When you run a business in Kentucky, you'll have to account for every detail, no matter how small. If you operate a daycare, dealing with other people's children can be both rewarding and risky. It's critical to have the right Kentucky business coverage from the get-go to avoid a major loss or worse.

Fortunately, a Kentucky independent insurance agent can help you find affordable insurance. They have access to a network of carriers so that you have options. Connect with a local expert for tailored quotes to get started.

What Is Daycare Insurance?

In Kentucky, daycare insurance comes in many different forms. It's crucial to review your policies with a trained professional so that you're fully protected from all angles. Specific coverage is necessary when you're offering childcare in any form. Check out some common policy choices for daycare insurance below:

- General liability: Pays for a claim of bodily injury or property damage.

- Business property: Pays for property repair or replacement due to a covered loss.

- Sexual misconduct: Pays for a sexual misconduct lawsuit filed by a customer.

- Commercial umbrella liability: Pays for additional liability when your underlying limits of protection are exhausted due to a larger claim.

- Workers' compensation: Pays for bodily injury and illness of an employee hurt as a result of doing their job.

- Employment practices liability: Pays for a discrimination or harassment lawsuit filed by your employee.

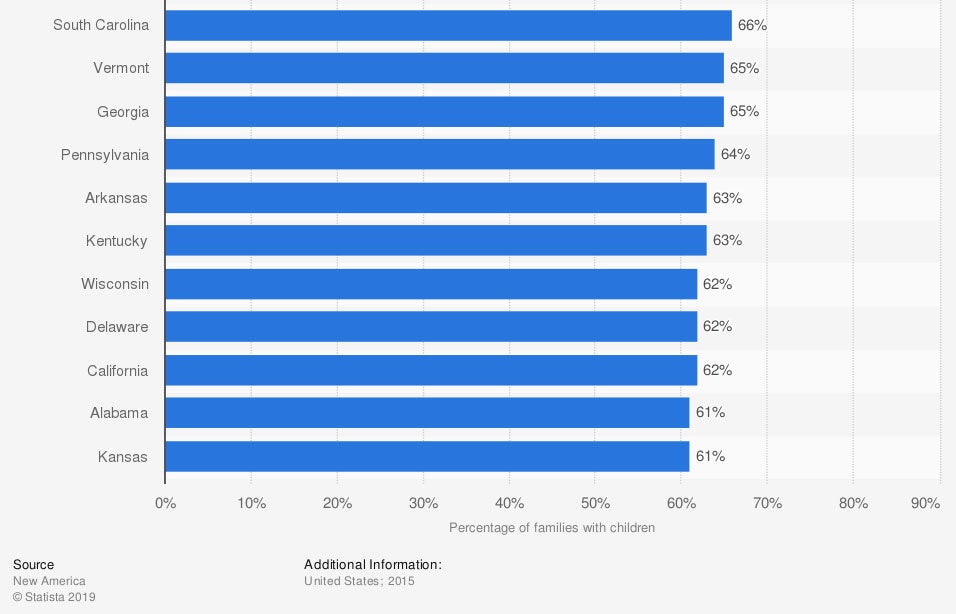

Percentage of families with children in daycare centers in the US in 2015, by state

US daycares are used by more than half of parents nationwide. Your business will need to have proper coverage to avoid significant financial exposure.

What Does Daycare Insurance Cover in Kentucky?

When you're in the business of caring for children, you'll have to account for many risks. It's essential to understand what your commercial insurance will protect against before a loss occurs. Let's look at standard coverage for daycares in Kentucky:

- Coverage for claims of bodily injury or property damage

- Coverage for your business property that is damaged due to a covered loss

- Coverage for sexual misconduct

- Coverage for business equipment that breaks down due to a covered loss

- Coverage for employees who are injured or become ill on the job

- Coverage for disgruntled employees that sue due to discrimination or harassment

Some perils are automatically included in your daycare policies in most cases. Fire, natural disasters, theft, vandalism, and water damage can be covered with the right insurance.

