Hail is an unfriendly weather pattern that can leave your vehicle with dents, scratches, and broken glass. A really bad hailstorm could result in thousands of dollars in damage or even total your vehicle. So what happens if a nasty hailstorm damages your car? Does your car insurance step in?

Fortunately, a Kentucky independent insurance agent can help you understand the relationship between car insurance and hail damage. Your car insurance will cover hail, but there are some caveats that we discuss below.

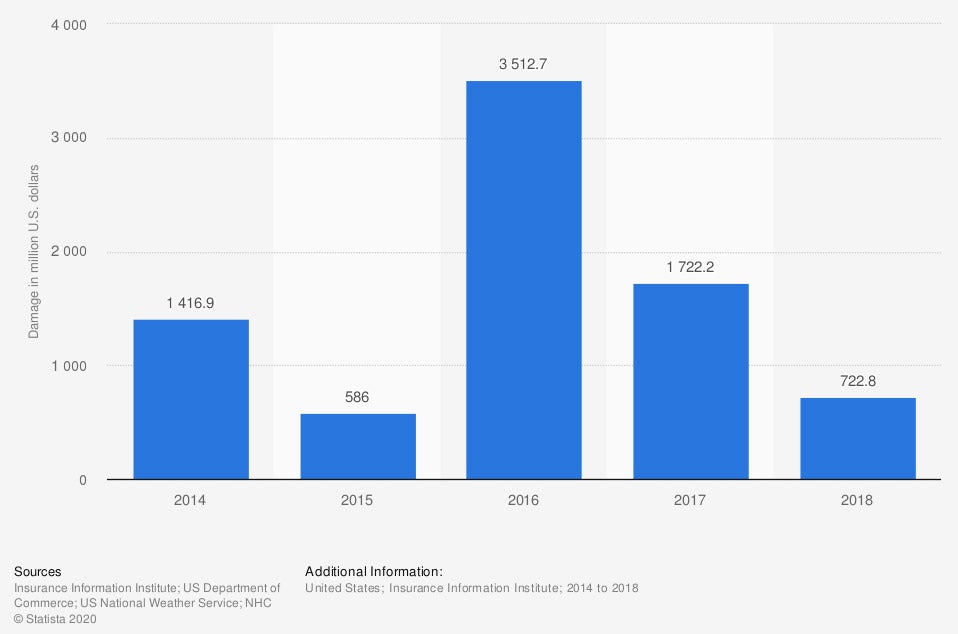

Property damage from hail in the United States from 2014 to 2018 (in million US dollars)

Property damage in 2018 equaled $722 million across the US, including damage to vehicles.

Q. What Does Car Insurance Cover in Kentucky?

Every state has a minimum amount of coverage that is required for all drivers. In Kentucky, a general car insurance policy that includes only the minimum state-mandated coverage will cover the following.

- Bodily injury liability: Pays for any medical bills or legal fees if you're in an at-fault accident and the other driver is injured.

- Property damage liability: Pays to repair or replace damaged property if you're in an at-fault accident. This includes a third-party vehicle or property like a fence or mailbox.

- Personal injury protection: Pays for medical bills and even funeral expenses for you and your passengers if you're in an accident, regardless of who is at fault.

In Kentucky, drivers must purchase the minimum amounts of these coverages, which is $25,000 per person bodily injury/$50,000 per accident bodily injury/$25,000 per accident property damage.

Even though the above coverages are what's required, all drivers have the opportunity to purchase additional coverage for further protection. Some of the most common additional coverages include:

- Collision insurance: Pays to repair or replace your vehicle when you're in an at-fault accident or if you collide with an object.

- Comprehensive insurance: Often referred to as "other than collision" insurance, comprehensive pays for scenarios that collision insurance wouldn't cover, such as hail damage, theft, vandalism, or running into a wild animal.

- Uninsured/underinsured motorist insurance: Helps pay for the cost of an accident if you're hit by a driver that does not have sufficient auto insurance. In Kentucky, 11.5% of drivers don't have insurance, so uninsured motorist coverage is worth looking into.

An independent insurance agent in Kentucky can help you determine which types of coverage are best for your unique needs.

