Insurance Content Navigation

- What Is Life Insurance?

- What Does Kentucky Life Insurance Cover?

- What Is Term vs. Life vs. Universal Life Insurance in Kentucky?

- In Kentucky, When Does Life Insurance Cover You?

- How Much Does Life Insurance Cost in Kentucky?

- Is My Life Insurance Taxable in Kentucky?

- How a Kentucky Independent Insurance Agent Can Help You

It can be odd to think about purchasing insurance for when you die, but life insurance is intended to help others in the event of your death. Most people don't realize that it's expensive to die, which is why Kentucky life insurance can relieve your loved ones of any financial burden that your passing might cause.

A Kentucky independent insurance agent can help you understand the different types of life insurance and which one might fit your needs. They'll make sure you're still protecting your family long after you're gone.

What Is Life Insurance?

Life insurance in Kentucky is an insurance policy that you purchase that is designed to pay a certain amount of money to a person of your choosing when you die. While you're alive you pay a monthly or yearly premium for your policy. In the event of your death, your beneficiary will receive the set amount of money outlined in your policy in order to pay for funeral costs, everyday expenses and bills, and other death-related costs.

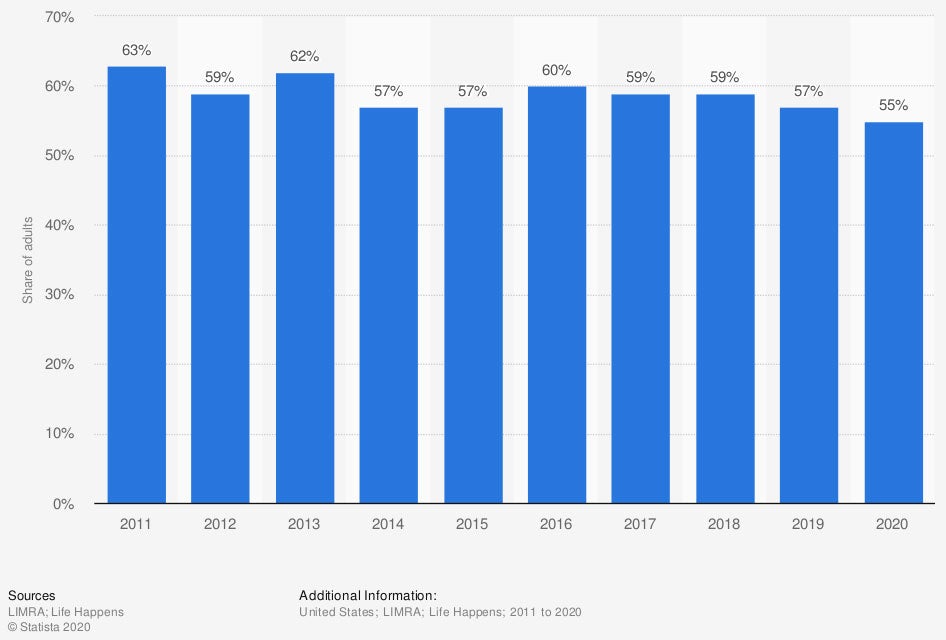

Share of adults who owned life insurance in the United States from 2011 to 2020

In 2020, 55% of Americans owned life insurance. This was the lowest percentage of people who have owned life insurance over the last 10 years.

What Does Kentucky Life Insurance Cover?

The average out-of-pocket costs for dying is $11,618, according to the National Bureau of Economic Research. In Kentucky, the average funeral costs $7,360, so it's clear that passing away is not cheap. Unfortunately, if you're no longer living, someone else has to pay these costs as well as any other debts or bills you leave behind. Life insurance helps pay for the costs associated with death and other expenses including:

- End-of-life expenses

- Monthly bills

- Everyday expenses

- Co-signed debt

- Childcare

- College tuition or education

Similar to most insurance policies, there are some exclusions and death events that will not be covered by life insurance.

- If your policy expires or becomes inactive: Your beneficiaries will not receive payment if you stop making payments toward your life insurance policy or do not renew it.

- Death by suicide: Most policies will only cover suicide if the person dies within a certain time frame of purchasing the policy. Typically this time frame is two years, so if the insured commits suicide within two years of purchasing a life insurance policy, their beneficiaries will most likely not receive payment.

- Deaths related to fraud or criminal activity: If you die robbing a bank, it's likely your beneficiaries will not receive a payout from your life insurance policy. The same goes for any fraudulent activities that could lead an insurance company to believe you were trying to work the system in order to receive a payout.

Your Kentucky independent agent can help you understand the different coverages in your life insurance policy and when your beneficiaries may or may not receive a payout.

What Is Term vs. Whole vs. Universal Life Insurance in Kentucky?

When you purchase life insurance, you'll have the option to choose between term, life, and universal policies. They all differ slightly from each other. It's important to understand the differences, as it could affect which one you purchase.

- Term life insurance: Just like the name suggests, term life insurance covers you for a specific "term" or period of time. Usually, this is 10, 20, or 30 years. If you die within the designated timeframe, your beneficiaries receive a payout. "30-year term policies are usually a good period for young people purchasing life insurance," says Paul Martin, insurance expert. "It gets you through college, most of life's big expenses and events, and you can always choose to cancel or extend it."

