Insurance Content Navigation

- What Is Storm Insurance?

- What Does Storm Insurance Cover in Kentucky?

- Does Homeowners Insurance Cover Tree Removal after a Storm In Kentucky?

- Does Home Insurance Cover Roof Damage after a Storm?

- Does Kentucky Car Insurance Cover Storm Damage?

- How to File a Claim for Storm Damage in Kentucky

- How a Kentucky Independent Insurance Agent Can Help You

Wind, fire, hail, and snowstorms are all dangerous weather events that can severely damage your home. They're also weather events that are likely to take place in Kentucky. That is is why Kentucky residents need to make sure they're properly protected with storm insurance.

Even though storm insurance is included in your homeowners policy, a Kentucky independent insurance agent can help you understand what your policy considers a "storm" and how much coverage you'll have. To start, let's talk more about storm insurance.

What is Storm Insurance?

Storm insurance is protection for your property and belongings if they're damaged in a storm. This type of insurance is not its own policy, but rather it's part of your homeowners insurance. If your home experiences a storm-related event, such as damage from high winds, fire, hurricanes, tornados, or the like, then the storm damage coverage portion of your homeowners policy will help pay to repair or replace the damage.

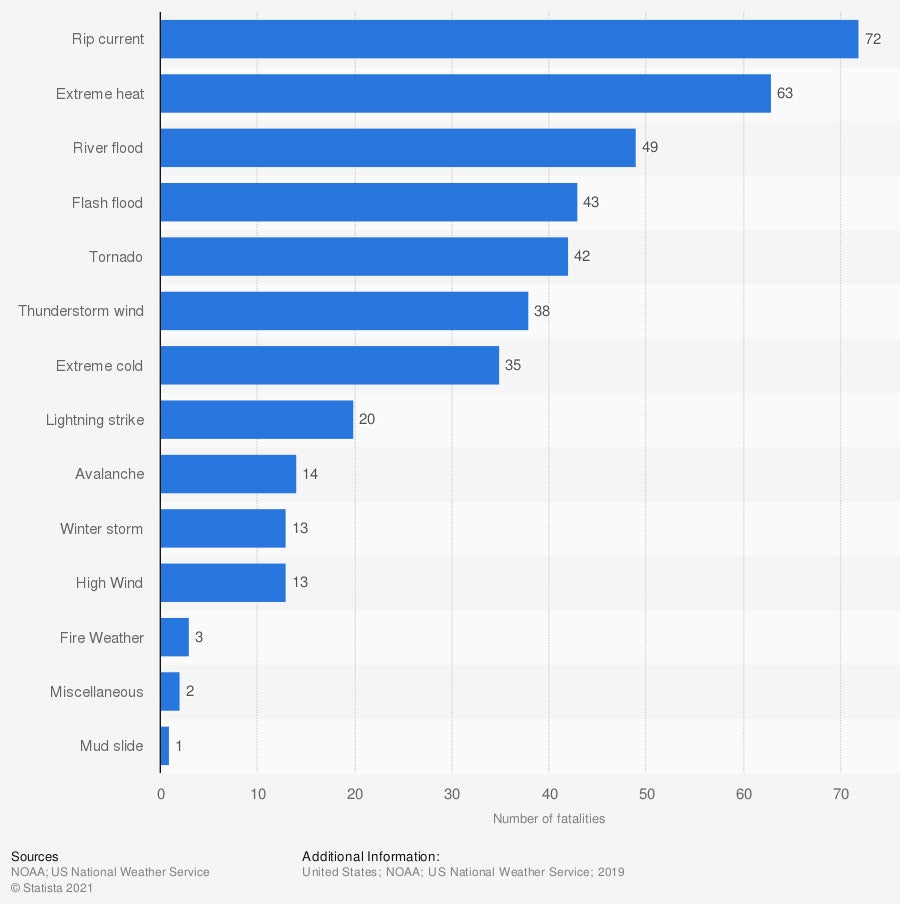

Number of deaths due to weather conditions and storms in the U.S. in 2019

The most common weather conditions in the U.S. that cause deaths are rip currents, extreme heat, river flooding, flash flooding, and tornadoes.

What Does Storm Insurance Cover in Kentucky?

