Leaving the scene of a car accident in Kentucky can result in hefty fines and even jail time. But what happens if you're the person that is left at the scene? Will your Kentucky car insurance pay for the damage?

To better understand your car insurance coverage and what you need in order to be protected in a hit and run, it helps to work with a Kentucky independent insurance agent. Agents can answer any questions you have and make sure your auto insurance is equipped with the coverage you need to protect you in any event, including the other driver leaving the scene after an accident.

Who Pays for Damage If an At-Fault Driver Leaves an Accident?

A hit-and-run accident is when a driver fails to stop at an accident scene in which a person is involved and avoids the consequences of the crash, regardless of fault. This means that the person left at the scene is responsible for the damage, even if they're not the person who caused the accident.

Fortunately, even if you're involved in a hit and run, you can file a claim with your auto insurance. This can be done through your independent insurance agent or by contacting your insurance carrier directly. You also want to call the police and provide them with any information you gathered about the person who hit you. A license plate is ideal, but even the make and model of the vehicle help. If the police can find them, they can be charged with leaving the scene of an accident.

What Does Kentucky Car Insurance Cover?

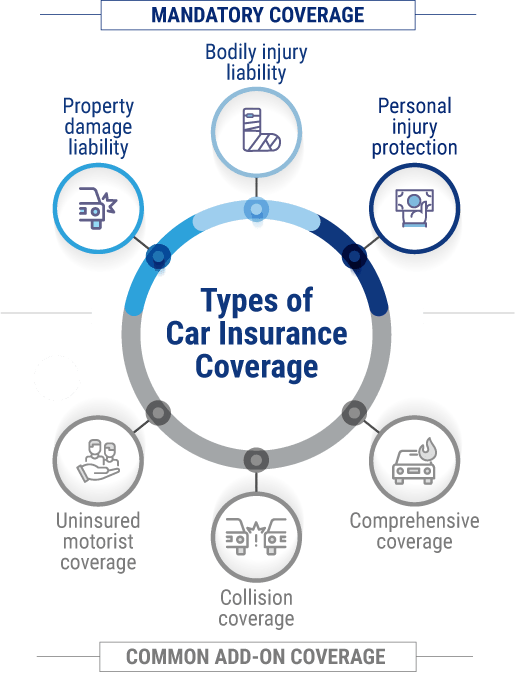

It is illegal to operate a vehicle in Kentucky without proper insurance. By law, you're required to have the minimum liability coverage, which includes bodily injury, property damage, and personal injury protection in the following amounts:

- Bodily injury liability: $25,000 per person and $50,000 per accident

- Property Damage liability: $25,000 per accident

- Personal injury protection (PIP): $10,000 per person per accident

These basic coverages protect drivers in the following ways:

- Bodily injury liability: If you cause an accident in Kentucky, bodily injury liability will help pay for medical bills associated with injuries to the other driver and passengers. It will also pay for legal and court fees if you're sued.

- Property damage liability: This will pay for any damage you cause to someone else's property, including their vehicle if you cause an accident.

- Personal injury protection (PIP): Helps pay for personal medical expenses whether you were the at-fault driver or not.

In addition to the required minimums, Kentucky drivers can add the following common coverages to their policy:

- Collision coverage: This covers the cost to repair or replace your vehicle if it is damaged or totaled in a collision, regardless of fault.

- Comprehensive coverage: This covers the cost to repair or replace your vehicle if it is damaged or totaled by a non-collision event such as a hailstorm or theft.

- Uninsured motorist coverage: Uninsured motorist coverage is not required in Kentucky but must be denied in writing if you don't want it, to ensure that nobody overlooks it by accident. Uninsured motorist coverage will pay for any personal injuries and damage your vehicle sustains in an accident with an uninsured or underinsured driver.

A Kentucky independent insurance agent can ensure that you have the minimum required coverage and any additional policies you may need to round out your auto insurance policy.

Are You Responsible for Paying a Deductible in a Hit-and-Run Accident?

Anytime you file a claim with your insurance, you need to meet your deductible before your insurance policy starts paying towards the claim. This doesn't change based on the type of accident or the reason for filing the claim. Knowing that you always need to meet your deductible first could impact choosing a high or low deductible when building your auto policy.

You'd first turn to your uninsured motorist policy to cover the damage in a hit-and-run accident. If you don't have uninsured motorist coverage, you can file the claim under your collision policy. Typically, collision deductibles are higher than uninsured motorist deductibles, so starting with the lower deductible policy is ideal.

What Is No-Fault/PIP Coverage and Is Kentucky a No-Fault State?

A no-fault state means that each driver is responsible for filing a claim with their insurance after an accident, regardless of who is at fault. Likewise, this means that every driver is responsible for insuring themselves.

Kentucky is a no-fault state, so in an accident, including a hit and run, you would file a claim with your insurance for any injuries and damage sustained in the accident. This is why no-fault states require personal injury protection so that you have coverage for medical expenses, lost wages, and other associated costs after an accident. However, property damage is based on who was responsible for the accident.

If you were hit by another driver in Kentucky and sustained personal injuries and damage to your vehicle, you'd file a claim with your auto insurance for both the damage to your vehicle and your injuries. Your PIP coverage would pay for the injuries, but your insurance would work with the at-fault driver's insurance to pay for the damage to your vehicle.

Will My Rates Increase Even If the Crash Isn’t My Fault?

Unfortunately, filing a claim with your auto insurance is likely to increase your premium. Rate increases are typically based on the size of the claim and the amount of money the insurance company has to pay out.

Your Kentucky independent insurance agent can talk with you about rate increases in Kentucky and what that may look like after a claim. An agent can also help you shop policies and discounts if your rates increase and you need to change carriers.

What Are the Charges in Kentucky If a Driver Commits a Hit and Run?

Leaving the scene of an accident in Kentucky is considered a Class A misdemeanor. If death or serious injury is involved, the charge can be elevated to a Class D felony.

Leaving the scene of an accident with another person or unattended property could result in the following charges in Kentucky:

- Class A misdemeanor penalties: If a person leaves the scene of an accident and causes minor injury or property damage, the punishment is up to 1 year in jail and a maximum monetary fine of $500.

- Class D felony penalties: If a person leaves the scene of an accident that results in a death or serious injury and the person knew or should have known of the death or serious physical injury, the punishment is up to a 1 to 5-year prison sentence and a monetary fine of up to $10,000.

- Hit-and-run conviction: Six-point infraction on the driver's license and possible cancellation of vehicle insurance.

How Can a Kentucky Independent Insurance Agent Help?

Being involved in a hit-and-run accident can leave you wondering what to do next and who will pay for the damage to your vehicle. A Kentucky independent insurance agent understands the ins and outs of car insurance and knows the coverage you need in order to be protected against any unexpected events.

Agents will work with you, free of charge, to assess your current coverage or find you new coverage that meets the state's requirements and protects you while you're on and off the road.

Article Reviewed by | Paul Martin

https://www.lexingtondefense.com/hit-run/

https://drive.ky.gov/motor-vehicle-licensing/Pages/Mandatory-Insurance.aspx

https://insurance.ky.gov/ppc/newstatic_info.aspx?static_id=24

https://www.alllaw.com/articles/nolo/auto-accident/who-pays-hit-run.html