A quality roof is one of the most important elements of the home to protect against storm damage and more. Unfortunately, individuals who present themselves as roofing contractors aren't always honest or legitimate. That's why it's critical to know how to protect yourself from roofing insurance scams in Kentucky, using this guide as a start.

What Is Roofing Insurance Fraud in Kentucky?

Roofing insurance fraud in Kentucky is similar to this type of scam anywhere else. Basically, someone knocks on your door or otherwise contacts you and claims to represent a roofing business that can help repair your home's roof. The problem is, these shady individuals are out to get your money and never perform the actual service.

Sometimes, however, these scammers actually do work on your roof, and leave you with a shoddy job. They might even cause more damage to your roof on purpose just so they can charge your Kentucky homeowners insurance company in hopes of receiving extra compensation they're not entitled to. Worse yet, sometimes you're actually held responsible for the mess.

Common Roofing Insurance Scams in Kentucky

Knowing the types of roofing insurance scams that happen in Kentucky can help you be prepared to spot the red flags when they arise, and help keep your money in your hands where it belongs. Some of the most common roofing insurance scams in Kentucky are:

- Storm chasers: This type of sketchy roofing contractor quickly visits a town that's just had a major storm that could cause roof damage to many homes. Once they have your attention, the scammer will offer to fix your roof if you just file a claim through your homeowners insurance. They either do some or none of the work, and you're left worse off than before.

- Free inspections: This type of sketchy roofing contractor shows up claiming to have spotted visible damage on your home's roof, and offers to inspect it right then at no charge. They get back to you claiming to have discovered a ton of damage that needs immediate repair. One of their tactics is to complete part of the job and then up their costs before they finish.

- Down payments: This type of sketchy roofing contractor asks for a large down payment check made out to them before they get to work on your roof. After you've paid, the "contractor" is never heard from again. Sadly, the most common folks targeted for this type of scam are homeowners with no mortgage payments and seniors.

Be on the lookout for these illegitimate strategies used by those who claim to be roofing contractors but are really just out to scam you. The more prepared you are from the start, the less chance these dishonest folks have of successfully deceiving you.

Will Homeowners Insurance in Kentucky Pay for a New Roof?

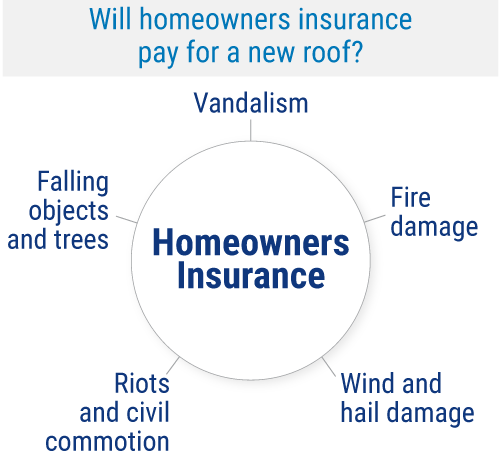

Homeowners insurance in Kentucky does cover repairs and replacements to your roof for a number of covered causes, like:

Knowing that homeowners insurance covers damage to your roof already, roofing scammers try to win you over by bringing up your deductible amount. They claim that all of your repairs will be completed at no cost to you and be completely covered by your insurance company. However, of course you'd still have to pay your deductible amount yourself for roof damage claims, which is part of the deceit.

What Is the Damage of Falling Victim to Roofing Scams in Kentucky?

Falling victim to roofing scams in Kentucky can put you out thousands of dollars, not to mention time lost to a con artist and filing insurance claims. Some scammers charge up to $12,000 or higher for their work, claiming your insurance company quoted $35,000 or more, and often you're held liable to pay it because they've already had you sign a contract. They may even up their costs part way through the scam.

Beyond losing money out of your pocket, you also lose time that could've been dedicated to getting your roof repaired the right way from the start, if it even needed repairs at all. You may also be left with a claim on your homeowners insurance, if the scammer took it that far, for work that didn't get finished or done correctly. If you then have to file another roof repair claim in the future, you might be subject to higher premium rates.

How to Protect Yourself from Roofing Scams in Kentucky

Ensuring you're getting a legitimate contractor to fix your roof starts with a prework interview. It's a safe practice to delay signing any type of contract until you've appropriately evaluated their credentials. Here are nine important things to ask for up front:

- Contact info: Ask for information about the contractor's place of business, phone number, tax ID number, and a copy of their business license.

- Proof of insurance: Ask for proof of contractors liability insurance and workers’ comp from your contractor.

- References and past projects: Ask for the contractor's personal references and a list of past completed projects.

- Proof of license/bond: Ask to see proof of their license or bond before allowing them to start work.

- Written proposal: Ask for a formal written proposal for your roof's repairs and the estimated cost, as well as other details like the time frame for the project and the schedule in which you're expected to pay.

- Proof of associations: Ask if your roofing contractor is a part of any local associations.

- Check for complaints: A quick check on the Better Business Bureau's website can show you if a contractor is legit or has past customer complaints for fraud.

- Supervisor/team details: Ask your contractor who will supervise this project and how many workers will be on the team.

- Roofing warranty: Ask to get a roofing warranty from the contractor and evaluate all the criteria presented beyond just their asking price.

Stay skeptical about contractors that ask for what seems like very little money up front. Those who are illegitimate could just end up demanding more money down the road.

Storms Most Likely to Damage Roofs in Kentucky

Kentucky is prone to strong storms and tornadoes, which can severely damage and destroy roofs. Due to its climate, the state sees strong thunderstorms that bring with them heavy rainfall, lightning, and hail. Kentucky also sits in Tornado Alley, and these storms frequently rip through homes and other structures.

Winter storms and wildfires are also common in Kentucky, and can damage roofs badly. Fortunately Kentucky homeowners insurance covers roof damage due to all these natural perils. A Kentucky independent insurance agent can help you find the right homeowners insurance to protect your roof.

Why Choose a Kentucky Independent Insurance Agent?

Kentucky independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

Kentucky independent insurance agents also have access to multiple insurance companies, ultimately finding you the best home insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

fox4now.com/news/local-news/contractors-promising-a-new-roof-taking-your-rights-and-money-instead

crisisequipped.com/what-natural-disasters-occur-in-kentucky/

forbes.com/advisor/homeowners-insurance/roof-repair-scams/#:~:text=Roof%20repair%20scams%20are%20often,with%20unfinished%20or%20shoddy%20work.

© 2024, Consumer Agent Portal, LLC. All rights reserved.