Insurance Content Navigation

- Average Cost of Flood Insurance in Kentucky

- How Is Flood Insurance Calculated?

- What Does Flood Insurance Cover in Kentucky?

- How Many Flood Insurance Claims Get Filed in Kentucky?

- What Doesn’t Flood Insurance Cover in Kentucky?

- What Additional Coverages Do I Need?

- Here’s How a Kentucky Independent Insurance Agent Can Help

Whether you live on the coast or not, it’s important to have flood coverage to protect your property from one of the costliest natural disasters around. Though flood insurance may not always be cheap, it’s much more affordable than paying out of pocket to rebuild your entire house.

Fortunately Kentucky independent insurance agents can help you find affordable flood insurance in your area. They’ll also be able to tell you all the factors that go into your policy’s premium costs. But before we get too far ahead of ourselves, let’s take a deep dive into flood insurance.

Average Cost of Flood Insurance in Kentucky

The national average cost of flood insurance is around $700 per year, currently. Unfortunately for residents in Kentucky, their premium rates are about 49% higher than the national average, at about $1,095 annually. However, with the help of a Kentucky independent insurance agent, you can still shop around for a policy that best fits within your budget.

How Is Flood Insurance Calculated?

There are a few factors that go into determining a flood insurance policy’s premium cost. The major factors that decide the cost of flood insurance are:

- The amount of coverage purchased

- The type of coverage purchased

- Your location and flood zone

- The design and age of insured structures

A Kentucky independent insurance agent can further explain how these factors influence a flood insurance’s premium. For residents in flood zones, coverage will obviously be more expensive due to a highly increased risk of flooding, or a more established, frequent flooding history in the area.

What Does Flood Insurance Cover in Kentucky?

Flood insurance is necessary because homeowners and renters insurance policies won’t protect your home from natural flood damage. Kentucky flood insurance covers the following:

- Home damage and destruction: Flood insurance provides protection for damage to or destruction of your home’s structure due to natural floodwaters, and sometimes even for detached structures like sheds.

- Personal property damage and destruction: Flood insurance also covers your personal belongings from floodwaters, like furniture, non-built-in appliances, some food, valuables, and clothing.

Some of your property may be reimbursed at its full replacement cost, but some may only qualify for its current value with depreciation factored in. A Kentucky independent insurance agent can help explain further how much your flood insurance policy will pay to repair or replace each type of your property after a natural flood event.

How Many Flood Insurance Claims Get Filed in Kentucky?

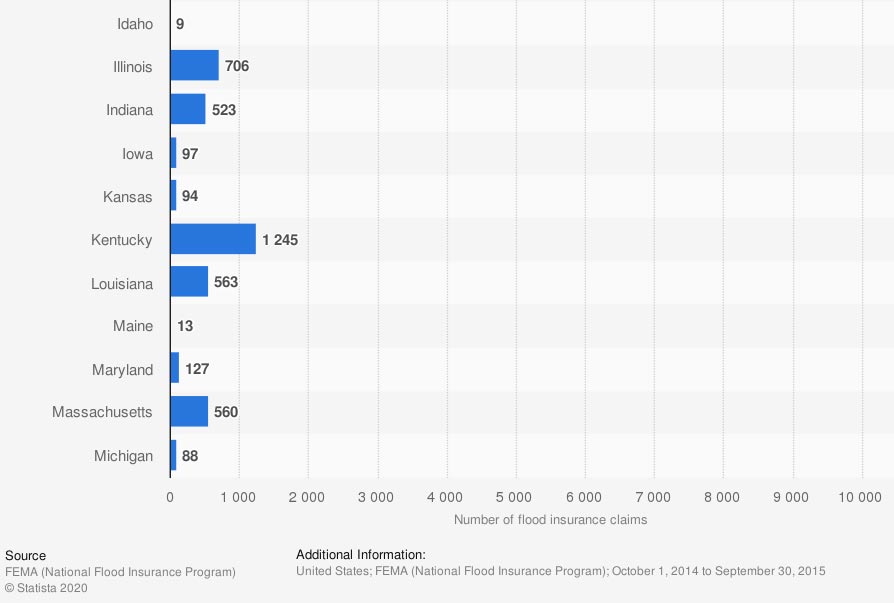

When considering the importance of flood insurance in Kentucky, it’s helpful to compare the frequency of these claims in your state to others. Check out some recent stats below.

Number of flood insurance claims in the US, by state

In one recent year, 1,245 flood insurance claims were filed in Kentucky. This is quite a big difference from states like Kansas, with only 94 claims, and even Indiana, with less than half of Kentucky’s number of claims, at a total of 523.

With such a high frequency of flood insurance claims filed yearly in Kentucky, it’s crucial to make sure that your property is protected by the right coverage.

What Doesn’t Flood Insurance Cover in Kentucky?

Before getting set up with flood insurance, it’s also important to understand what’s not included in coverage. Insurance expert Paul Martin listed the following as common coverage exclusions under flood insurance in Kentucky:

- Flooding caused by non-natural water events, such as broken appliances

- Natural flooding events that inundate less than two acres of land

- Mold, mildew, or other moisture damage

- Earthquake or mudslide damage

- Property outside the home like patios, fences, pools, septic systems, and plants

- Additional living expenses*

*Kentucky homeowners insurance does provide additional living expenses coverage if you need to live in a temporary residence while your home’s being repaired for flood damage. A Kentucky independent insurance agent can help you find the right homeowners insurance policy for you.

What Additional Coverages Do I Need?

Before you worry about protecting your home from flood damage, you’ll first want your property to be protected against other, more common disasters, like fire and vandalism. It’s critical that your property is covered by a basic Kentucky homeowners insurance or renters insurance policy.

A Kentucky independent insurance agent can explain the importance and benefits of these policies. Homeowners and renters policies provide a much more comprehensive picture of protection for your property than flood insurance does.

Here’s How a Kentucky Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect homeowners and renters against commonly faced disasters. Kentucky independent insurance agents shop multiple carriers to find providers who specialize in flood insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

https://www.statista.com/statistics/192902/number-of-flood-insurance-claims-in-the-us-by-state/

https://www.fema.gov/faq/calculation-flood-insurance

© 2024, Consumer Agent Portal, LLC. All rights reserved.