Storms are stressful enough on their own, but even more so when you’re left to clean up the damage all by yourself. It’s important to be familiar with what your homeowners insurance covers in relation to storms before one ever crosses your path.

Fortunately a Kentucky independent insurance agent can not only explain what homeowners insurance covers, but also help you find the right policy for your needs. But first, here’s a closer look at home insurance and if it covers tree removal after a storm.

What Is Storm Insurance?

The term “storm insurance” often refers to “wind only” policies, said insurance expert Paul Martin. Kentucky homeowners insurance policies include protection for windstorm damage and hail already, but in some areas, an additional wind only policy is required.

Storm insurance increases a specific kind of protection for your home that surpasses standard homeowners insurance limits. Only specific states require storm or wind coverage by law, and Kentucky isn’t one of them.

What Does Storm Insurance Cover?

Certain states exclude windstorm coverage from homeowners insurance, since these areas are at a notoriously high risk of hurricanes and other storms. In these states, you can buy optional windstorm policies to protect your home. However, in Kentucky, this additional coverage isn't required.

What’s Not Covered by Storm Insurance?

Windstorm only, or "storm insurance," doesn’t cover anything beyond what the name suggests. This coverage is only available and necessary in select states.

Wind only policies won’t cover damage to your house caused by other disasters like fire, vandalism, etc. It also won’t cover you for liability incidents, stolen property, and more.

Which Storms Cause the Most Damage?

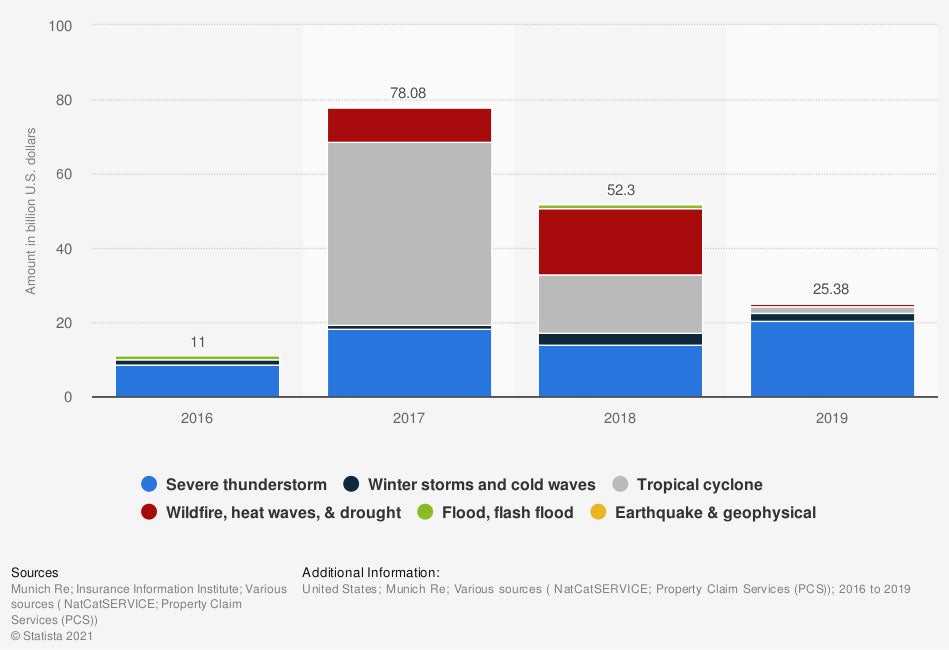

When considering purchasing additional storm insurance, it’s helpful to know which natural disasters are the costliest for residents in the US. Check out the chart below to help make your decision.

Estimated insured losses due to natural disasters in the United States, by type

At the end of the observed period, severe thunderstorms caused by far the most insured losses, at a total of $20.3 billion. Winter storms and cold waves came in second place, causing $2.1 billion in insured losses.

Since severe thunderstorms often bring strong winds and sometimes hail, having storm insurance can be beneficial no matter where your home is located in the country.

Does Home Insurance in Kentucky Cover Tree Removal after a Storm?

Yes, Martin said, a portion of homeowners insurance is called “tree damage cleanup.” This coverage pays for the removal of trees and shrubs that fall on insured structures after a storm. Coverage also pays for the necessary repairs and debris cleanup of what’s left behind. Replacement of lost trees and shrubs is in some cases reimbursed, if their loss was due to a covered cause.

Does Kentucky Homeowners Insurance Cover Roof Damage after a Storm?

Your homeowners insurance includes damage to the structure or dwelling of your home for covered losses. Natural disasters, aside from flooding, fall into the covered perils list on standard home insurance policies. If your roof gets damaged by a storm other than flooding, your home insurance should reimburse for the damage up to the policy’s limit in the dwelling category.

Common Insurance Claims for Storm Damage

Storms can cause homeowners and insurance companies alike tons of headaches. Here’s a quick peek at some of the most common insurance claims for storm damage.

- Damaged roofs: One of the first parts of the home to get damaged during a storm is often the roof. Fortunately homeowners insurance can help pay for roof repairs following many kinds of storms.

- Damaged detached structures: Detached, yet insured, structures like external sheds are also especially vulnerable to storm damage, whether it’s by lightning strikes or fallen trees. Luckily homeowners insurance often covers these structures, too.

- Damaged windows: Windows are easily damaged or shattered by many types of storms, especially if they involve strong winds. Fortunately your homeowners insurance should include window repair or replacement due to covered storms as well.

A Kentucky independent insurance agent can list even more common storm insurance claims, and help your home get equipped with all the homeowners and storm insurance it may need.

Here’s How a Kentucky Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect homeowners against commonly faced disasters. Kentucky independent insurance agents shop multiple carriers to find providers who specialize in storm insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

https://www.statista.com/statistics/251219/estimated-insured-losses-due-to-natural-disasters-in-the-united-states/

https://www.iii.org/article/if-a-tree-falls-on-your-house-are-you-covered

© 2024, Consumer Agent Portal, LLC. All rights reserved.