Lightning strikes are costly and can even be deadly. In one recent year, lightning strikes cost $2.1 billion in insured losses in the US. The good news is that damage from lightning can be covered under home and auto insurance if you have the right policies in place.

A Kentucky independent insurance agent can help you secure coverage and answer any questions about the type of protection you'll receive for lightning strikes.

How Does Kentucky Home Insurance Cover Lightning Damage?

Lightning damage is covered in Kentucky homeowners insurance under property coverage. Should your home be struck, your insurance will cover the following:

- The structure of your home

- Detached structures like garages and sheds

- Some landscape

- Personal property

This is provided through four main coverages within a standard homeowners insurance policy.

- Dwelling coverage: This includes your home's structure and "other structures." Other structures will be defined in your policy but typically include detached garages and sheds. Dwelling also includes built-in appliances in the home.

- Personal property coverage: This is the personal property inside your home, including furniture, appliances, clothing, electronics, and similar. Lightning can cause a power surge in your home, which can start a fire or short circuit plugged in appliances or electronics.

- Liability: This covers third-party injuries and property damage that occurs on your property.

- Additional living expenses: This covers any costs associated with temporarily having to reside somewhere else while repairs are being made to your home after an event.

Since lightning is listed as a covered peril under homeowners insurance, you'd only be on the hook for your deductible if you need to file a claim. Setting the proper policy limits can assure that you have enough coverage if disaster strikes.

Why Does Lightning Cause So Much Damage?

Lightning is the only weather pattern that can get into your electrical wiring and cause short circuits, fires, and other severe damage. Lightning can enter the home in numerous ways, and it doesn't have to be a direct hit. The electricity from lightning can travel up to 60 feet from where it hits and enter the home through communication wires or utility poles.

One lightning strike can contain more than 100 million volts of electricity and reach temperatures of 50,000°. At temperatures reaching 50,000°, moisture instantly turns into steam, which can cause things like concrete and tree sap to expand and eventually explode. As you can imagine, this can lead to more significant issues, including fires, property damage, and other damage we often see from lightning strikes.

What about My Car? If It Gets Hit by Lightning, What Protects It?

Lightning is also a covered peril listed in auto insurance, but only if you have the right coverage. You'll need a comprehensive car insurance policy to get reimbursed for damage from a lightning strike. In Kentucky, comprehensive insurance is an optional coverage, but it can protect you from more than just lightning strikes. It also helps pay for damage from the following:

- Fallen trees or objects

- Collision with a wild animal

- Storms

- Fires

- Theft and vandalism

Whether your vehicle is parked at your home or out on the road when lightning strikes, you'd always file a claim with your auto insurance policy for your car. It's never covered under your home insurance policy, even if it's parked in your garage and a lightning strike causes a tree to fall on it. Like home insurance, you'd be responsible for your deductible before your car insurance covers the claim.

Is Lightning Damage Really That Common?

In one recent year, there were 1,493,348 lightning strikes in Kentucky. While you may not always hear about the damage from lightning, a strike can spark a fire or power surge. For this reason, when looking at stats on how common lightning is, you need to consider lightning strikes and the other events they can spark.

- In recent years there have been 71,551 lightning claims to personal property

- The value of those claims was $2.1 billion

- The average cost per lightning claim for a homeowner was $28,885

- Florida had more homeowners insurance lightning loss claims than any other state

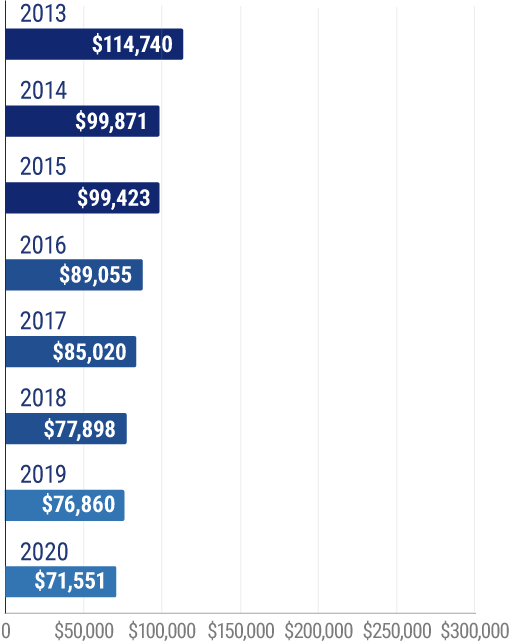

Homeowner Insurance Claim Losses in The US

Even though lightning damage claims have decreased in recent years, it is still a common claim for homeowners.