- Whole life insurance: This insurance is designed to protect you for your whole life. It also comes with a savings account component that is designed to accrue money over your lifetime. A whole life insurance policy is often referred to as a permanent or traditional policy. While you're alive you can use the savings component to invest or access the cash through withdrawal or borrowing against it. It's important to know that when you die, the insurance company will absorb the cash value of the account and the beneficiary will only receive the policy's death benefit, unless you purchase a policy rider that says your beneficiary receives the cash value and face value of the death benefit.

- Universal life insurance: Universal life insurance is very similar to whole life insurance in that it is meant to last your entire life and includes a savings account aspect. However, it also accrues interest and you can put in more money than your payment in order to take advantage of the interest. As long as your account has money in it, you can also skip payments to your account in addition to having access to the cash value.

In Kentucky, When Does Life Insurance Cover You?

As long as you have purchased life insurance and you've maintained your policy payments, life insurance will cover you immediately upon purchase. There are exclusions for suicide, but in the event of your death, your policy will provide a payout to your beneficiary. It's also worth noting that you don't have to be a certain age in order to have life insurance cover you. You can purchase life insurance at any age and it will cover your death, no matter what age you are when you die.

Parents can even purchase life insurance for their children. Typically this is a whole life policy, so that the cash value account can increase in value as your child ages. The policy can then be transferred into your child's name when they turn 18. You can also add a child life rider to your existing term or whole life insurance policy that will provide a payout in event of an unexpected death.

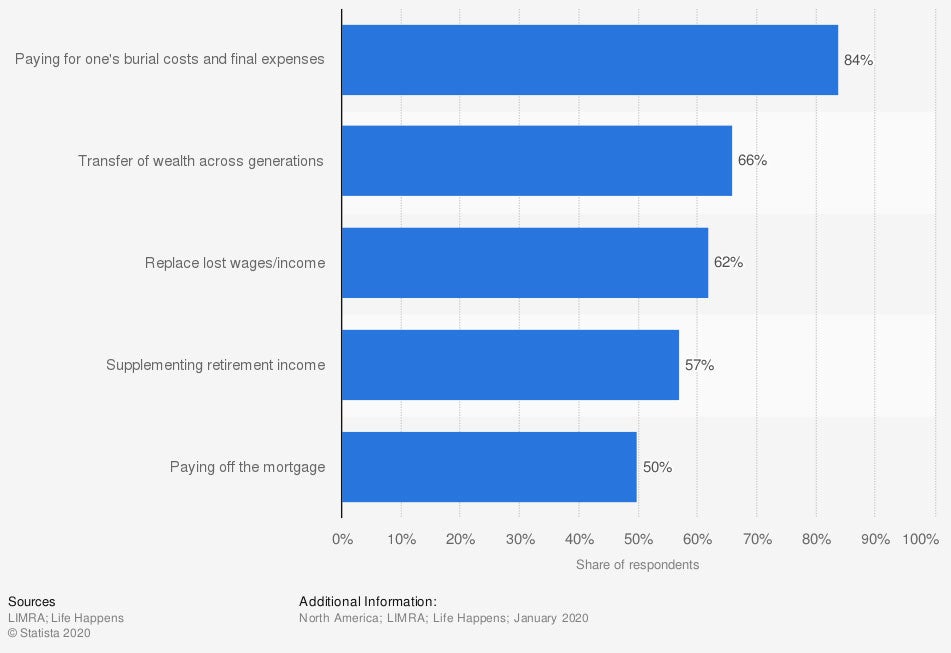

Leading reasons for owning life insurance in the United States in 2020

Paying for burial costs and other final expenses is the top reason people purchase life insurance policies.

How Much Does Life Insurance Cost in Kentucky?

More than 34 million life insurance policies were purchased in Kentucky in 2018, but there is not a set price for life insurance policies. It depends heavily on multiple factors, including:

- Policy type: term or whole

- Term length

- Age

- Sex

- Health

- Family medical history

Insurance companies will even take your daily habits into consideration when pricing your life insurance. Ultimately, the healthier you are, the more affordable your life insurance will be, because your carrier will see you as a low risk for dying. Policy prices can range from as little as $10/month to several hundred dollars, but your Kentucky independent insurance agent can provide you with a specific price quote.

Is My Life Insurance Taxable in Kentucky?

If you die and your beneficiary receives a $100,000 payout, you might be wondering if they'll be taxed on the money. Typically, payouts are not counted as gross income and therefore are not taxable. However, if you receive interest on your payout or on your life insurance policy, such as with a universal policy, then you will need to pay taxes on the interest you accrue.

How a Kentucky Independent Insurance Agent Can Help You

No one wants to leave their loved ones with financial burdens, and a Kentucky independent insurance agent is the best person to help you understand and find life insurance. Whether you're a young family with a baby on the way or a retired individual looking at your future finances, an agent can help you determine whether a term or whole life insurance policy is right for you and where to find it.

Author | Sara East

Article Reviewed by | Paul Martin

https://www.irs.gov/faqs/interest-dividends-other-types-of-income/life-insurance-disability-insurance-proceeds#:~:text=Generally%2C%20life%20insurance%20proceeds%20you,report%20it%20as%20interest%20received.

https://www.nber.org/bah/2010no2/out-pocket-health-care-expenditures-end-life

statista.com