While you may have heard that many factors can contribute to an increase in your car insurance rates, you may be relieved to know that there are plenty of ways to reduce them, too. Being familiar with how to lower your car insurance premiums can help save you money and stress.

A Kentucky independent insurance agent can not only help you find the right car insurance for your needs, but can also provide you with tips on how to save on your premiums. But before we jump too far ahead, here’s a behind-the-scenes look at how to reduce your car insurance rates.

How Much Is Car Insurance in Kentucky?

Before shopping for Kentucky car insurance, it’s helpful to know some average costs in your area. Check out some figures for car insurance rates in Kentucky below, versus the US overall.

- The average cost of car insurance in Kentucky is $1,341 annually.

- The average cost of car insurance in the US is $1,311 annually.

- Kentucky ranks #21 for most expensive car insurance rates in the country.

To find out more exact quotes for car insurance in your town, a Kentucky independent insurance agent is your greatest ally.

What Are Some Factors That Influence My Rates?

Like many other types of insurance, car insurance costs are calculated by factoring in several details. Some of the most common factors that go into determining your car insurance rates are:

- Your vehicle’s type and value: More valuable, newer vehicles would be more expensive to replace, and are therefore often more expensive to insure.

- How often you drive it: You can often save a lot on your car insurance if you spend less time on the road, and the inverse is also true.

- Your driving history: If you’ve got a clean record with no history of accidents or traffic violations, you can save quite a bit on your coverage.

A Kentucky independent insurance agent can help you review all the specific factors that will determine your car insurance rates.

How Can I Lower My Car Insurance Rates in Kentucky?

Many car insurance companies offer various discounts to help you save on your coverage. But even if you didn’t qualify for these discounts when first signing up for coverage, you might later on down the line. Here are just a few ways to save money on your car insurance.

- Bundle car and home insurance: One of the most common bundling discounts is for home and auto insurance together through the same insurance company, but you may have the option to bundle car insurance with many other types of coverage.

- Complete a defensive driving course: Car insurance companies may offer you a discounted rate if you complete a state-approved defensive driving course.

- Keep a clear record: The cleaner your driving record, the more money you stand to save over time if you avoid accidents and traffic violations.

A Kentucky independent insurance agent can advise on even more ways to save money on your car insurance.

Your Age Also Impacts Your Car Insurance Rates

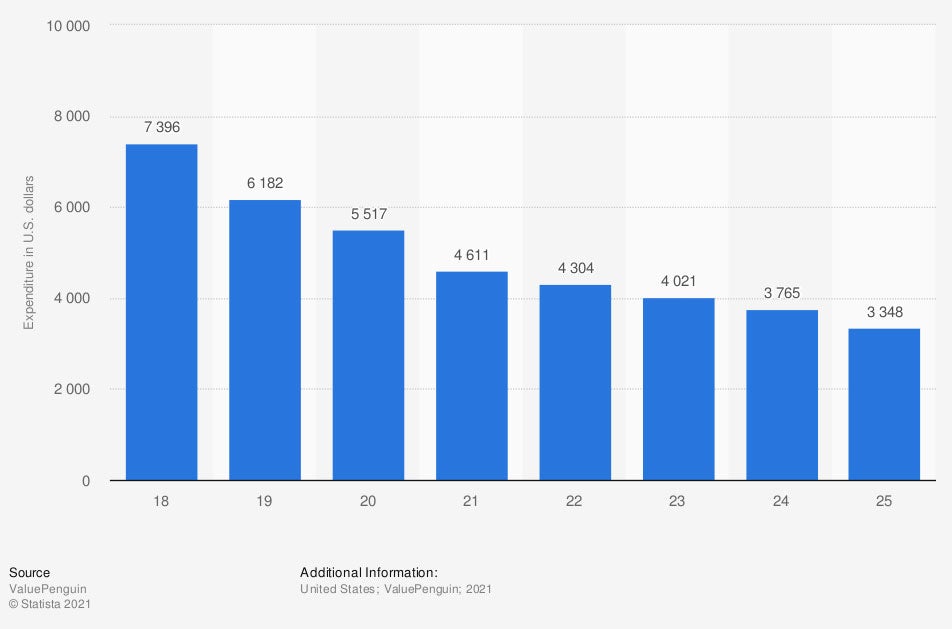

While some factors that impact your car insurance premiums are obvious, some may be less apparent. Your age is a big factor that influences your car insurance rates. Check out some stats for car insurance rates by age below and see for yourself.

Average auto insurance expenditure in the US, by age

After age 25, drivers tend to pay much less for car insurance. In recent years, 18-year-olds paid much more, an average of $7,396 annually for car insurance. In that same period, 25-year-olds paid about half of what their younger counterparts did, at about $3,348 per year.

With a few years of experience under their belt, drivers are seen by insurance companies as less risky to insure. Drivers in their mid-20s are also much less likely, statistically speaking at least, to get into an accident.

Will My Safe Driving Record Improve My Rates?

Yes, according to insurance expert Jeffery Green, one of the easiest ways to reduce your car insurance rates is to maintain a safe driving record. Without any accidents or traffic violations, your car insurance company will see you as less of a risk, and reward you for it with cheaper premiums.

It’s not necessary to switch your car insurance policy to start saving money, either. Your insurance company may offer you loyalty or renewal discounts over time for sticking with them. A Kentucky independent insurance agent can help provide even more tips for improving your car insurance rates.

Here’s How a Kentucky Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to help drivers reduce their car insurance premiums. Kentucky independent insurance agents shop multiple carriers to find providers who specialize in car insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

https://www.statista.com/statistics/555827/auto-insurance-costs-usa-by-age/

https://www.iii.org/article/what-determines-price-my-auto-insurance-policy

https://www.iii.org/fact-statistic/facts-statistics-auto-insurance

© 2024, Consumer Agent Portal, LLC. All rights reserved.