Insurance Content Navigation

- Does Crop Insurance Cover Drought in Kentucky?

- What Does Crop Insurance Cover in Kentucky?

- Drought Stats for Kentucky

- Do I Need Farm and Ranch Insurance to Be Fully Covered?

- Are All of My Products Covered against Drought?

- Are There Any Other Policies That Can Provide Additional Coverage?

- Here’s How a Kentucky Independent Insurance Agent Can Help

When you’ve got profitable crops, you want to be positive they’re covered against numerous disasters from the very start. This includes planning for catastrophes that could even stem from Mother Nature herself. Fortunately there’s a type of crop insurance in Kentucky that can provide coverage for drought, among many other disasters.

Even better, a Kentucky independent insurance agent can help you find the right kind of crop insurance for your farm’s needs. They’ll be able to get you equipped with all the coverage you need to feel secure in your business’s livelihood. But before we get too far ahead of ourselves, here’s a closer look at this crucial coverage.

Does Crop Insurance Cover Drought in Kentucky?

According to insurance expert Jeffery Green, whether your crops have coverage against drought depends entirely on what kind of crop insurance you purchase. If you select multiple peril crop insurance, your crops will be guarded against losses caused by drought and many other disasters. To get set up with the right type of coverage, your best bet is to work with a Kentucky independent insurance agent.

What Does Crop Insurance Cover in Kentucky?

Again, what your crop insurance policy covers depends on the specific type you select. If you want to be protected against drought, you’ll have to get multi-peril crop insurance. This coverage reimburses for losses relating to drought, as well as the following:

- Fire damage

- Flood damage

- Insect damage

- Disease outbreaks

- Hail or frost damage

- High wind damage

To find the right multi-peril crop insurance policy for your unique farm, working with a Kentucky independent insurance agent is the easiest route to take. They’ll be able to get you equipped with all the coverage you need, and answer any questions you may have.

Drought Stats for Kentucky

When considering the type of crop insurance you need, it’s helpful to know your area’s risks, as far as natural disasters go. Check out some drought stats for Kentucky and the US overall below.

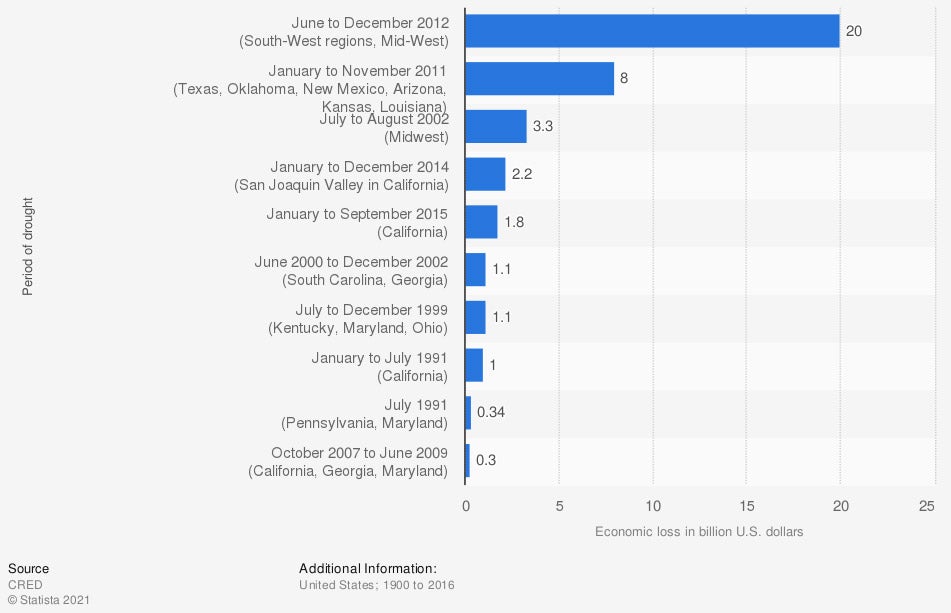

Economic loss caused by major droughts in the United States from 1900 to 2016

(in billion US dollars)

The costliest drought season in the past couple of decades occurred in 2012, with $20 billion in losses affecting the Southwest and Midwest regions of the country. Kentucky’s no stranger to costly droughts, either, as in 1999 damage due to drought in the area amounted to $1.1 billion.