How to File a Claim after Lightning Strikes Your Kentucky Home

If you determine that you should file an insurance claim after a lightning strike, there are a few easy steps you can follow. Filing a claim is not always the best option, so it's recommended that you speak with your independent insurance agent before starting the process. Remember that you'll need to pay your deductible before your insurance will pay for any damage, so it typically only makes sense to file a claim if the damage is significantly more than your deductible.

If you do file a claim, here's how to do it.

- Assess the damage: The insurance company will send out an adjuster to assess the damage to your home and property and determine the total cost. However, you can help the process by assessing the damage yourself and documenting anything you see. Using your phone, take videos and photos of any damage you see, large or small. Make sure it's safe to re-enter your home before doing this.

- Call your independent agent: Agents are here to help you find insurance when you need it, but also use the coverage you have if an incident occurs. An agent can walk you through the claims process so you're prepared, and can even call the insurance company for you. They'll also work with you and your insurance company to make sure you get reimbursed for everything your policy covers.

- Consider your deductible: As previously mentioned, your deductible plays a large role in filing a claim. If your home has $500 worth of damage and your deductible is $1500, it's not worth filing an insurance claim as you'll end up paying $1500 before insurance will consider your claim. You can ask a contractor or other professionals to provide you with a quote on repairs before starting the claim process to see if it's worth it.

- Receive payment: After reviewing your claim, sending out a claims adjuster, and organizing other necessary documents, your insurance company will provide you with a reimbursement check for repairs or replacement costs for the damage.

Four Ways to Protect Your Home from Lightning Strikes

Once lightning strikes there's not much you can do. But since lightning is common in Kentucky, there are ways you can prepare your home just in case.

1. Install surge protectors: Surge protectors can help protect electronics such as computers, televisions, cable boxes, etc.

2. Install a lightning protection system: Lightning protection systems guide any lightning that comes into the ground and therefore away from your home. This protects your home against fires and structural damage that could occur if the lightning were to directly strike your home.

3. Take inventory of your personal property: Having an updated inventory of your belongings is helpful for potential weather patterns beyond just lightning strikes. The more information you have on your personal property, the easier it is to prove what was destroyed and make sure you're reimbursed.

4. Review your home insurance with your agent: Insurance can help you immensely if your home is struck. Reviewing your coverage every year with your agent can make sure your limits are properly set and that you have coverage if there are any major life changes or physical changes to your home.

How Can a Kentucky Independent Insurance Agent Help?

A Kentucky independent insurance agent is your one-stop shop for finding home, auto, and other insurance coverages. Agents shop multiple quotes and insurance companies to find you the right blend of coverage that fits your budget.

Should lightning strike your home, an agent can advocate for you to make sure you receive the coverage that is outlined in your policy. Agents are located across the state and ready to help you with your insurance needs.

Article reviewed by | Jeffrey Green

https://www.iii.org/fact-statistic/facts-statistics-lightning

https://www.earthnetworks.com/blog/states-most-lightning-strikes/

https://electricalconnection.org/news/when-lightning-strikes-the-home-tips-for-homeowners-393

https://strikecheck.com/webinars/surge-and-lightning-damage-to-electronics/#:~:text=The%20energy%20from%20a%20nearby,the%20foundation)%20(NWS)

https://www.bereadylexington.com/lightning/#:~:text=Between%202004%20and%202013%2C%20the,recorded%20between%202003%20and%202012