Q. What Doesn't Kentucky Car Insurance Cover?

If you purchase the minimum required car insurance and you're in an accident where you're at fault, any damage done to your vehicle or your personal property will not be covered. You must purchase collision insurance if you expect your car insurance to pay for damage to your vehicle in an at-fault accident. The minimum requirements will also not include coverage if your vehicle is vandalized or stolen.

Assuming you've purchased beyond the minimum requirements and you have a fairly comprehensive car insurance package, you'll be well covered against a variety of perils and risks. However, there are always exceptions that are important to know.

- Driving for business reasons: If you're using your vehicle for business purposes or for ridesharing, like driving for Uber or Lyft, you'll most likely need to secure additional coverage.

- Normal wear and tear: Insurance won't cover damage that results from normal wear and tear, like mechanical issues or broken glass.

- Personal possessions: If your bike is stolen out of your vehicle, it won't be covered by auto insurance. Most of the time, personal property is covered under a homeowners insurance policy or renters insurance policy.

- Nuclear accidents: Damage caused by nuclear accidents, war, or other catastrophic events is not typically covered by car insurance.

- Intentional damage: Any intentional damage or damage caused by things like racing will not be covered.

Your independent insurance agent can help you understand what is and is not covered by your car insurance package in Kentucky.

Q. Does Car Insurance Cover Hail in Kentucky?

Car insurance in Kentucky may cover hail damage if you've purchased the proper insurance coverage.

Hail is typically covered under comprehensive insurance. According to insurance expert, Paul Martin, hail is considered an "other than collision" loss, which is why you would need to add comprehensive insurance to your policy in order for hail to be covered. A good way to think of comprehensive coverage is coverage for damage that occurs where you don't have control over the incident. This includes hailstorms, hitting a wild animal, or if a missile falls from the sky and lands on your vehicle.

"If you do not have comprehensive insurance, you can usually claim hail on your collision insurance," says Martin. "However, most collision insurance has a higher deductible than comprehensive policies so it's best to claim hail damage under your comprehensive policy."

Why you should consider car insurance that covers hail in Kentucky

Car damage as a result of hailstorms in Kentucky

- Bowling Green Hailstorm - 1998 - $500 million in damage, 4,000 vehicles damaged

- Pre-Derby Hail Storm - 1996 - $20 million in damage, more than 100 claims related to car and home damage

- Warren and Marion-Washington Hailstorm - 1995 - $5 million in damage, $50,000 in car and window damage

- Breckinridge County Hailstorm - 2000 - $15,000 in property damage, including vehicle damage

- Valley Station Hail Event - 2001 - $5,000 in property damage, including vehicle damage

Q. How Much Does Car Insurance in Kentucky Cover?

Any covered claims on your insurance will be paid up to your policy limits. Most comprehensive coverage limits do not exceed the cash value of your vehicle. If your car is worth $12,000 and that is the maximum your policy will pay, then it would cover up to $12,000 in covered damage under your comprehensive policy.

Before your policy will pay out a claim, you must meet your policy deductible.

Q. Does Kentucky Car Insurance Cover a Disaster?

Most disasters that you might encounter in Kentucky will be covered under your car insurance package if it includes the minimum required coverages and comprehensive coverage. Whether it's damage from a tornado or rockslide, disasters fall into the "other than collision" category and are covered by a comprehensive policy.

The only damage related to disasters that are not covered are those that are a result of nuclear disasters, war, or other catastrophic events.

Q. Why Work with an Independent Agent in Kentucky?

A Kentucky independent insurance agent can help you get car insurance quotes that will compare the rates for different coverage options. Whether you're looking for a high deductible or low deductible, minimum coverage or a combination of coverages, Kentucky independent insurance agents work with multiple companies to find the best rates. They can help you shop around for a price and policy that fits your budget.

Article Reviewed by | Paul Martin

https://www.weather.gov/lmk/thetoptenhaileventsinthelouisvillecwa

Iii.org

https://www.onlyinyourstate.com/kentucky/ky-disasters/

https://www.statista.com/statistics/1015618/property-hail-damage-usa/

© 2025, Consumer Agent Portal, LLC. All rights reserved.