No one wants their windows smashed by anything, let alone a stray golf ball. Unfortunately though, it happens, and you can’t always identify where it came from. So what if a mysterious golf ball does break your window? Who’s responsible for this mess, anyway?

Fortunately a Kentucky independent insurance agent can help you answer this question and find the right homeowners insurance. They’ll get you protected against stray golf balls and much more. But to start with, here’s how homeowners insurance would help in this case.

Who’s Responsible If a Golf Ball Smashes Your Window?

Sadly, it’s probably not going to be easy to identify the party that’s really responsible if your Kentucky home gets a golf ball through the window. But the good news is that your Kentucky homeowners insurance should cover you either way.

If you find a new golf ball on your floor next to some shattered glass, it’s a good idea to go ahead and file a claim through your homeowners insurance. Your Kentucky independent insurance agent can help walk you through the process.

Would I Ever Be Found Responsible in This Case?

According to insurance expert Paul Martin, if you choose to live on or close to a golf course, you assume extra risk in doing so. Therefore you could be found responsible for any damage golf balls cause to your home. Many insurance companies will specifically exclude this type of coverage if the homeowner lives on a golf course, so keep that in mind when you’re house hunting.

If It’s on Me, How Much Would I Have to Pay?

Unless you do live on a golf course, you shouldn’t be responsible for the costs to repair your home after an incident like this. You would be responsible for paying your homeowners insurance’s deductible yourself, and after that, your policy should kick in to reimburse for the rest, up to its limit.

Sometimes property damage isn’t worth filing a claim through insurance, since it won’t amount to a value higher than your policy’s deductible. It’s up to you to determine if it’s worth it. If you’re unsure, your Kentucky independent insurance agent can help you figure it out.

A Look at the Growing Golf Industry

Unfortunately for your windows, the golfing industry is continuing to grow across the country. Here’s a quick look at some stats for the golf industry’s growth in the US overall.

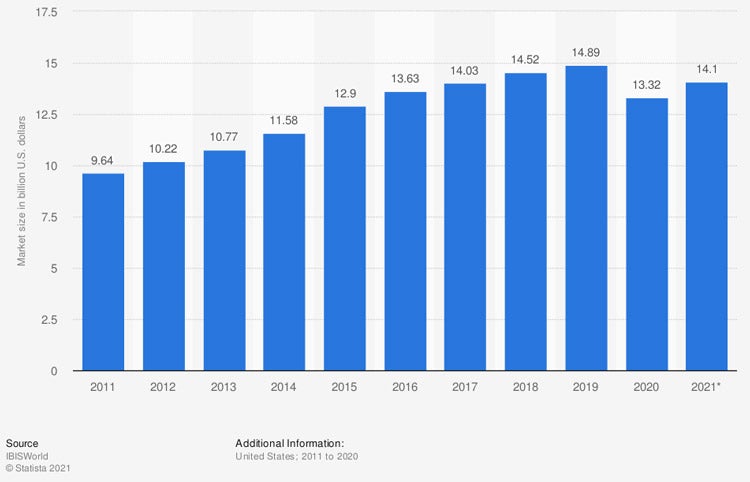

Market size of the golf driving ranges & family fun centers industry in the US

For the past decade, golf driving ranges have exceeded $10 billion in annual revenue. By the end of the observed period, revenue had risen to $14.1 billion per year, up from $9.64 at the beginning of the study.

With golf continuing to become a bigger industry, that means more chances that one day you’ll find a new accessory on your floor. Speak with your Kentucky independent insurance agent today to help get prepared.

What Does Homeowners Insurance Cover in Kentucky?

Beyond potential property damage caused by flying golf balls, your Kentucky homeowners insurance covers many things, like:

- Contents coverage: Your personal belongings like clothing are covered against many disasters like fire and theft.

- Additional living expenses: Your policy provides coverage for extra costs if you must live somewhere outside your home while awaiting repairs.

- Structural coverage: Your home’s structure or dwelling is also covered against several disasters like fire, vandalism, and more.

- Liability coverage: Your policy protects you from third-party lawsuits by reimbursing for legal costs.

Your Kentucky independent insurance agent can help review your homeowners insurance policy with you and show you all the areas where you have coverage.

What’s Not Covered by Kentucky Homeowners Insurance?

Your Kentucky homeowners insurance offers you a ton of critical protection, but it doesn’t cover just anything. Your policy probably excludes the following:

- Home-based business costs

- Earthquake damage

- Routine maintenance costs

- Natural flood damage

- War or nuclear fallout damage

- Insect damage and infestations

If you’re concerned about any of your policy’s exclusions, be sure to talk to your Kentucky independent insurance agent. They may be able to help you secure additional coverage.

Here’s How a Kentucky Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect homeowners against commonly faced disasters. Kentucky independent insurance agents shop multiple carriers to find providers who specialize in homeowners insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

https://www.statista.com/statistics/1174931/driving-ranges-family-fun-centers-market-size/

© 2024, Consumer Agent Portal, LLC. All rights reserved.