Kentucky sees an average of 546,989 lightning strikes a year. If lightning strikes your home, it could lead to a fire. If this happens, you may get insurance coverage from your home or car insurance, but how do you know which one to use?

To answer this question and others you have, a Kentucky independent insurance agent can help. Agents can get you the coverage you need to protect your personal property from unexpected weather events and more. Here's why lightning damage can be so costly and how you can prepare for a potential storm.

How Does Home Insurance Protect from Lightning Damage?

Lightning damage is listed as a covered peril in your Kentucky home insurance. There are several ways that home insurance covers lightning damage.

- Coverage for personal property: If a lightning strike were to cause damage to your personal property, such as appliances, electronics, or other valuable items, your home insurance would reimburse you for these items at the actual cash value.

- Coverage for the structure and detached structures: If lightning damages the structure of your home or detached structures like sheds or garages, home insurance will help pay for repairs or replacement.

- Coverage for additional living expenses: If your home experiences extreme damage from lightning and you need to move out of the home while repairs are being made, home insurance will cover additional living expenses such as hotel stays, meals, mileage, and the like.

In addition to damage from lightning, home insurance will cover damage from several other events resulting from a thunderstorm. This includes:

- Fallen trees

- Power surges

- Lightning fires

- Ground surges

Lightning damage and fires could be extremely costly. The best way to make sure you're fully protected is to work with your independent insurance agent to set the proper policy limits.

How Does Lightning Cause So Much Damage?

Lightning is a unique weather event that can get into your home's electrical wiring and cause serious damage. Each lightning strike is extremely hot and contains a massive amount of electricity. Just one lightning strike can contain 100 million volts of electricity or more and produce temperatures of 50,000°. That's enough energy to keep a 100-watt bulb burning for three months, and is five times as hot as the surface of the sun.

The extreme temperatures of lightning cause moisture to instantly turn into steam. This can cause moisture in concrete to expand and sap in trees to expand and explode, leading to the damage we often see from lightning strikes.

Lightning can enter the home in numerous ways, and it doesn't have to involve a direct hit. The electricity from lightning can travel up to 60 feet from where it hits and enter the home through communication wires or utility poles. Once inside the house, it can cause a surge and damage appliances and pipes, and start fires.

What Protects My Car If It's Hit by Lightning?

Lightning damage is a covered peril under comprehensive car insurance. This is not a required coverage for drivers, so you'll need to add it to your policy.

Comprehensive coverage is good for more than covering lightning damage. Known as "other than collision" insurance, it helps pay for damage that occurs from several events that are considered non-collision. A few examples include:

- Damage from fallen trees or objects

- Damage from hitting a wild animal

- Damage from a storm

- Damage from a fire

- Theft

Because of its wide range of coverages, a comprehensive policy is worth considering to make sure your vehicle is fully protected. If you did not have comprehensive coverage, you would be paying for any damage to your car from lightning strikes or other non-collision events out of pocket.

How to File a Claim after Lightning Strikes Your Kentucky Home

If lightning strikes your home and the damage is significant enough to warrant filing a claim, you can do so in four easy steps. Remember that you'll be responsible for any deductibles you owe before your insurance policy pays. To file an insurance claim after a lightning strike, follow these steps:

- Assess the damage: Once it is safe to do so, you can enter your home and assess the damage. Your insurance company will want any evidence of damage, so you can use your phone or a camera to take photos and videos to thoroughly document everything. If you're worried about whether it's safe to reenter the home, it's best to play it safe and not go inside.

- Call your independent agent: Your agent can help you with every step of filing your claim. They'll even call the insurance company for you if you need it. Agents have dealt with a variety of claims, so they'll know what steps you can take and help guide you through the claims process.

- Factor your deductible: Your deductible is the amount of money you owe before your insurance pays for damage in a claim. Factoring your deductible can help you determine if it's worth filing a claim. If your deductible is $1,500 and you only have $700 in damage, it's probably not worth going through insurance for repairs.

- Receive payment: After reviewing your claim, sending out a claims adjuster, and organizing other necessary documents, your insurance company will provide you with a reimbursement check for repair or replacement costs for the damage.

Is Lightning Damage Really That Common?

Lightning damage remains a fairly common insurance claim across the US. Lightning is so damaging because it can lead to numerous other events, such as fallen trees, surges, and fires. Here's how costly lightning damage can be to a homeowner.

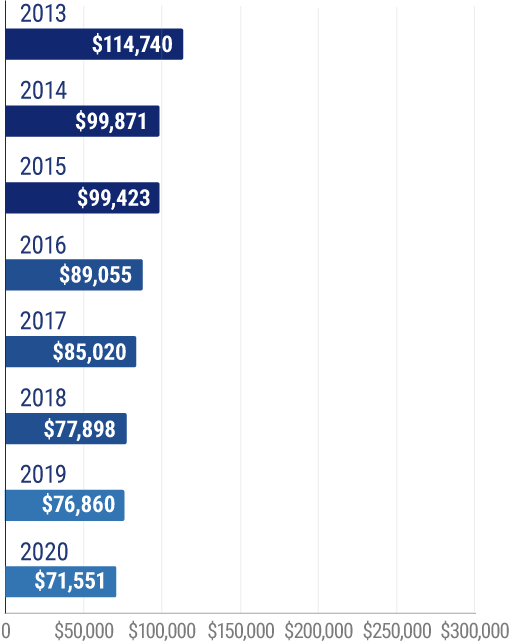

- In one recent year, there were 71,551 lightning claims on personal property.

- The value of those claims was $2.1 billion.

- The average cost per lightning claim for a homeowner was $28,885

- Florida had more homeowners insurance lightning loss claims than any other state

Lightning losses in the US

Even though lightning damage claims have decreased in recent years, it is still a common claim for homeowners.

4 Ways to Protect Your Home from Lightning Strikes

Lightning comes with a thunderstorm, so there are several ways you can prepare and protect your home from the damage that lightning can cause.

- Install surge protectors: Surge protectors can help protect electronics such as computers, televisions, cable boxes, etc.

- Install a lightning protection system: These systems are designed to protect against fire and structural damage by guiding the lightning into the ground.

- Take inventory of your personal property: Take pictures and videos of your belongings. Keep essential documents in a safe and easy-to-access place.

- Review your home insurance with your agent: Your agent can help review your home and its safety precautions, identify risks, and make sure you have the coverage to help get your family back where they belong after a disaster.

How Can a Kentucky Independent Insurance Agent Help?

Lightning is one of the many risks homeowners face. Having the right coverage for your property and your possessions ensures that your possessions are protected if disaster strikes.

A Kentucky independent insurance agent is an expert in all things insurance, including home and car insurance. Agents can review existing policies or assist in finding you a new policy that fully protects you. Work with a local agent today.

Article reviewed by | Jeffrey Green

https://www.iii.org/table-archive/20504

https://www.iii.org/fact-statistic/facts-statistics-lightning

https://electricalconnection.org/news/when-lightning-strikes-the-home-tips-for-homeowners-393

https://strikecheck.com/webinars/surge-and-lightning-damage-to-electronics/#:~:text=The%20energy%20from%20a%20nearby,the%20foundation)%20(NWS)

https://www.bereadylexington.com/lightning/#:~:text=Between%202004%20and%202013%2C%20the,recorded%20between%202003%20and%202012

https://www.weather.gov/lmk/lightning_safety