No one wants disaster to strike their happy place. Unfortunately incidents like fires can happen to your home, even when you’re not covered by insurance. Unexpected disasters like this make having the right homeowners insurance crucial.

Fortunately a Kentucky independent insurance agent can help you get equipped with adequate homeowners insurance, even if you’ve already had a house fire. They’ll get you set up with coverage before you need to file another claim. But first, here’s a closer look at home insurance and how to get covered after a fire.

What to Do after a House Fire with No Insurance in Kentucky

Even if you’re not currently protected by a Kentucky home insurance policy, there are a few important steps that need to be taken after a house fire.

Follow these quick action steps after a house fire:

- Tend to any injuries: Your main priority after a house fire is tending to any injuries, including your own, your family’s, and those of any guests or workers on your property.

- Document property damage: After a disaster like a fire, it’s important to go around and document any physical damage to your home through photos or videos, but not until your property’s been professionally inspected and declared safe to enter.

- Determine the cause of the fire: Pinpoint the cause of the fire, if possible, to determine if you might have the right to sue a third party for negligence.

- Seek outside help: You might be in need of extra assistance or temporary shelter, especially if you lack homeowners insurance, after a house fire. Local organizations like the Red Cross can help.

Without the right homeowners insurance, you could be stuck paying out of your own pocket for damage to your home after a fire. That’s why having coverage is so critical.

Can I Get Home Insurance after a House Fire?

Typically, yes, you should be able to get home insurance after a house fire, according to insurance expert Jeffery Green. However, your new policy wouldn’t cover a fire that already happened on your property. Having a new policy in place would protect you from future incidents and losses, though.

When Can You Get Insurance after a House Fire?

Unless your home has a history of fires and other disasters, you should be able to get home insurance right away after a fire. Home insurance companies may decline to offer you coverage if your property has a history of being risky to insure.

A new home insurance policy would be active right away, or after you’ve made your first payment. Working together with a Kentucky independent insurance agent is a great way to get coverage fast.

House Fire Costs

Without home insurance, you could be stuck paying thousands of dollars or more out of your own pocket after a house fire. These house fire cost stats might further inspire you to seek out coverage.

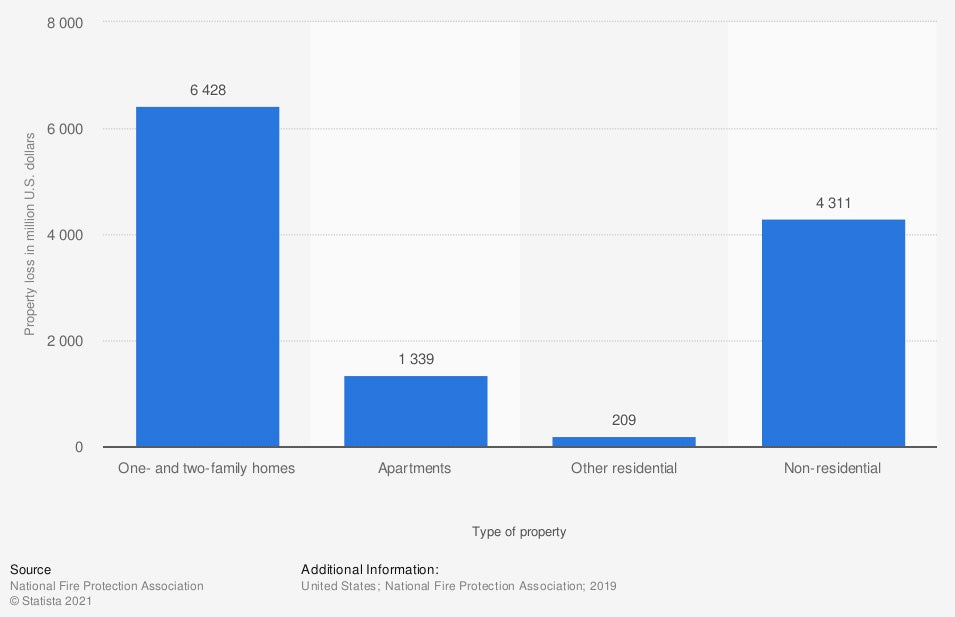

Property loss due to fires in the US, by property use

In one recent year, one-family and two-family homes with house fires saw losses totaling $6.4 billion. Apartment fires caused $1.3 billion in losses, and fires in other residential structures totaled $209 million.

About 481,500 structural fires happen every year, causing $12.3 billion in total damage. Since house fires are not only common, but extremely costly, it’s imperative to consider getting set up with a home insurance policy ASAP.

Difference Between Owning Home Insurance and Not Owning Insurance in Case of House Fire

Without insurance, after a huge incident like a house fire, you could end up bankrupt, or even worse, homeless. Home insurance offers coverage reimbursement for fire, one of the most common incidents, and much more.

Home insurance also provides additional living expenses coverage if you need to live somewhere else while waiting for repairs to your home after a fire. If you lack coverage, you’re responsible for paying all these costs out of your own pocket.

When Won't Home Insurance Cover a House Fire?

If a fire is caused by a non-covered peril, like certain kinds of explosions, war damage, or nuclear fallout, it won't be covered by a home insurance policy. Homeowners insurance also typically doesn’t cover fires caused by arson, or other intentional or malicious acts.

In some cases, fires that stay within their intended realm, such as a fireplace, are not covered either. A Kentucky independent insurance agent can clarify which exact causes of fire are covered under standard home insurance.

Here’s How a Kentucky Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect homeowners against commonly faced liabilities. Kentucky independent insurance agents shop multiple carriers to find providers who specialize in home insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

https://www.statista.com/statistics/374819/us-fire-statistics-property-loss-due-to-fire-by-property-use/

https://www.iii.org/fact-statistic/facts-statistics-homeowners-and-renters-insurance

© 2024, Consumer Agent Portal, LLC. All rights reserved.