Insurance Content Navigation

- Does Homeowners Insurance Cover Chimney Fires in Kentucky?

- What Does Homeowners Insurance Cover in Kentucky?

- What Doesn’t Homeowners Insurance in Kentucky Cover?

- House Fire Stats

- What If I or My Family Get Injured by a Chimney Fire?

- Are My Belongings inside My House Covered against Chimney Fires?

- Here’s How a Kentucky Independent Insurance Agent Can Help

Though enjoying a fire indoors is meant to be a cozy experience on a chilly evening, it can also present one of the biggest risks to homeowners. Fire is one of the top perils homeowners across the map face, and sadly sometimes these occur right in the chimney. That’s why it’s crucial to have the right protection in place beforehand.

Fortunately a Kentucky independent insurance agent can help you get set up with the right home insurance to protect against chimney fires. They’ll make sure you have all the coverage you need, long before you need to use it. But first, here’s a closer look at home insurance and how it covers chimney fires.

Does Homeowners Insurance Cover Chimney Fires in Kentucky?

According to insurance expert Jeffery Green, fires are one of the top listed perils on standard homeowners insurance policies. Chimney fires are included in this coverage, as well as several other types of fires, such as electrical fires. A Kentucky independent insurance agent can help you review your specific homeowners insurance policy to become familiar with all the perils it covers, from the types of fire damage and beyond.

What Does Homeowners Insurance Cover in Kentucky?

Aside from fires, homeowners insurance provides a lot of important coverage in Kentucky. The main coverages included in homeowners insurance are:

- Contents coverage: Covers your personal belongings like furniture and clothing againsst loss or damage due to perils like fires, but also theft and more.

- Structural coverage: Covers the structure of your home against fire damage, storms, and more.

- Liability coverage: Covers your legal expenses in the event you get sued by a third party for claims of property damage or bodily injury.

- Additional living expenses: Covers the extra expenses necessary if you must live elsewhere temporarily while repairs are being made to your home following a covered disaster, like a fire. Coverage pays for hotel costs, extra gas mileage, and more.

A Kentucky independent insurance agent can review the coverage provided by your homeowners insurance, or help you find the right policy if you don’t already have one.

What Doesn’t Homeowners Insurance in Kentucky Cover?

Green says that though homeowners insurance covers many common disasters, there are certain exclusions as well. Some of the top exclusions for homeowners insurance in Kentucky are:

- Certain explosions

- War or nuclear damage

- Routine maintenance costs

- Business liability costs

- Insect infestations

- Earthquakes and floods

If your home is located in a flood or earthquake zone, it’s important to consider adding flood insurance or earthquake insurance, depending on your needs. A Kentucky independent insurance agent can help you find coverage.

House Fire Stats

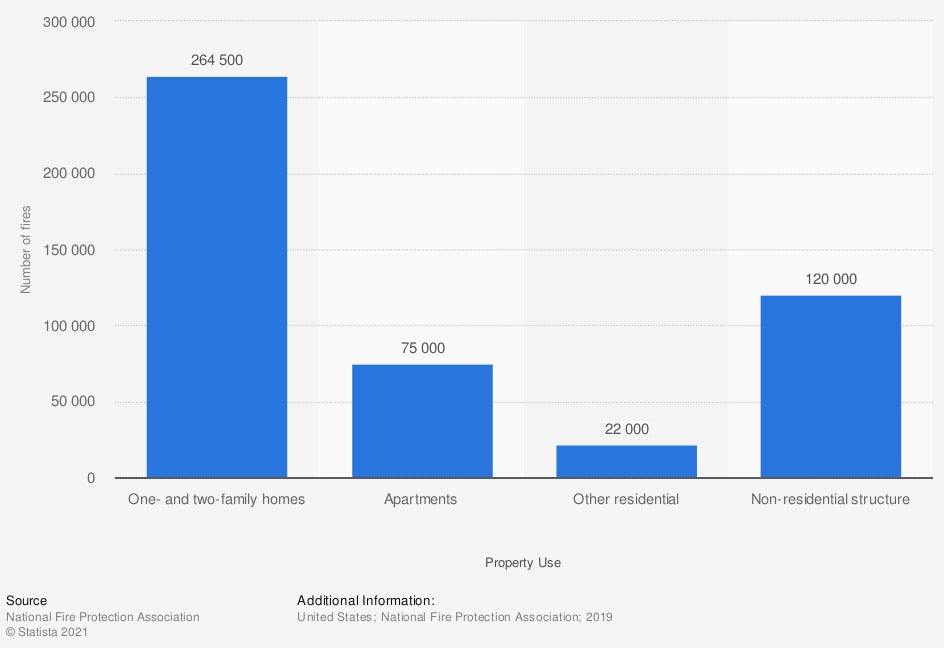

When considering the importance of home insurance for chimney fire coverage and more, it’s helpful to know just how prevalent house fires are across the country.

Number of structure fires in the United States in 2019, by property use

Perhaps surprisingly, by far the greatest number of structural fires occurred in one- and two-family homes in 2019. A total of 264,500 fires were reported in these structures in that year alone. The second-most common structural fires occurred in non-residential properties, at 120,000 total reported fires.

That same year, property damage resulting from structural fires in one and two-family homes amounted to $6.3 million. House fires can originate from chimneys and many other sources. That’s why it’s crucial to be protected by the right home insurance before you ever strike a match.

What If I or My Family Get Injured by a Chimney Fire?

Unfortunately, home insurance doesn't cover your own injuries on your property, or your family’s injuries. The liability section of your coverage includes medical payments, but only for third parties. So if a guest was injured at your home due to a chimney fire gone wrong, your home insurance policy would pay for their medical expenses. To treat yours or those of your family members, you’d need to rely on a health insurance policy.

Are My Belongings inside My House Covered against Chimney Fires?

Yes, your personal belongings inside your house are covered against chimney fires. The contents coverage section of standard homeowners insurance provides protection for belongings such as clothing, electronics, silverware, collections, and more. For very valuable property such as jewelry or expensive artwork, however, you may want to add extra coverage through a rider or endorsement. Your Kentucky independent insurance agent can help.

Here’s How a Kentucky Independent Insurance Agent Can Help

When it comes to protecting Kentucky homeowners against chimney fires gone wrong and all other catastrophes, no one’s better equipped to help than an independent insurance agent. Kentucky independent insurance agents search through multiple carriers to find providers who specialize in homeowners insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

chart - https://www.statista.com/statistics/374811/us-fire-statistics-number-of-structure-fires-by-property-use/

https://www.statista.com/statistics/374819/us-fire-statistics-property-loss-due-to-fire-by-property-use/

iii.org

© 2024, Consumer Agent Portal, LLC. All rights reserved.