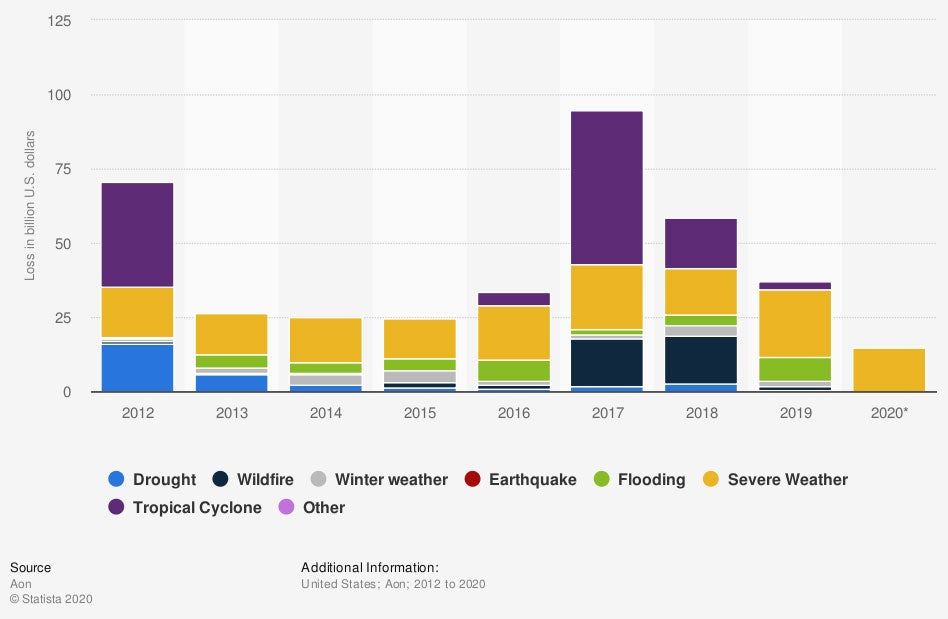

Value of insured losses in the United States from 2012 to 2020, by natural disaster type

(in billion US dollars)

Over the past decade, drought has cost billions of dollars in insured losses most years. As of 2019, this number had fallen a bit to $0.63 billion in insured losses due to drought.

Knowing how common and costly drought seasons can be, it’s imperative to work with a Kentucky independent insurance agent to get your farm covered against these disasters, before it’s too late.

Do I Need Farm and Ranch Insurance to Be Fully Covered?

Well, your crops would be fully covered under a multi-peril crop insurance policy. However, to get a better picture of coverage for your entire farm, a farm and ranch policy would be ideal. Farm and ranch insurance in Kentucky would provide coverage for your crops (though to a lesser extent than under a multi-peril crop policy), as well as the following:

- Liability coverage: Protects you from lawsuits filed by third parties for bodily injury or property damage sustained on your business premises.

- Property coverage: Protects your specialty equipment and machinery, buildings, fencing, tools, and more from fire, various natural disasters, theft, etc.

- Livestock coverage: Protects your sheep, cattle, swine, horses, goats, mules, etc. against numerous threats, including disease outbreaks.

Talk to your Kentucky independent insurance agent about adding farm and ranch insurance to get the best overall protection for your business.

Are All of My Products Covered against Drought?

According to Green, most types of crops are covered under a multi-peril crop policy. However, there may be a couple of specialty crops that are excluded. In order to find out if all of your specific farm’s crops will be covered, work with a Kentucky independent insurance agent. They’ll help review your specific crops and your coverage needs to get you set up with the right type of insurance to get the job done correctly.

Are There Any Other Policies That Can Provide Additional Coverage?

As far as crops go, yes, there are additional policies that can provide extra coverage. One such policy is known as revenue crop insurance. Green says revenue crop insurance is designed to protect farmers who sell their crops before the harvest season. It protects farmers in case they lose crops due to storm damage, etc. and still have a contract to fulfill. It also ensures farmers make profits based on the current value of the crop, if it’s risen over the season.

Here’s How a Kentucky Independent Insurance Agent Can Help

When it comes to protecting farmers and their crops against hazards like drought, fire, and all other disasters, no one’s better equipped to help than an independent insurance agent. Kentucky independent insurance agents search through multiple carriers to find providers who specialize in every type of crop insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Article Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

graph 1 - https://www.statista.com/statistics/237433/economic-loss-due-to-drought-in-the-us/

graph 2 - https://www.statista.com/statistics/612615/value-of-insured-losses-usa-by-natural-disaster-type/

iii.org

© 2025, Consumer Agent Portal, LLC. All rights reserved.