How Much Is Daycare Insurance in Kentucky?

Every business insurance policy will have unique pricing based on your individual risk. In Kentucky, $4,661,744,000 in commercial insurance claims were paid in 2019 alone. To avoid paying a loss out of pocket, you'll need to obtain adequate protection for your daycare. Take a look at the factors companies consider when quoting:

- Loss history

- Replacement cost values

- Insurance score

- Experience level

- Location

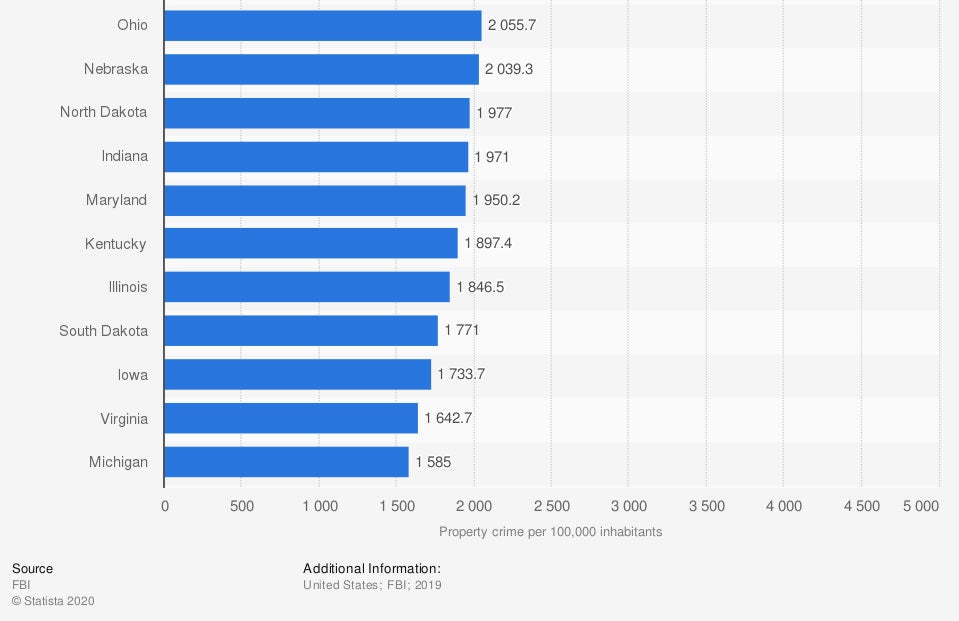

- Local crime rate

How Much Property Is Covered under Daycare Insurance in Kentucky?

Your Kentucky daycare will have an option for property coverage. This can include your equipment, inventory, supplies, and furniture. The structure your daycare is in can have coverage as well. Theft and vandalism are automatically insured unless stated otherwise.

Property crime rate per 100,000 inhabitants in the US in 2019, by state

When you operate a daycare, safety is crucial for your property and customers. Your commercial insurance will respond to property crime in most scenarios.

Will My Location Impact My Rates?

Kentucky has 4,414,349 residents and is growing. While more people can mean better business, where your daycare is located will impact your insurance costs. From crime rates to the building itself, your daycare will need to be in a safe and secure area in order to obtain the lowest insurance premiums. The flood zone you're in will affect pricing as well, and should be considered when purchasing coverage.

How an Independent Insurance Agent Can Help in Kentucky

If you operate a daycare in Kentucky, there are several insurance options that you'll need to consider when obtaining coverage. Your policies should match up to your risk exposures as a business. Fortunately, a trusted adviser can help you find insurance that meets your needs as a daycare.

A Kentucky independent insurance agent has access to multiple carriers so that you get the best policies for a fair price. They'll do the shopping for you at zero extra expense to your business. Connect with a local expert on TrustedChoice.com for custom quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/625343/share-of-families-with-children-in-day-care-by-state-us/

Graphic #2: https://www.statista.com/statistics/232575/property-crime-rate-in-the-us-by-state/

http://www.city-data.com/city/Kentucky.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.