Insurance Content Navigation

- Does Car Insurance Cover Tornado Damage in Kentucky?

- Do I Need Full Coverage to Be Insured against a Tornado?

- What Does Car Insurance Cover in Kentucky?

- Tornado Stats for Kentucky

- Are My Belongings inside My Vehicle Covered against a Tornado?

- Are There Any Other Polices That Can Provide Additional Coverage?

- Here’s How a Kentucky Independent Insurance Agent Can Help

You want your car to be protected against all threats, not just irresponsible drivers on the road. This also means every kind of natural disaster, from wildfires to hurricanes and even tornadoes. Fortunately, there’s a kind of Kentucky car insurance that can help.

Better yet, a Kentucky independent insurance agent can help you get equipped with the right kind of car insurance to protect against these specific perils and more. But first, here’s a deep dive into car insurance in Kentucky and when it covers certain disasters, like tornadoes.

Does Car Insurance Cover Tornado Damage in Kentucky?

That mainly depends on which type of car insurance you purchased. If you added comprehensive coverage to your car insurance policy, your vehicle will be protected against tornado damage, in addition to many different natural disasters and other perils. That’s why it’s a good idea to always shop for coverage with the help of a Kentucky independent insurance agent. They’ll ensure you don’t have any gaps in coverage that could end up hurting you further down the road.

Do I Need Full Coverage to Be Insured against a Tornado?

Technically, the term “full coverage” isn’t a real one in the insurance industry. According to insurance expert Paul Martin, when folks ask for “full coverage,” what they really want is complete protection for their vehicle. But depending on the individual and the insurance company, this can include a different combination of coverages.

Rather than worrying about “full” coverage, instead look into getting comprehensive coverage for your vehicle. This is the only type of car insurance that will reimburse you for damage to your vehicle caused by a tornado. If you have any further questions about which type of coverage you need to be protected against tornadoes, enlist the help of a Kentucky independent insurance agent.

What Does Car Insurance Cover in Kentucky?

While you can choose from several kinds of car insurance policies no matter where you live, each state has its own set of requirements for minimum coverage. All drivers on the road in Kentucky are legally obligated to carry the following:

- Bodily injury liability insurance: Protects you against lawsuits for bodily injury claims made by third parties.

- Property damage liability insurance: Protects you against lawsuits for property damage claims made by third parties.

- Personal injury protection: Protects you and your passengers after an accident by covering the medical treatment costs for any injuries.

A Kentucky independent insurance agent is your greatest ally when it comes to finding the right kind of car insurance coverage to meet your needs and eliminate your stress behind the wheel.

Tornado Stats for Kentucky

When thinking of the protection your vehicle needs, tornado damage coverage might not be one of the first things that comes to mind. But tornadoes occur more frequently than you may think, and it’s important to be prepared for them no matter where you are. Check out some eye-opening tornado stats and see for yourself.

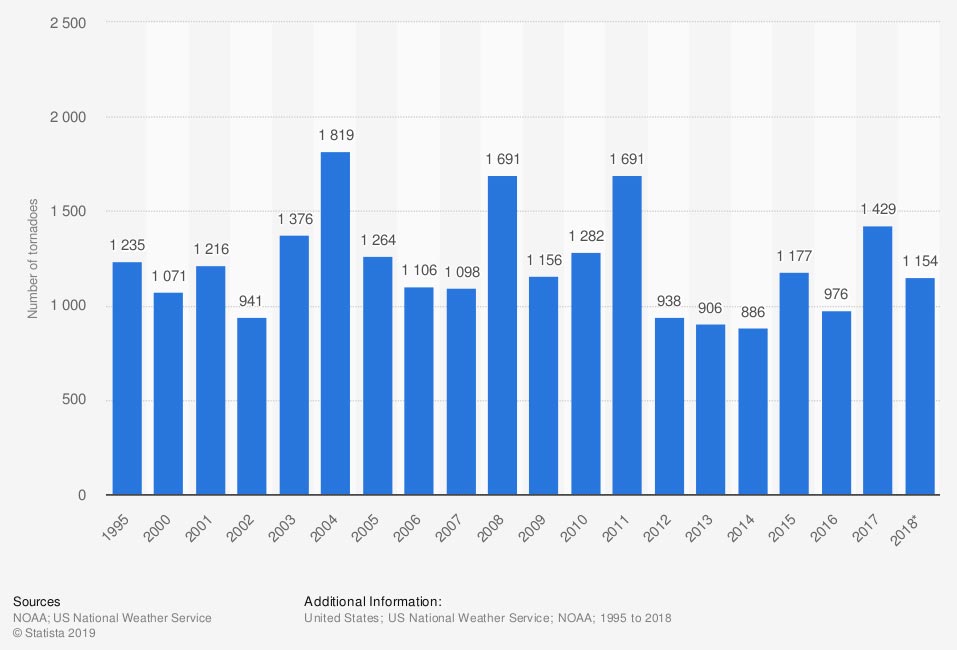

Number of tornadoes in the United States from 1995 to 2020

Over the past couple of decades, the US was hit by more than 1,000 tornadoes nearly every year. The peak number of reported tornadoes in the observed period occurred in 2004, with 1,819 disasters on record. As of 2020, this number had dropped a bit, to 1,248.

