When securing coverage for your home, you need to be aware of what disasters you’ll be protected against, whether you own or rent. Some threats, like those stemming from Mother Nature, can’t be avoided. That’s why it’s so important to be familiar with what’s covered by your insurance.

Luckily a Kentucky independent insurance agent can help you find the best renters insurance for you, and help you review what’s included in your policy. They’ll even get you set up with the coverage you need, long before you have to file a claim. For starters, here’s a closer look at renters insurance and if/when it covers tornado damage.

What Is Renters Insurance?

Renters insurance is very similar to Kentucky homeowners insurance, except it’s tailored to meet the needs of renters instead of owners. Coverage includes necessary protection for tenants’ personal property stored in the home, plus important protection against lawsuits and more. A Kentucky independent insurance agent can help you find the right renters policy for you.

What Does Renters Insurance Cover in Kentucky?

Renters insurance is structured differently than Kentucky homeowners insurance because renters do not own the exterior of the building they live in. But renters insurance still offers several important protections, including:

- Personal property insurance: Covers your personal belongings in your home, like silverware, furniture, and more, against many perils like fire.

- Liability insurance: Covers third-party lawsuits against you for claims of property damage or injury.

- Additional living expenses: Covers your additional expenses if you’re forced to live elsewhere while your rental unit undergoes repairs for a covered disaster.

A Kentucky independent insurance agent can help explain the importance of having adequate renters insurance.

What Doesn’t Renters Insurance Cover in Kentucky?

Renters insurance provides a lot of important protection for renters, but it doesn’t cover everything. Some common exclusions under renters insurance in Kentucky are:

- Routine maintenance

- Business liability costs

- Floods, earthquakes, and mudslides

- Insect damage or infestations

- War or nuclear damage

Your Kentucky independent insurance agent can help you get additional coverage, if necessary, beyond what’s offered by a renters insurance policy.

What Policy Covers Tornado Damage to a Renter?

According to insurance expert Jeffery Green, renters insurance generally considers tornadoes a covered peril, since they fall into the “windstorm” category. Windstorms are commonly covered by both homeowners and renters policies.

However, certain renters insurance policies may specifically exclude tornado coverage, especially if you live in or near Tornado Alley. It’s important to work together with a Kentucky independent insurance agent to review your policy to find out for sure.

Economic Damage Caused by Tornadoes

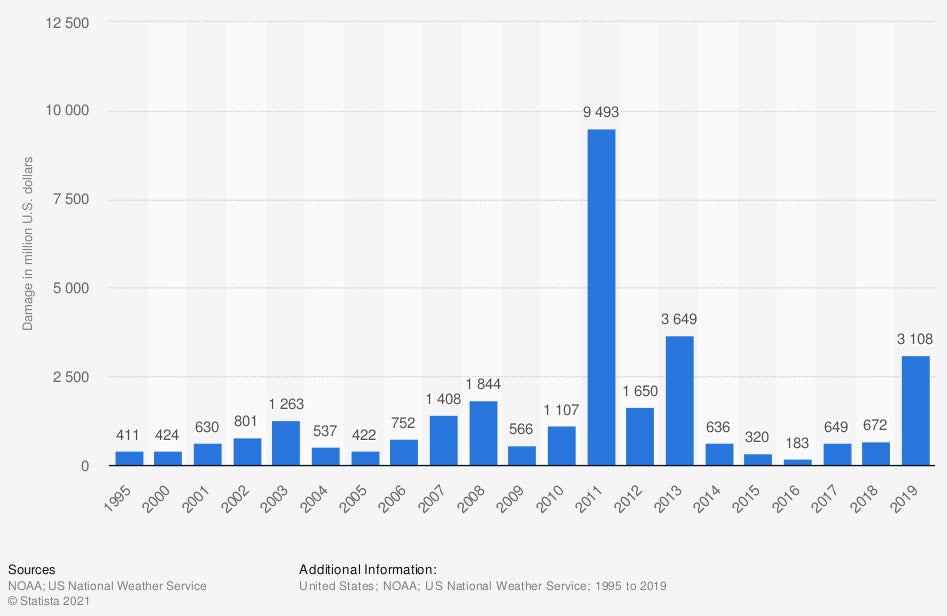

When considering if your renters insurance covers tornadoes, it’s helpful to understand just how important having this protection is. Check out some stats for the economic impact of tornadoes.

Economic damage caused by tornadoes in the US

Over the past couple of decades, tornadoes have caused millions of dollars in economic damage every single year. Some peak years of economic damage due to tornadoes reached as high as $9.49 billion and $3.64 billion.

Tornadoes are naturally devastating in terms of both destruction and cost to clean up after. That makes having coverage under your renters insurance all the more critical.

How Much Tornado Damage Needs to Happen in Order to Be Covered?

Green said that for tornado damage to be covered under your renters insurance in Kentucky, the amount of damage would have to exceed the limit of your policy’s deductible. Common deductible amounts for renters insurance policies range from $500 to $1,000, but can reach up to $5,000.

So, if a tornado caused $750 in damage to your personal property and your renters insurance’s deductible was $500, you’d be reimbursed for $250. You can work with your Kentucky independent insurance agent to find a policy with the lowest possible deductible.

Here’s How a Kentucky Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect renters against commonly faced liabilities. Kentucky independent insurance agents shop multiple carriers to find providers who specialize in renters insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

https://www.statista.com/statistics/237409/economic-damage-caused-by-tornadoes-in-us/

https://www.iii.org/fact-statistic/facts-statistics-renters-insurance

https://www.iii.org/article/renters-insurance

© 2024, Consumer Agent Portal, LLC. All rights reserved.