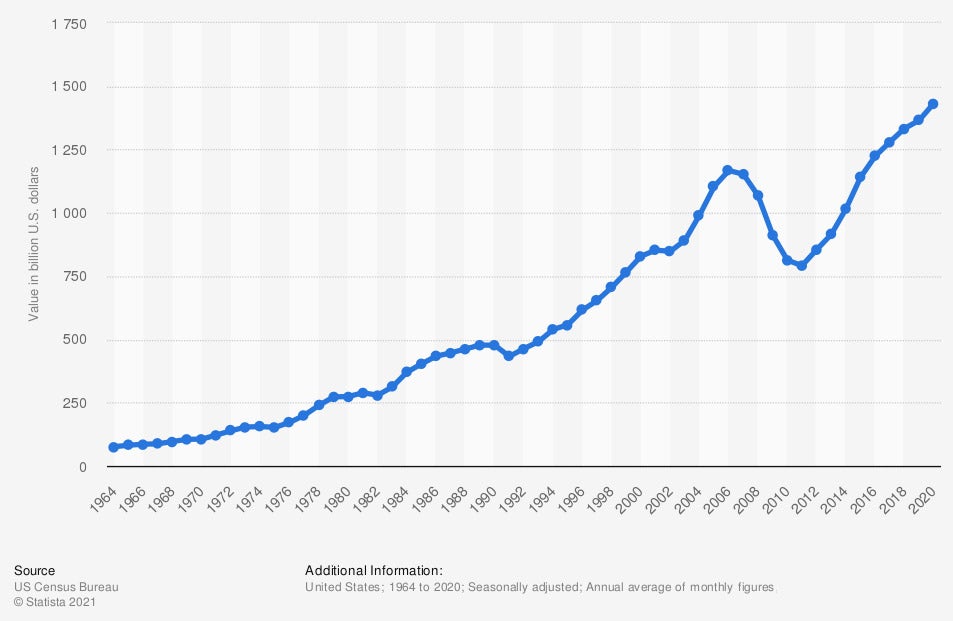

Average value of new construction put in place in the US from 1964 to 2020 (in billion US dollars)

When you're building new construction, builders risk insurance is usually mandatory. There is a lot of time and materials involved in the build-out process that need to be insured against various exposures.

How Much Is Builders Risk Insurance in Kentucky?

If you're building a commercial structure, the cost for your Kentucky builders risk insurance will vary. All projects are unique and require different limits of protection, which alters costs per build. Take a look at what your builders risk insurance premiums are rated on:

- Type of project

- Details of the project

- Coverage selected

- Anticipated cost of completion

- Length of project

Who Is Responsible for Builders Risk Insurance in Kentucky?

Who is responsible for the builders risk insurance when a project is underway? There are a few different options, but no matter which way you choose, you should be added to the policy if you have any financial interest in the property. A general contractor will have commercial insurance that typically extends to each project. You will probably want to list the following people on your builders risk insurance:

- Subcontractors

- Lender

- General contractor

- Architect

Do I Need Builders Risk Insurance in Kentucky?

In Kentucky, $4,661,744,000 in commercial insurance claims were paid in 2019 alone. A builders risk policy can protect your pocketbook from one of these losses so that you're adequately insured. Coverage is necessary for these types of projects:

- A residential construction project

- A commercial construction project

- Remodeling your house

- Remodeling your commercial property

Does Builders Risk Insurance Cover Theft in Kentucky?

Theft or vandalism on a job site is pretty common and one of your top exposures when working on a project. Contractors leave equipment and materials out in the open, and this can be tempting for any passerby. A Kentucky builders risk policy will cover a theft or vandalism loss in most cases, and it can help pay for things like:

- Building materials

- Items left out on a job site

- Equipment

Builders Risk for Your Home in Kentucky

When you're building or remodeling your home in Kentucky, you won't be covered under your primary homeowners policy. To have the right insurance for the job, a builders risk policy is necessary. This works the same as with a commercial project and insures the build out process. If you are building a new home, the construction company usually holds the builders risk insurance. It's vital to speak with a trusted adviser before starting a build to be sure you're appropriately covered.

How to Connect with an Independent Agent in Kentucky

In Kentucky, the right insurance for your property is crucial if you want to avoid a major out-of-pocket financial loss. When you're starting a new project, it can be exciting, but insurance should be on the top of your to-do list. A builders risk policy can cover the process from start to finish, and a licensed professional can help.

A Kentucky independent insurance agent has access to multiple carriers at once so that you're presented with the best coverage for your budget. They'll even do the shopping for you at no additional cost. Get connected with a local expert on TrustedChoice.com for tailored quotes today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/456883/number-of-single-family-building-permits-in-the-usa/

Graphic #2: https://www.statista.com/statistics/184341/total-value-of-new-construction-put-in-place-in-the-us/

http://www.city-data.com/city/Kentucky.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.