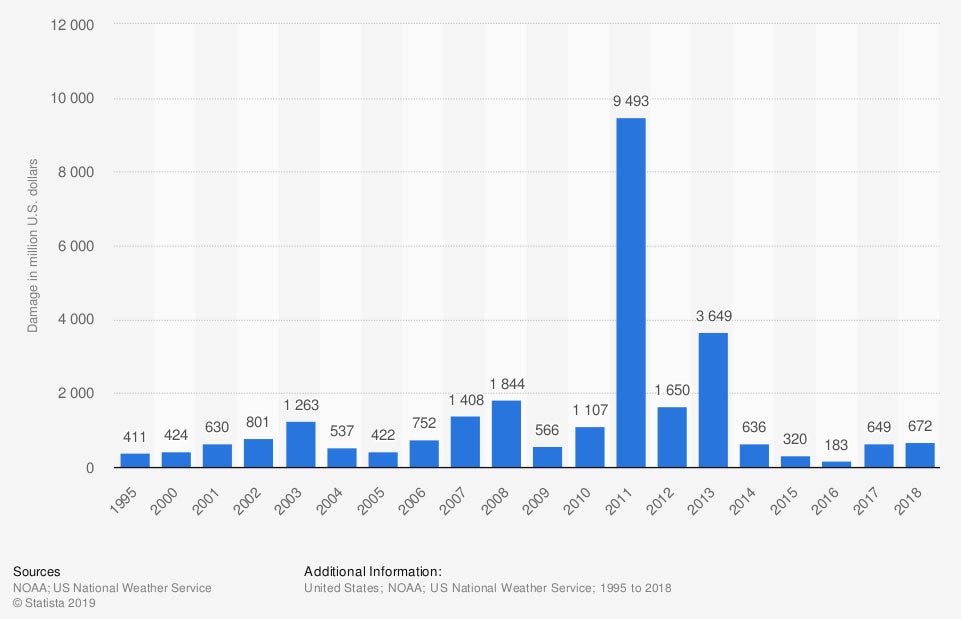

Economic damage caused by tornadoes in the US from 1995 to 2019 (in million US dollars)

Tornadoes are not only destructive and deadly, they’re also extremely costly to clean up after. In 2011, tornado damage in the US hit a high of $9.49 billion. As of 2019, tornado damage was still extremely costly, at a reported $3.1 billion.

Knowing the frequency and extreme cost of tornadoes and their damage in the US, it’s crucial to work with a Kentucky independent insurance agent to get the right coverage for your vehicle.

Are My Belongings inside My Vehicle Covered against a Tornado?

According to Martin, unfortunately, the answer is no — at least, not under your car insurance policy. However, your homeowners insurance does cover belongings stored in your car, though most likely at a lower limit than what you keep inside your home. Also note that you’ll have to pay the deductible on your homeowners insurance’s personal property coverage section before reimbursement for the damaged or lost items kicks in.

Are There Any Other Policies That Can Provide Additional Coverage?

Yes, there are other types of car insurance available in Kentucky that can provide you with additional coverage during tornadoes and more. Here are a couple of common options:

- Collision coverage: Protects you if you get into a collision with your vehicle. If a tornado tosses your car into another car or piece of property, collision coverage can help.

- Uninsured/underinsured motorist coverage: Protects you if you get into an accident with a driver that lacks adequate car insurance. If a tornado causes you to collide with an uninsured driver, this coverage can help.

A Kentucky independent insurance agent can help you get set up with all the car insurance you need to cover you and your vehicle from all angles. They’ll be able to answer any remaining questions you may have about coverage for tornado damage, as well.

Here’s How a Kentucky Independent Insurance Agent Can Help

When it comes to protecting Kentucky drivers against costly tornado damage and all other perils, no one’s better equipped to help than an independent insurance agent. Kentucky independent insurance agents search through multiple carriers to find providers who specialize in car insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

chart 1 - https://www.statista.com/statistics/203682/number-of-tornadoes-in-the-us-since-1995/

chart 2 - https://www.statista.com/statistics/237409/economic-damage-caused-by-tornadoes-in-us/

iii.org

© 2024, Consumer Agent Portal, LLC. All rights reserved.