Storm insurance is designed to cover any storm-related events. Your Kentucky independent agent can help you understand what your insurance classifies as a "storm," but typically you'll receive coverage for damage from the following:

- Wind

- Hail

- Lightning

- Fire

- Wind-driven rain or snow

- Falling trees

It's important to understand what is covered by your policy, because you may want to purchase additional coverage. A standard homeowners policy won't cover any damage caused by flooding or earthquakes. Both of these types of coverage can be purchased separately.

Surprising facts about storms in Kentucky

- Every year, Kentucky experiences between 40 and 55 thunderstorms.

- Wind speeds during severe storms often exceed 100 miles per hour.

- Kentucky receives an average of 45 inches of precipitation every year.

- Kentucky averages 10 tornados per year.

- The largest reported tornado in Kentucky was 1.70 miles wide.

- Kentucky experiences 13.7 lightning flashes per square mile

Does Homeowners Insurance Cover Tree Removal after a Storm In Kentucky?

Fallen trees are a common result of a storm. According to insurance expert Jeffrey Green, most homeowners insurance will cover tree removal. "Some policies will cover tree removal from any area covered by the policy, others will only cover removal from specific areas," says Green.

Some of the additional factors that an insurance company will consider are what caused the tree to fall, as well as where it landed. If a windstorm caused a tree from your yard to blow onto your house and cause damage, it would be covered. If the tree fell into empty space in your yard and caused no damage, removal might not be covered by your insurance. If you are in need of tree removal after a storm, you can check with your independent insurance agent to see if the removal will be covered.

Does Home Insurance Cover Roof Damage after a Storm?

Typically, damage to your roof by storm-related events will be covered by the dwelling coverage portion of your homeowners policy. This includes damage from wind, fire, hail, or the weight of snow, along with other sudden or accidental damage.

The information to know is whether your roof is covered partially or fully. Depending on the damage, your insurer may choose to replace the entire roof even if it's only partially damaged. In some policies, you may need to purchase full roof replacement coverage to get that protection.

Because of the cost of roof replacement, some insurance companies only allow customers to purchase "actual cash value" coverage for wind and hail damage if they have an older roof that wouldn't qualify for replacement value coverage. Newer roofs typically qualify for replacement cost coverage.

Does Kentucky Car Insurance Cover Storm Damage?

In Kentucky, the required car insurance policies are bodily injury liability, property damage liability, and personal injury liability coverage. None of these will cover damage from a storm. If your car was damaged by wind, hail, lightning, or the like, you would need to have Kentucky comprehensive insurance coverage to make a claim against your insurance policy.

Comprehensive insurance, also known as "other than collision" insurance, is designed to cover any damage your vehicle sustains from events other than a collision. This includes storm-related events. Comprehensive insurance can easily be added to you policy for a minimal price. Your independent insurance agent can help you add this coverage to your existing car insurance.

How to File a Claim for Storm Damage in Kentucky

In the unfortunate event that a storm causes damage to your home or vehicle, you'll want to file a claim as soon as possible. Follow these steps to quickly and efficiently file a claim.

- Step 1: Assess and document the damage.

- Take photos and videos of the damage, and write down what’s been damaged. Always keep safety in mind and do not attempt to walk through structural damage.

- Step 2: Contact your insurance agent.

- Call your insurance agent to let them know what has happened and ask them what the best next step is.

- Step 3: Fill out the claim forms.

- Your insurance company will ask you to submit a form that lists everything that was damaged. Filling out these forms in a timely manner can help your claim move along more quickly.

- Step 4: Prepare for an adjuster to come.

- Never try to move anything or start fixing damage before an adjuster has come and looked at your property.

Once your claim is filed, your insurance company will let you know if you can start repairing items and be reimbursed, or if you must wait to use a certified repair company approved by your carrier.

How a Kentucky Independent Insurance Agent Can Help You

Since storm insurance is built into your Kentucky homeowners insurance policy, you may think it's not important to know much about it. However, the last thing you want is to get caught with storm damage and have it not be covered by your insurance because you didn't fully understand your policy.

Whether you want to understand your existing storm insurance or purchase new insurance, a Kentucky independent insurance agent can help. They'll shop multiple carriers to find the most affordable storm insurance available and can assess your existing policy to see the terms and coverages included. They're even there if you end up having to file a claim and can help you through the process. Find an insurance agent today.

Article Author | Sara East

Article Reviewed by | Jeffery Green

http://coolweather.net/staterainfall/kentucky.htm

https://www.weather-us.com/en/kentucky-usa-climate#climate_text_4

Iii.org

© 2024, Consumer Agent Portal, LLC. All rights reserved.